Ghana Revenue Authority (GRA) is aiming to rake in GHȼ55.02 billion from taxes this year.

The upward revision, if it gets achieved, will represent 25.2 per cent growth over last year's target of GHȼ47 billion.

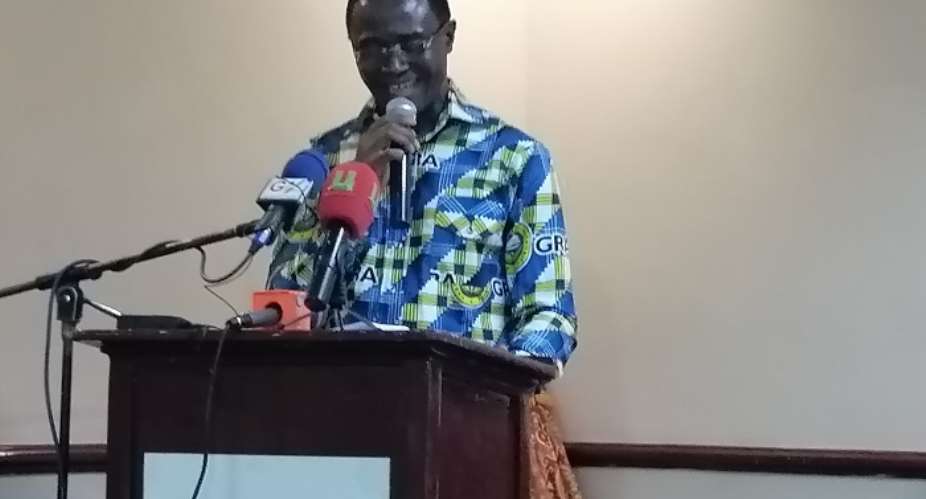

Acting Commissioner-General of GRA, Ammishaddai Owusu-Amoah, who disclosed this at a GRA management retreat in Kumasi, recently, said GHȼ26.3 billion would be collected through domestic direct tax, GHȼ13.2 billion from domestic indirect and GHȼ15.5 billion from customs.

He commended the staff for working hard for GRA to chalk such success in spite of the introduction of a benchmark policy at the ports and the non-implementation of the electronic point of sale (ePOS) for VAT collection, which resulted in a revenue loss of GHȼ2 billion.

Rev Owusu-Amoah attributed the target realization to vigorous and issue-based audits, massive debt collection, rigorous examination of imports, increased VAT invigilation and enforcement of Excise Tax Stamp.

The rest were the introduction of a monthly performance-based league table for departments and an increase in the Communication Service Tax (CST) in the last quarter.

Strategies for 2020

The Commissioner-General indicated that the GRA had outlined a number of strategies to help in the attainment of the target for the year, and said these included a strong digitization drive, rollout of the second phase of the Integrated Tax Application and Processing System (ITaPS) and making banks as points of tax collection.

According to him, the ITaPS, which would be rolled out in March, would automate the filing of returns, issuance of tax clearance certificates, withholding tax credit certificates and tax credit certificates among others.

“We want to give taxpayers a first-class experience this year,” he noted, pointing out also that efforts will be intensified to bring in people outside the tax net, while paying critical attention to improved customer service.

“GRA will also introduce an Informant Award Scheme under which informants, who provide the Authority with (information) leading to the recovery of taxes owed by businesses, will be handsomely rewarded based on the amount retrieved,” he asserted.

Rev Owusu-Amoah said the Authority would also intensify tax education exercise this year throughout the country, disclosing that the message of taxation and its benefits would be well communicated to the taxpayer and the general public.

He added that the GRA would use NABCO interns for tax compliance exercise by deploying them to VAT registered businesses to undertake invigilation while assisting in the identification of property owners for the purpose of rent tax payment.

---Daily Guide

Lay KPMG audit report on SML-GRA contract before Parliament – Isaac Adongo tells...

Lay KPMG audit report on SML-GRA contract before Parliament – Isaac Adongo tells...

Supervisor remanded for stabbing businessman with broken bottle and screwdriver

Supervisor remanded for stabbing businessman with broken bottle and screwdriver

NDC watching EC and NPP closely on Returning Officer recruitment — Omane Boamah

NDC watching EC and NPP closely on Returning Officer recruitment — Omane Boamah

Your decision to contest for president again is pathetic – Annoh-Dompreh blasts ...

Your decision to contest for president again is pathetic – Annoh-Dompreh blasts ...

Election 2024: Security agencies ready to keep peace and secure the country — IG...

Election 2024: Security agencies ready to keep peace and secure the country — IG...

People no longer place value in public basic schools; new uniforms, painting wil...

People no longer place value in public basic schools; new uniforms, painting wil...

'Comedian' Paul Adom Otchere needs help – Sulemana Braimah

'Comedian' Paul Adom Otchere needs help – Sulemana Braimah

Ejisu by-election: Only 33% of voters can be swayed by inducement — Global InfoA...

Ejisu by-election: Only 33% of voters can be swayed by inducement — Global InfoA...

Minority will expose the beneficial owners of SML, recover funds paid to company...

Minority will expose the beneficial owners of SML, recover funds paid to company...

Prof. Opoku-Agyemang has ‘decapitated’ the NPP’s strategies; don’t take them ser...

Prof. Opoku-Agyemang has ‘decapitated’ the NPP’s strategies; don’t take them ser...