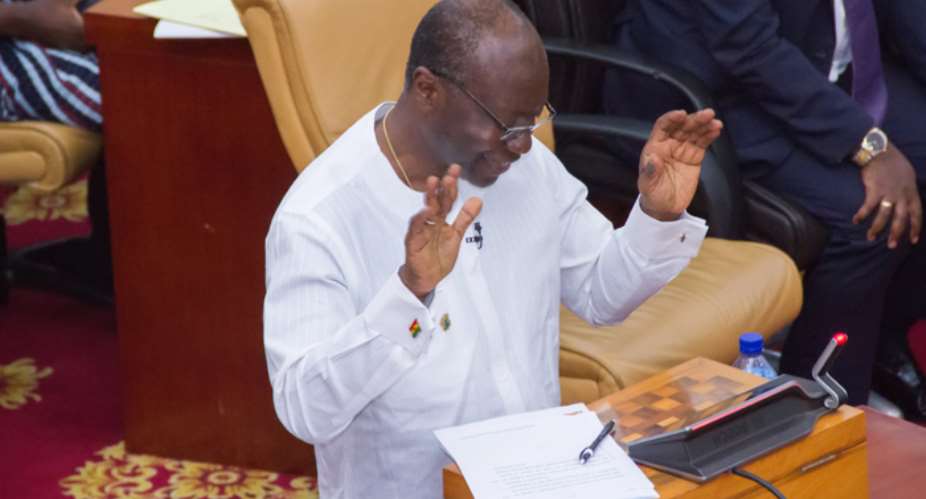

The Ghana 2020 budget statement and economic policy presented by the Hon. Finance minister was under the theme “Consolidating the gains for growth, jobs and prosperity for all”. Accordingly, the budget is centered on accelerating government’s programme of growing the economy, protecting the vulnerable, and creating jobs and prosperity for the Ghanaian people over the next financial year. The budget statement highlighted policy proposals focused on enhancing domestic revenue mobilization.

First of all I wish to commend government for not introducing new taxes in the 2020 budget. What is unfortunate for me however was the fact that Government is unable to meet its revenue target as at September 2019. I believe that our approach to revenue mobilization in Ghana is outdated hence such outcome. Not in the distant past, I saw some officials of the Ghana Revenue Authority (G.R.A) closing down the offices of people in an attempt to force them to pay their taxes. I think it is good but to what extent can this go without risking the lives of these officials?

I have total confidence in the decision of government to leverage on digitization to boost domestic revenue mobilization. This is because of the substantial body evidence that alludes to the fact that allowing people and businesses to pay taxes digitally can increase government revenue and produce a wide range of other benefits for society. For instance, a recent study found that digitization of value-added tax payments increased the country’s annual revenue by almost $500 million per annum in Tanzania. Also, Uganda has already experienced a similar breakthrough, by increasing revenue by 167% just a year after automating its tax collection system. Along with increasing overall tax revenue, digitizing individual and corporate tax payments can lower transaction costs for both the government and taxpayers. It reduces instances of fraud and corruption, increases government transparency, and improves the overall efficiency of a country’s tax system. As for the issues of corruption in the country by GRA officials, the least said for now the better.

Digitizing an economy is an arduous task and it cannot happen overnight. It needs visionary leadership, a systematic collaboration across multiple government agencies and institutions, an investment in infrastructure, and the incentivizing of behavior change among citizens and merchants alike. Some countries have taken the lead in this regard so we can learn from them. Hence no excuse is acceptable. I therefore urge government to expedite this process for the collective good of every citizen.

Elisu By-election: "If you call yourself a man, boo Chairman Wontumi again" — Bo...

Elisu By-election: "If you call yourself a man, boo Chairman Wontumi again" — Bo...

Fuel tanker driver escapes with his life after tanker goes up in flames near Suh...

Fuel tanker driver escapes with his life after tanker goes up in flames near Suh...

Uniform change: ‘Blue and white are brighter colours’ — Kwasi Kwarteng explains ...

Uniform change: ‘Blue and white are brighter colours’ — Kwasi Kwarteng explains ...

MoE not changing all public basic school uniforms but only newly built ones — Kw...

MoE not changing all public basic school uniforms but only newly built ones — Kw...

We’re only painting new public basic schools blue and white – Dr. Adutwum clarif...

We’re only painting new public basic schools blue and white – Dr. Adutwum clarif...

Bawumia has lost confidence in his own govt’s economic credentials – Beatrice An...

Bawumia has lost confidence in his own govt’s economic credentials – Beatrice An...

I fought WW2 at age 16 – WO1 Hammond shares At Memoir Launch

I fought WW2 at age 16 – WO1 Hammond shares At Memoir Launch

GRA-SML deal: Regardless of what benefits have been accrued, the contract was aw...

GRA-SML deal: Regardless of what benefits have been accrued, the contract was aw...

April 26: Cedi sells at GHS13.75 to $1, GHS13.18 on BoG interbank

April 26: Cedi sells at GHS13.75 to $1, GHS13.18 on BoG interbank

Champion, promote the interest of women if you become Vice President – Prof. Gya...

Champion, promote the interest of women if you become Vice President – Prof. Gya...