A suitable environment for businesses to succeed remains an important precursor to economic growth and ultimately the improvement of living standards. At a UN forum held in 2015, UN Secretary-General Ban Ki-moon stressed the relevance of the role of the private sector in the realization of the newly-adopted SDGs which essentially support sustainable development, reduction of poverty and inequality as well as the promotion of peace and good governance.[1]

Research has also regularly shown that SMEs typically contribute highly to employment and economic growth in economies. More particularly, SMEs contribute about 60-70% of jobs in most OECD countries[2] and 40% of total employment in emerging countries. SMEs also contribute up to 33% of national income (GDP) in emerging economies.[3] Therefore supporting businesses to grow and provide jobs is crucial in the fight against poverty and the ultimate improvement of living standards especially of individuals in the developing world.

Despite the critical role that the private sector plays, in Ghana, the sector faced significant challenges in the period under review. From a macroeconomic perspective, real GDP growth slowed substantially from about 14.0% in 2011 to 3.9% in 2015 which was indicative of an anaemic macroeconomic environment. The rate of inflation generally trended upwards partly due to supply-side pressures from a severe energy crisis. Tight monetary policy did not effectively contain inflationary pressures and wide interest spread slowed growth of credit to the private sector. Persistent twin deficits of fiscal and current account deficits (and rising public debt) further indicated systemic weakness of the Ghanaian economy in relation to the world economy notably susceptibility to commodity price slumps. This compelled the government to go for an IMF support programme-Extended Credit Facility in 2015. A new tax reform Act 896 which increased tax rates overall also took effect from January 2016.

Table 1 Selected Business Environment Indicators

| Indicator | 2011-2012 | 2012-2013 | 2013-2014 | 2014-2015 | 2015-2016 |

| Ease of Doing Business Index | 63rd* | 64th | 69th* | 112th* | 114th |

| Global Competitiveness Index | 101st | 103rd | 110th | 111th | 119th |

*shows that the position was revised based on new methodology and corrections in the data

Source: World Bank/World Economic Forum

Table 1 above shows that the World Bank's Doing Business report has demonstrated a significant deterioration of the business environment with regards to business-friendly regulations in recent years. Ghana's rank dropped markedly from 63rd in the 2012 report to as low as 114th in the 2016 report out of 189 countries assessed across the globe. To be fair, the dataset showed that the significant drop of Ghana's rank between 2014 and 2015 was partly due to changes in methodology. However, a significant part of the drop was also as a result of increasing difficulty in trading across borders especially in terms of excessive import cost (and time). The fading favourableness of Ghana's business environment was also corroborated by the World Economic Forum's Global Competitiveness Report which ranks 144 countries based on the Global Competitiveness Index. More particularly, Ghana's rank drop 18 places overall from 101st in the 2011-2012 report to 119th in the 2015-2016 report.

Furthermore, according to the NDPC, the latest National Annual Report for 2014 showed that medium-term policy interventions geared towards enhancing the competitiveness of the private sector performed below average as only 40.9% of selected 22 indicators met their targets, 31.8% failed to achieve their targets and the remainder could not be ascertained due to data collection constraints. The Medium Term Private Sector Development Strategy Phase II (PSDS II) for the period 2010-2015 has also not been implemented for any apparent reason.

Against this background, a comprehensive analysis of five (5) major business challenges since 2011 coupled with key policies/bills/laws intended to ameliorate the situation is vital. Hence the report aimed to:

1) Identify and examine major business challenges since 2011.

2) Analyse and discuss key policies/bills/laws with the view to appreciate gaps/inconsistencies related to each identified challenge.

3) Make robust recommendations to deal with the challenges and improve the business environment.

Due to the broad scope of the private sector, greater focus was given to the economic sector as defined by the 2016 budget. This implies that policies/bills/laws discussed and analysed were typically associated with: Ministry of Trade and Industry, Ministry of Power, Ministry of Food and Agriculture and others. Five major challenges identified within the scope of study (that is, 2011 to April 2016) relate to: access and cost of credit, exchange rate volatility, inflation rate, cost and availability of power supply and tax rates and tax administration. They were selected based on various reports particularly the Doing Business country reports, Global Competitiveness reports and AGI's Business barometer reports which communicated real and repeated concerns of businesses in the period under study. The challenges are not necessarily in order of intensity as the degree of importance differed across years and in the case of AGI BB reports across quarters.

The WEF's Global Competitiveness report 2015-2016, for instance, highlights the following challenges in Ghana indicated by Figure 1 below.

Figure 1 Major Business Challenges in Ghana

AGI Business barometer report for the first quarter of 2016 also found the major constraints for businesses respectively as high cost of utilities, multiplicity of taxes, exchange rate volatility, access to credit and delayed payments to contractors.[4] These reports together with the World Bank's Doing Business reports informed our choice of business hurdles for the analysis.

1. Access and cost of credit to the private sector

The importance of credit to the private sector cannot be overemphasized as it enables businesses, especially start-ups and Small and Medium Scale Enterprises (SMEs), to cater for various costs, produce goods and services and grow. According to the World Bank's WDI data, Ghana's domestic credit to the private sector (% GDP) has been on an increasing trend, in general, from 15.1% in 2011 to 20.3% in 2015. However, a look at the annual growth of real private sector credit for the period under review shows that its pace of expansion has been unstable at best. From September 2011 to September 2012, growth of real private sector credit increased from 16.3% to 31.4% but fell sharply to 13.1% in 2013. It then increased from 13.1% to 26.6% in 2014 but fell even more painfully to as low as 3.7% in 2015.

This was largely due to the high cost of credit as well as the lack of access to credit (that is, the ability of individuals and firms to obtain credit from banks in relation to requirements which must be met to obtain the amount of credit requested). These credit-constraints represented major challenges to businesses particularly between 2011 and 2013 according to the Association of Ghana Industries' Business Barometer reports. From 2014 to 2015, the reports showed that high cost of credit and inadequate access to credit were toppled as top constraints to businesses by power supply constraints due to an energy crisis which increased inflation rate and exchange rate volatility. Table B in the Appendix reports a more detailed sectorial allocation of Deposit Money Banks' (DMBs') credit from 2013 to 2015 according to the Bank of Ghana (BoG). The table indicates that services enjoyed the largest share in total credit whereas export trade had the lowest share.

Monetary policy in the period under review was generally tight as indicated by Table 2 which also illustrates key interest rates extracted from BoG annual reports available up to 2015.

Table 2 Key Interest rates 2011-2015

2-year note

12.4

23.0

16.5

23.0

24.0

| Interest Rate (%) | 2011 | 2012 | 2013 | 2014 | 2015 |

| Policy rate | 12.5 | 15.0 | 18.0 | 21.0 | 26.0 |

| DMBs' Average lending rate | 25.9 | 25.7 | 25.6 | 29.0 | 27.5 |

| DMBs' Average 3-month Time Deposit rate | 7.8 | 12.5 | 12.5 | 13.9 | 13.0 |

| 91-day Treasury bill | 10.3 | 22.9 | 18.8 | 25.8 | 23.1 |

| 182-day Treasury bill | 11.1 | 22.9 | 18.8 | 26.4 | 24.4 |

| 1-year note | 11.3 | 22.9 | 17.0 | 22.5 | 22.7 |

Source: Bank of Ghana

The monetary policy rate was hiked up from 13.5% in February 2011 to 26% by November 2015. It has since been maintained. The BoG (2015) argued that the tightness of the policy was intended to reduce, “imminent upside risks to the inflation outlook such as worsening external financial conditions and the planned utility tariff adjustments”[5]. In theory, an increase in the policy rate is expected to increase the lending rate in order to reduce aggregate demand and inflationary pressure in the economy. But in Ghana, evidence suggests that banks' lending rate is not as responsive as expected. In fact, contrary to theory, the average DMB's lending rate fell marginally from 25.9% in 2011 to 25.6% in 2013 despite the increase in the end-period policy rate from 12.5% to 18% in the same period. In 2014, however, the lending rate increased substantially by 342 bps to 29% possibly to reflect the high risk in the economy due to the energy crisis and rising inflationary pressure. The lending rate fell again in 2015 but has since been on an increasing trend marginally as at April 2016 due to more responsive interbank interest rates.

Table 2 illustrates that both the 91-day and 182-day Treasury bill end-period rates respectively increased generally from 10.3% and 11.1% in 2011 to 23.1% and 24.4% in 2015 although both decreased to 18.8% in 2013 from 22.9% the previous year. Typically, financial intermediaries take deposits from entities with excess loanable funds and conduit them to productive sectors of the economy with the aim of maximizing returns and minimizing risk. Due to the high returns on domestic debt instruments coupled with the risk-free nature of Treasury bills for instance, banks were invariably given a high incentive to purchase Treasury bills from the government instead of providing funds to the private sector. The incentive to pursue this lower-risk alternative was further strengthen by the difficult macroeconomic environment.

Analysis and Discussion of Key Policies/Bills/Laws

Selected policies/bills/laws discussed and analysed include: (i) Moral suasion from BoG and Treasury bill rate by GoG; (ii) Interest rate spread; (iii) MSME programme; (iv) EDAIF (now EXIM) Act; (v) SME fund; and (vi) Dormant Asset Scheme.

To commence, in 2011, it was observed that the Central Bank used moral suasion to encourage commercial banks to reduce lending rates (borrowing cost) to the private sector.[6] But simultaneously, high interest rates on domestic debt instruments were provided which incentivized banks to invest in these instruments instead of providing credit to the private sector. Thus moral suasion and high interest rate on domestic debt instruments provided contradictory incentives to banks with regards to the provision of private sector credit. It was crucial for fiscal and monetary policies to be in harmony in order to reduce the lending rate and increase the growth of real private sector credit especially within the macroeconomic context of 2011 when the rate of inflation was relatively low and averaged 8.7%. Unfortunately, the prevailing policy inconsistency resulted in a marginal decrease in the lending rate from 25.9% in 2011 to 25.7% in 2012.

Additionally, interest rate spread which is the difference between the average lending rate and the average savings rate was generally wide averaging about 15% between 2011 and 2015 according to Table 2 above.

Figure 2 below provides a graphical description of the interest rate spread.

Figure 2 DMBs Savings (3-months deposit) and Average Lending rate (%)

Source: Bank of Ghana

Figure 2 shows that the interest rate spread was wide in 2011 but narrowed in 2012 and 2013 due to the reduction in average lending rate and the increase in savings rate. The average savings rate stayed at 12.5% in 2013 from 2012 but average lending rate declined marginally which narrowed the interest rate spread. The spread widened in 2014 even though both the average lending rate and average savings rate increased because the average lending rate increased relatively higher by 342 bps compared with the increase in average savings rate of 135 bps. In 2015, interest rate spread reduced from 15.1% the previous year to 14.5%.

The wide spread is symptomatic of a weak degree of financial intermediation. Essentially, it constrained the regular expansion of private sector credit. A previously conducted study claimed that the determination of banks to maintain high profit margins coupled with high labour costs in the banking sector were significantly responsible for the wide interest rate spread in Ghana[7]. Nevertheless, vitally, it is observed that financial deregulation introduced in the late 1980s expected to enhance efficiency in the financial sector since the previous regime was too restrictive has rather engendered inefficiency in financial intermediation in recent years by giving commercial banks in Ghana too much liberty. Indeed, financial deregulation does not imply the absence of regulation. Yet there is no policy currently to check the behaviour of banks in this regard. The condition has also made banks less innovative in making profits. Consequently, banks charge the private sector high lending costs to make profit. Former AGI President, Nana Owusu Afari lamented this point on Joy Business in 2012.

“Even where the rate of interest is high, it is still very difficult to access credit. We think that the banks also are not doing enough to access cheaper funds because just about 20 to 25% of Ghanaians are banked. Over 75% Ghanaians don't have bank accounts so what are all the banks in the system doing? Why don't they go round and get Ghanaians banked?”[8]

Therefore a policy to regulate the interest rate spread would encourage banks to be innovative in obtaining loanable funds ultimately resulting in reduced lending costs to the private sector.

More positively, one of the vital policy interventions for the period under review was the MSME policy. It was a joint programme conducted by Government of Ghana, International Development Association (IDA) and International Finance Corporation (IFC) MSME Program between 2006 and 2013. The main objectives were to increase the competitiveness of the private sector and employment levels of Ghanaian MSMEs. The programme was meant to complement Government's Medium-Term Private Sector Development Strategy (PSDS) and the Trade Sector Support Programme (TSSP). The Ministry of Trade and Industry was responsible for its implementation.

As part of the aim to increase the competitiveness of MSMEs, the project aimed to enhance access to finance. The Access to Finance component of the MSME Project was intended to equip participating banks with required capacity and resources that would enable them to extend and increase their lending to MSMEs. There were five sub-components under the Access to Finance components namely; (i) Partial Credit Guarantee (to cushion participating banks on the losses they may incur in dealing with MSMEs); (ii) Technical Assistance to Banks (to improve the MSME Departments of participating banks in order to enable them better understand the MSME sector and improve lending to MSMEs); (iii) Line of Credit (to offer participating banks access to long-term funds to enable them offer MSMEs longer-term loans); (iv) Performance-Based Grants (to be given to participating commercial banks that meet performance criteria at the end of each year); and (v) Additional Financial Instruments (in order to mobilize funds from Ghanaians in the diaspora to support MSMEs). According to the Implementation Completion and Results (ICR) report, there was a modest achievement in terms of the broad objective of enhancing private sector competitiveness.[9] With respect to access to credit for MSMEs, the total volume of bank credit to MSMEs increased by 236% (US$ 5.1 Billion from a baseline of US$ 2.2 Billion). Also, under the objective of access to markets, 148 projects were supported with 223 applicants approved and 638 beneficiaries via the Business Development Services (BDS) fund.[10]

Aside from the MSME program discussed above, the Export Trade, Agricultural and Industrial Development Fund (EDAIF) Act 2013 (Act 872) provided significant financial assistance and support for the development of manufacturing, especially agro-processing and start-ups. Act 872 was a revision of Act 823 2011 which replaced EDIF Act 582 2000 in order to include the provision of financial resources for the development and promotion of agriculture relating to agro-processing.[11] Act 872 2013 has also recently been replaced by the Ghana Export-Import Bank (EXIM) Act, 2016 (Act 911) which came into force in March 2016. The EXIM Act is expected to consolidate export finance activities of the EDAIF, Eximguaranty Company and Export Finance Company ultimately to support and develop directly or indirectly trade between Ghana and other countries, and build Ghana's capacity and competitiveness in the international market-place. Particularly, insurance and finance facilities will be provided to support the overseas activities of exporters.[12] Indeed, funding support for exporter is vital considering the observation in Table B showing that the share of DMB credit for export trade was typically the lowest in the period under study.

Before the EDAIF Acts 823 and 872 were repealed, however, there were important achievements made through various facilities. This includes the provision of concessionary financing of zero percent interest rate credit facility to small scale agro-processors. More specifically, according to EDAIF's operational report, from 2011 to 2012, a total amount of GH¢ 89,239,179.25 was approved as loans to one hundred and three (103) companies through seventeen (17) Designated Financial Institutions (DFIs).[13] This partly contributed to the increase in the growth of real credit to the private sector from 16.3% in September 2011 to 31.4% in September, 2012. In 2013, EDAIF disbursed GH¢46.15 million to 36 applicants. The Agriculture and Agro-Processing component was the highest beneficiary with an amount of GH¢20.89 million for 13 applicants. There was also the Export Development and Promotion facility with an amount of GH¢14.01 million given to 13 applicants. EDAIF's funding resulted in the completion of the Kpong Left Bank Irrigation project which supplies water to about 2,400 hectares of farmland (Budget, 2014).

Again, the SME fund was proposed in 2014 to improve SMEs' access to credit. However, it was not mentioned in the 2015 and 2016 budgets. Graphiconline reported based on an interview with the Finance Minister Seth Terkper that the fund may not materialize since it was part of the Chinese Development Bank (CDB) loan which experienced significant challenges.[14]

Furthermore, according to the Finance Minister Seth Terkper, "…evidence indicates that significant amount of assets lie unclaimed. These include dormant bank accounts and unclaimed dividends, interest payments, pensions and insurance benefits. There is currently no regulatory framework to govern the management of this large pool of assets which represents a significant portion of private savings in the economy and which is often forgone without a structure to consciously trace the beneficiary's next of kin (Budget, 2016).”

In 2007, the Kufuor's Administration announced an unclaimed assets initiative but it was not implemented. The implementation of the Dormant Asset Scheme would be vital in ensuring that rightful owners have access to funds/more valuable collateral security in order to improve their position with regards to access to credit. Stated differently, those who receive the funds are less likely to be perturbed by inadequate access to credit since they can convert the assets into liquidity and invest where necessary or use the properties as collateral in order to gain access to higher loan amounts which they could not previously obtain for business.

- Exchange rate volatility

The behaviour of the exchange rate can have a substantial effect for businesses. For instance, depreciation of a country's currency usually leads to a fall in the price of exports from the country and an increase in the price of imports into the country in question. Thus, theoretically, importers usually lose during depreciation since the commodities imported become more expensive and exporters usually benefit as the lower price of exported goods is likely to attract demand for the goods. The reverse is usually true during appreciation of the currency (all other relevant factors held constant) as importers benefit whiles exporters lose. Even for firms not directly involved in international trade, a fast rate of depreciation can also be detrimental via an elevation of the rate of inflation or production costs. Furthermore, the volatility of the exchange rate poses a risk to businesses because future (investment) plans are invariably beset with a high element of uncertainty.

According to the AGI business barometer reports for the period under review, exchange rate volatility consistently remained one of the top challenges to business particularly in 2014 and 2015. For instance, the reports cited exchange rate volatility/cedi depreciation as the topmost challenge to businesses in the 2nd and 3rd quarters of 2015. Vitally, AGI asserted that the depreciation of the cedi eroded business confidence and further culminated in an increase in taxes for importers of raw materials since duties on imported raw materials were computed in dollars.[15] [16] Table 3 below shows the end-period transaction rates of the cedi against the US dollar, pound sterling and euro between 2011 and 2015.

Table 3 Exchange Rate Depreciation 2011-2015

| End-period Transaction rates | 2011 | 2012 | 2013 | 2014 | 2015 |

| GHS/USD | 1.6 | 1.9 | 2.2 | 3.2 | 3.8 |

| GHS/POUND STERLING | 2.5 | 3.1 | 3.7 | 5.0 | 5.6 |

| GHS/EURO | 2.1 | 2.5 | 3.1 | 3.9 | 3.2 |

Source: Bank of Ghana

Table 3 illustrates that the cedi consistently weakened against the US dollar, pound sterling and the euro from 2011 to 2015.

In 2011, the cedi depreciated by 4.9 per cent, 9.0 per cent and 7.9 per cent against the US dollar, the pound sterling and the euro respectively in the interbank market according to the Bank of Ghana. It further weakened significantly in both the interbank and forex bureau markets in the first half of 2012 but recovered in the second half of the year on the back of contractionary monetary policy. The depreciation experienced was due to high demand pressures and speculative activity in the foreign exchange markets. Interest rate hikes and strict implementation of the foreign exchange regulations were introduced in order to limit the foreign exchange demand pressures. However, the cedi depreciated on the interbank market by 17.5 per cent against the US dollar, 18.4 per cent against the pound sterling and 14.9 per cent against the euro which was higher than 2011. The foreign bureau markets exhibited analogous developments with the cedi depreciating by 15.4 per cent against the US dollar, 18.0 per cent against the pound sterling and 15.5 per cent against the euro in 2012.

The cedi continued to weaken in the interbank and forex bureau markets on account of heightened demand pressures, speculative activities and declining inflows partly due to falling commodity prices of gold and oil in 2014. In order to contain the fast rate of depreciation of the cedi, BoG reviewed foreign exchange regulations and encouraged compliance to the regulations. From September the same year, the cedi stabilized not because of the restrictive foreign exchange regulations but due to tight monetary policy and proceeds from the Eurobond and cocoa syndicated loans coupled with the announcement of going for the IMF programme. In the interbank market, the cedi weakened respectively by 31.3 per cent, 26.3 per cent and 20.5 per cent against the US dollar, the pound sterling and the euro in 2014. These can be compared with depreciation rates of 14.5 per cent, 16.7 per cent and 20.1 per cent against the US dollar, the pound sterling and the euro respectively in 2013. Forex bureau market developments were similar to those in the interbank market. The cedi depreciated respectively by 27.6 per cent, 24.5 per cent and 20.2 per cent against the US dollar, the pound sterling and the euro. This compares with the corresponding depreciation rates of 16.3 per cent, 17.5 per cent and 19.3 per cent against the US dollar, the pound sterling and the euro in 2013.

In 2015, the cedi weakened in the first half of the year as a result of seasonal demand pressures and reduced inflows partly emanating from falling commodity prices notably for gold and marginally for oil. The value of merchandise exports for 2015 was US$10,356.7 million, indicating a decrease of 21.6 per cent compared to the US$13,213.1 million outturn in 2014 as a result. The net impact of the oil price decline was marginal because the value of export and imports of oil are fairly close. Table D in the Appendix section shows that the value of crude oil export was about US$ 1.9 billion compared to imported value of US$ 2.1 billion in 2015 for example. In the second half of 2015, however, the cedi became relatively stable due to improved inflow from development partners, proceeds from Eurobond and cocoa export finance facility. In the interbank market, the cedi depreciated by 16.1 per cent against the US dollar in 2015 compared with 31.2 per cent depreciation recorded in 2014. It also depreciated by 11.5 per cent against the Pound sterling and 6.2 per cent against the Euro. Developments in the foreign bureau markets are similar to developments in the interbank market (BoG Annual report, 2015).

By September 2015, exchange rate developments over the nine-month period continued to demonstrate a general weakness in the Ghana cedi against the major trading partners with the exception of the month of July when the cedi regained some value. In the interbank market, over the nine month period, the Ghana cedi depreciated cumulatively by 14.8 percent, 12.6 percent and 7.8 percent against the US dollar, the pound sterling and the euro, respectively, compared to higher depreciation rates of 31.2 percent, 29.3 percent and 23.6 percent recorded in the corresponding period of 2014. Increased demand for foreign exchange intended for loan repayments and the purchase of imports, however, meant that demand pressures still existed, although it was more restricted. In the near future, a continual fall in commodity prices in the world market, particularly oil, coupled with unfair WTO trade rules could lead to a sharp reduction of income from export and a further widening of the current account deficit. This would culminate in a reduction in the already low reserve buffer, generating increased exchange rate pressures; heighten inflationary pressures and increase the cost of foreign debt service. Increased foreign debt cost, for instance, is illustrated by Figure 3 in 2015.

Figure 3 Public Debt (% of GDP) and Exchange Rate Developments, Jan-Sept 2015

Source: Ministry of Finance

Figure 3 illustrates that depreciation led to an increase in public debt because the value of external debt increased although gross domestic debt remained fairly unchanged for a greater part of 2015.

It is vital to mention that the Ghana cedi has remained relatively stable in the 4th quarter of 2015 and the 1st quarter of 2016. . Although there were challenges across the borders such as in relation to the Duty Drawback scheme[17], the EDAIF Act (now EXIM Act), however, contributed to improving and adding value to exports. Furthermore, aside the previously cited reasons by Bank of Ghana, the issuance of the 5-year domestic bonds using the book-building process in November 2015 and March 2016 also contributed to the stability of the cedi. Particularly, offshore investors took up 67 percent of total allotted bids for the 3rd March, 2016 issue for example indicating inflow of foreign exchange.[18] [19]

Analysis and Discussion of Key Policies/Bills/Laws

Selected policies/bills/laws discussed and analysed include: (i) BoG's restrictive administrative measures; and (ii) MDTS.

To begin with, in February, 2014, the Bank of Ghana (BoG) reviewed foreign exchange regulations and insisted on compliance to the regulations. The administrative measures taken were basically intended to restrict the use of foreign currency in domestic transactions. For instance, no cheques or cheque books was to be issued on the Foreign Exchange Account (FEA) and Foreign Currency Account (FCA), cash withdrawals over the counter from FEA and FCA were only be permitted for travel purposes outside Ghana and were not to exceed US$10,000.00 or its equivalent in convertible foreign currency, per person, per travel. Also, authorised dealers were not to sell foreign exchange for the credit of FEA or FCA of their customers. Unfortunately, the potential costs and benefits of the intervention were not adequately considered before the implementation of the measures. Although developments in the GHS/USD exchange rates showed that monthly depreciation declined steadily from a peak of 7.8 percent in January, to 2.7 percent in May 2014, the restrictions on the use of foreign exchange adversely affected businesses, especially those of importers and exporters. This is because the nature of the export-import trade required flexibility in the use of foreign exchange to facilitate transactions. The Bank of Ghana ultimately reviewed and suspended some aspects of the policy 6 months after implementation.

Also, poor debt management has also partly contributed to exchange rate pressures in the period under review. One of the primary medium term strategies under the MTDS is to lengthen the maturity profile of domestic debt through the issuance of longer dated bonds. However, actual implementation conflicted with the strategy as government concentrated on curtailment of financial cost. Particularly, in order to circumvent lock-in rates, government focused more on shorter dated debt instruments. Since offshore investors who typically possess foreign exchange are not permitted to participate in the short-term government debt auctions, there was little opportunity for foreign exchange inflow (to stabilize the cedi) despite increases in the monetary policy rate. This is mind boggling considering the fact that the 2014 Budget reported that in 2013, “…the issue of a 7-year domestic bond in August…did not only increase the maturity profile of domestic debt but also improved refinancing risk”.

- Inflation rate

A high rate of inflation adversely affects businesses especially when it arises from cost-push inflation. This is because profits reduce when costs are high and increasing at a fast pace. The challenge of a high rate of inflation is particularly detrimental to small businesses since they do not enjoy economies of scale to (partially) offset upward inflationary pressure. Interestingly, a high inflation rate can both cause and be caused by exchange rate depreciation thus posing further constraints to the profitability of businesses. In other words, not only does high rate of inflation reduce the value of a country's currency domestically but it also reduces the value of the domestic currency against the value of the currency of a trading partner even if the trading partner's currency remains unchanged. This implies that importers will need more of the domestic currency for the same foreign (dollar)-value of the foreign good or service, making imports more expensive. In the period under review, inflation was generally high averaging about 12% each year. Table 4 shows the inflation rates for the period under review.

Table 4 Inflation rate (%)

Annual average

8.7

9.2

11.4

15.4

17.1

| Year-on-year Inflation (%) | 2011 | 2012 | 2013 | 2014 | 2015 |

| End period | 8.6 | 8.8 | 13.5 | 17.0 | 17.7 |

Source: Ghana Statistical Service

Table 4 illustrates that in 2011 and 2012, the rate of inflation remained subdued since single-digit inflation was achieved on the average. Specifically, in 2011 and 2012, inflation rate respectively averaged 8.7% and 9.2%. It is worth mentioning that the rate of inflation did not enter double-digit figures or increase at a fast pace in 2012 as is typical of election years in Ghana. This was on the back of relatively stable prices of crude oil on the world market as well as buoyant food harvests (BoG, 2012). However, overall, inflation has remained on an upward trajectory in general as indicated by table 4.

Figure 4. Headline Inflation, 2014-2015 (%)

Source: BoG

Figure 4 demonstrates that headline inflation experienced an upward trend between December 2014 and December 2015. It further presents the components driving inflation. Figure 4 reveals that headline inflation was mostly driven by the food index which increased from 6.8 per cent in 2014 to 8.0 per cent in 2015. Non-food inflation, on the other hand, declined from 23.9 per cent in 2014 to 23.3 per cent in 2015. Previously, however, headline inflation between January 2013 and October 2014 was mostly driven by the non-food component. This is was largely attributed to huge fiscal injection, the pass-through effects of fuel and utility price adjustments as well as the depreciation of the Ghana cedi.

Analysis and Discussion of Key Policies/Bills/Laws

Selected policies/bills/laws discussed and analysed include: (i) Monetary policy from BoG and Treasury bill rate by GoG; (ii) Exchange rate channel (iii) Absence of Fiscal Responsibility law and abuse of Bank of Ghana Act.

To commence, the Bank of Ghana (since 2012) typically employed contractionary monetary policy to limit inflationary pressures as depicted graphically by Figure 5. This is against the backdrop of Ghana formally adopting the inflation-targeting framework in 2007. Unfortunately, monetary policy has largely been ineffective and end period targets mostly missed due to the weak monetary transmission mechanism. That is to say, lending rates of commercial banks have been highly insensitive to changes in the policy rate by Ghana's Central Bank. More recently however, fiscal policy dominance of monetary policy has contributed significantly to the weak response of lending rates to the MPR. This is demonstrated by figure 6.

Additionally, the energy predicament which intensified in 2015 increased production costs and generated supply-side inflationary pressure. Unfortunately, monetary policy under the IT-framework directly works to stimulate or discourage aggregate demand instead.

Figure 5 Monetary Policy Rate (Jan 2011- Mar 2016)

Source: Bank of Ghana

Figure 6 Developments in Monetary Policy (2011-2015)

Source: Bank of Ghana

Figure 6 shows that fiscal dominance of monetary policy in 2015 has affected the ability of lending rates to reduce aggregate demand and consequently the rate of inflation. Stated differently, government intending to reduce its own borrowing costs via a reduction in T-Bill rates due to pressure to meet fiscal targets has inadvertently weakened the impact of the MPR on the lending rate. This is because of the positive relationship between Treasury bill rate (as well as Inter-bank weighted average rate) and lending rate. Therefore, in 2015, the lending rate's sensitivity to the MPR was weakened by fiscal policy although the inter-bank weighted average rate has responded quite well since the introduction of the standing facility[20] in 2013.

The analysis does not suggest that, in 2016, Treasury bill rates should be increased so as to ensure that fiscal and monetary policies harmonize to reduce inflationary pressures since this could cause more harm than good in the current macroeconomic context. This is because Treasury bill rates represent the banks' opportunity cost of lending to the private sector. Therefore increase in T-bill rates is likely to increase the lending rate.

More explicitly, it is important to recall that growth of real private sector credit reduced sharply from 26.6% by September 2014 to 3.7% by September 2015 showing existing downward pressures on private sector credit. Considering this development coupled with recent cost-hurdles including higher petroleum levies, tax rates and utility tariffs imply that reducing the willingness and/or ability of businesses to obtain credit by increasing the T-bill rates would invariably compel many of them (especially SMEs who do not enjoy economies of scale) to shut down. It is central that government places greater focus on taking advantage of the exchange rate channel in the short-to-medium term to influence the rate of inflation via the issuance of 5-year and 7-year bonds accessible to foreign investors with attractive yields. Foreign exchange inflows would stabilize the exchange rate and contain inflationary pressures as a result. Furthermore, amounts obtained from the bonds could then earmarked towards the acceleration of cheap gas supply projects, improvement in the distribution efficiency of electricity and payment of various debts in the energy sector in order to fix the erratic power supply predicament as a long term approach to reducing inflationary pressure emanating from the supply-side.

It is worth noting that prior to 2015; fiscal policy dominated monetary policy mainly through high government expenditure. This has mainly been due to the absence of a biting Fiscal Responsibility law and the abuse of the Bank of Ghana Act[21]. Consequently, in 2015, a memorandum of understanding (MOU) was signed between the Ministry of Finance and the BoG establishing a ceiling of 5 percent of previous year's budget revenue for monetary financing as a prelude to 0 percent monetary financing.[22]

Against the backdrop of the consequences of huge government expenditures such as rising inflation rate and public debt, the Government of Ghana entered into an IMF support programme-Extended Credit Facility (ECF) with various aims including the restoration of the effectiveness of monetary policy by inhibiting the dominance of fiscal policy of monetary policy through austerity measures. Yet, even though government expenditure has arguably been contained, the same problem has manifested itself in another form, namely, through Treasury bill rates. More interestingly, CEPA has asserted that fiscal deficit has reduced not because of major cuts but rather due to government owing various entities and building up arrears.[23] This could put the economy in a precarious situation with regards to inflationary pressures as elections approach. This is owing to the fact that various entities are likely to demand payment of arrears which they are likely to spend rather than save having been denied the opportunity to spend the money to cater for various needs/wants earlier.

- Cost and availability of power supply

Costly and unstable power supply continued to plague Ghanaian businesses in the period under review. The situation aggravated to the extent that, in 2015, businesses consistently ranked unreliable power supply as the second topmost constraint (at least) for the first three quarters of the year according to the AGI business barometer reports.

With respect to energy generation mix, the Akosombo dam and other hydro-based sources contributed about 50% of the total 2,813 MW generation capacity as at December 2013. This is illustrated by Figure 7 below[24].

Figure 7 Energy Generation Mix (as at December, 2013)

Source: AGI

Figure 7 reveals that the potential energy from moving water is the most widely used source of generating power in Ghana. Solar contributes the least to Ghana's power generation mix. This demonstrates that the hydrological risk of the energy generation mix remains a challenge. The uncertainty associated with hydro-electric power supply is further illustrated by figure 8 below.

Figure 8 Volta Lake Hydrograph

Source: Volta River Authority

Figure 8 shows that net inflow to the Akosombo dam was generally high during the rainy season and low during the dry season but the actual net inflow fluctuated among years: it was wrought with uncertainty (looking at the month of July from 2011 to 2014, for instance).

The growth in energy demand (partly due to population growth and government policy to extend coverage under the National Electrification scheme) has increased at a fast pace as presented by Figure 9.

Figure 9 Energy Consumption

Source: Volta River Authority

Figure 9 provides graphical evidence showing the increase in demand. In brief, it illustrates that energy consumption has been rising in the period under review. More specifically, it has been rising by 10-15% annually.[25] This occurrence coupled with inefficiencies and poor policy choices have resulted in recurrent power rationing.

Despite the growing demand, the latest annual report by ECG on the 2013 year indicated that the 2,813MW of installed generation capacity (and the 2,492MW of effective capacity[26]) of existing facilities far outweighed the peak demand of 1,371MW. A more recent report from the Energy Commission also disclosed that the System Peak demand[27] at 2,061MW at the end of 2014 was still lower than the recorded 2,831MW installed generation capacity for the year.[28] There were, however, significant distribution losses by ECG demonstrated by Table 5 below.

Table 5 Electricity Purchases, Sales and losses by ECG

Source: VRA, GRIDCo, ECG

Table 5 indicates that percentage losses out of ECG's total purchases averaged about 25% from 2011 to 2014 which provided evidence to substantiate inefficiencies in ECG's operations. Distribution losses were attributed to technical losses emanating from old cables and low equipment capacity as well as commercial losses stemming from illegal connections, metering problems, billing and collection challenges. Fundamentally, the implication for the losses (mainly during distribution rather than transmission) was that much of the energy generated could not be accounted for and hence partly resulting in significant power outages. It has also been reported by Daily Graphic, more recently, that the cut in natural gas supply from Nigeria to the VRA as a result of the government's indebtedness to N-Gas and the reduction in supply from the Atuabo Gas Plant have also contributed significantly to a reduction in reliable power supply. Indeed, the Director of Public Relations and External Affairs of the PURC, Nana Yaa Jantuah wondered why a country with an installed capacity of 3,200 megawatts (MW) and a demand of 2,100MW would be shedding load but for poor planning.[29] Table 6 presents the power outage situation as at December 2013 according to the latest ECG Annual report.

Table 6 ECG Corporate Vital Statistics (as at December, 2013)

Source: ECG

Table 6 reveals areas hit by the power outages with regards to frequency and duration. Table 6 shows that, in 2013, outages lasted longer in metropolitan areas than the less densely populated urban areas.

Although AGI research in 2014 indicated that businesses generally considered the quality of the electricity as average, they have been adversely affected by the erratic supply of power in ways including: wasted raw materials during the abrupt curtailing of power, wages paid for work not done, market losses due to failure to deliver produce on time and damages to equipment. More specifically, in 2014, 176 hrs of generator usage was approximately GHS 332,444 far exceeding the GHS 56,000 average monthly grid electricity bill recorded.[30] Periodic increases in petroleum levies also amplified the cost of using generators during the outages further increasing the working cost of businesses.

In relation to utility costs, electricity tariffs were substantially increased during the period under study. More particularly, in 2012, electricity tariff was increased by 7.42 percent for residents after the first quarter but non-residents' was reduced by an average of 5.26 percent (to encourage private sector growth). These rates were maintained for the most part of 2013, before the gargantuan increase by 78.9 percent (averagely) across board in October 2013. The rates were further increased in 2014 by an average of 28.35 percent across board. The reason provided was that it was to hedge the income from existing electricity tariff against fast depreciation of the cedi. Basically, the electricity tariff was increased by 9.73 percent, 12.09 percent and 6.53 percent in the first, second and fourth quarter respectively. The Public Utilities Regulatory Commission (PURC) further increased the electricity tariff by 2.63 percent in the second quarter of 2015 explaining that the increase would help service providers cater for maintenance costs and circumvent a breakdown of the distribution network.[31]

What is more, the PURC increased electricity tariff by 59.2 percent in December 2015, but in practice, Groupe Nduom research showed that hotels were being overbilled by ECG: hoteliers were found to pay about 140 percent instead of the PURC approved 59.2 percent. This further emphasizes the inefficiency of ECG in the area of electricity pricing as well. Additionally, GN research also asserted that the electricity tariff was again increased, relatively silently, by some 10 percent in February 2016 without any apparent justification in order to side-step howls of public protest.[32] It is vital to mention that, despite the frequent increases in electricity tariffs, in reality, government provided subsidies that essentially distorted the actual price mark-up (typically resulting from inefficiencies) to be passed to end-users in several instances.

Analysis and Discussion of Key Policies/Bills/Laws

Selected policies/bills/laws discussed and analysed include: (i) subsidy policy; (ii) Power Generation, Transmission and Distribution Programme; and (iii) LI 1935 provides for the release of load shedding schedule during outages.

Basically, the power sector has been replete with poor government decisions and policy interventions. Vitally, government's objective of preventing a loss in the welfare of residents by providing subsidies to absorb a part or whole of proposed tariff increases rather resulted in aggravating the welfare of residents by making power supply more erratic. This is owing to the fact that government usually failed to fulfil its promise to the Independent Power Producers (IPPs) of paying these subsidies (on time)[33]. Interestingly, government has rather resorted to spending on expensive so-called “fast-track projects” notably the 250MW Ameri and 225MW Karpower projects intended to increase the already higher installed generation capacity (as compared with System Peak demand). Indeed, aside the high fuel costs, a gargantuan $700 million is to be spent over the duration of the Karpower barge for instance. Such poor policy choices by government coupled with non-payment of bills in some instances has resulted in various debt-burdens borne by key entities in the power sector. The VRA, for example, was found to owe banks over $1.3 billion and has consequently struggled to pay over $100 million owed to Nigeria Gas Company.[34] In essence, reliable power supply for businesses to operate effectively and efficiently remains elusive since vital institutions in the power sector are not able to function at their optimal capacities because they are drowning in a sea of debt.

Also, government's strategy, under the Power Generation, Transmission and Distribution Programme (since 2014), to urgently increase installation capacity (but at the same time procrastinate in implementing relevant energy projects to produce stable supply of energy inputs for actual generation) has adversely affected the energy sector. The Liquefied Natural Gas (LNG) projects, for instance, would have provided a cheap and reliable gas supply for power generation. As a result of delay in implementation, there is a wide gap between actual generation of electricity and potential generation (or installed generation capacity). Continual blame on external factors such as unfavourable weather conditions or massive investments meant to fulfil a manifesto promise[35] of increasing the already high total installation capacity will do the energy sector little good currently. Policy must be geared towards reducing Ghana's reliance on external sources of energy input as well as hydro-based sources to circumvent the associated hydrological risks.

Government has also breached LI 1935 and refused to announce load-shedding and publicize a schedule in some instances. The Director of Public Relations and External Affairs of the PURC, Nana Yaa Jantuah was reported to have said: “In emergency situations, such as the one being experienced, it does not necessarily need a timetable but constant communication from providers to consumers.”[36] This excuse is unacceptable because it could culminate in costly damages to equipment of businesses as a result of inability to plan properly by the businesses. For example, out of 100 companies interviewed in an AGI survey conducted in 2014, repairs or replacement of damaged machine parts due to power outages cost 43% of these companies up to GHc10,000 whilst 23% of the companies have also spent more than GHc20,000 on repairs and replacements of damaged parts.[37]

- Tax rates and Tax Administration

In order for the state to provide public goods such as quality infrastructure and security, it needs a proper tax base to obtain revenue. Further, from the business' point of view, a heavy tax burden (both explicit and implicit costs) can be detrimental to their productivity. Hence, the level and shape of taxes must be carefully chosen to take cognizance of the various incentives for business it creates, and needless difficulties in paying taxes must be avoided.

According to the World Bank's Ease of Doing Business reports, Ghana's rank on the ease paying taxes has fallen continually and significantly from 80th out of 185 economies assessed in DB2012 to 106th out of 189 economies in the DB2016 report. It is important to note that the DB2016 report was based on data between January, 2014 and December, 2014 and therefore reflect context of paying taxes for a typical medium-size firm in 2014. Hence, in general, paying taxes was not only costly but also difficult for the average company under Internal Revenue Act, 2000 (Act 592). Consequently, the Income Tax Act, 2015 (Act 896)[38] intended to improve compliance and simplify the income tax regime was passed by Parliament in 2015 and became effective in January 2016. It is hence early to comprehensively analyse the effects of Act 896.

In general, tax policy initiatives under Act 592 intending to increase government revenue both increased the amount to be paid as taxes as well as the difficulty of paying taxes via its multiplicity and/or frequency of payments in some instances. For instance, in 2011, government proposed that mining royalties be paid monthly rather than quarterly in order to improve government cash flow. Such strategies only increased hours spent paying taxes and were therefore detrimental to businesses. The Tax Administration bill proposed in 2011 under Act 592 to address the challenge of multiplicity of taxes via harmonizing tax laws was not passed. Instead, a related tax bill Revenue Administration bill has been proposed under Act 896.

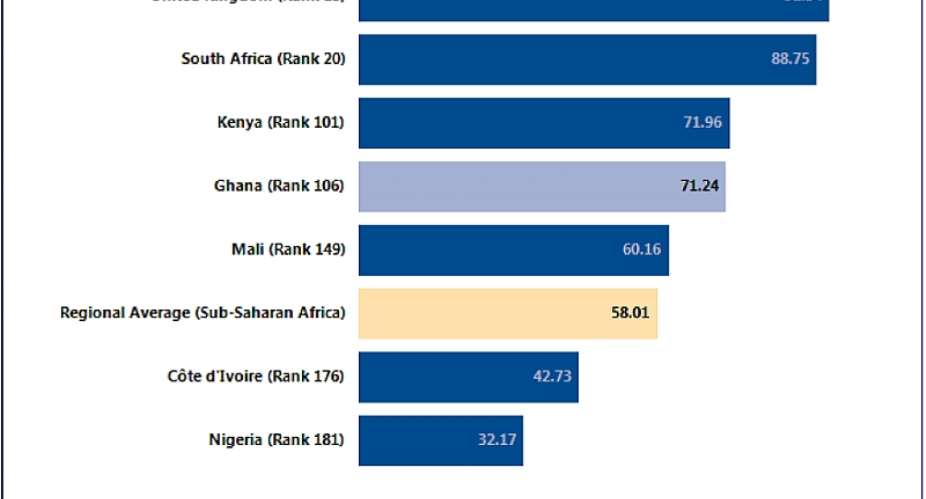

In comparison to the Sub-Saharan African regional average, under Act 592, Ghana performed better on the ease of paying taxes according to the 2016 Doing Business report. Figure 10 below shows how Ghana compares with selected economies on the ease of paying taxes.

Figure 10 How Ghana and Comparator Economies Rank On Ease of Paying Taxes

Source: Doing Business database

Although Ghana ranks higher than the typical situation in Sub-Saharan Africa, African countries such as Kenya and South Africa performed better. Lessons including how to make electronic filing of tax returns work in Ghana could be learnt from high performers such as the United Kingdom.

Table 7 provides a summary of tax rates and administration in Ghana under Act 592 according to the Ease of Doing Business report 2016.

Table 7 Summary of Tax Rates and Administration in Ghana

Source: Doing Business database

Act 896 and Act 592 differ is some important ways. Broadly speaking, total tax rates have increased overall under Act 896 even though the corporate tax rate remains unchanged at 25%. The increased rate of taxes in general has elicited howls of protest among the business community. Some differences between Act 592 and Act 896 include the following: permanent residents will be taxed not only on income obtained from Ghana but also abroad (world-wide source), capital gains tax has been increased from 15% to 25%, capital allowance cannot be deferred but instead unused capital allowance will be recognized as business loss and carried forward (in order to prevent tax evasion), business loss carried forward is 3 years for all businesses and 5 years for businesses in special industries (such as mining and petroleum industries) and a penalty of an interest at 125% of the prevailing Bank of Ghana's discount rate of the tax unpaid if a company understates or fails to pay tax.[39]

Trading across borders was challenging for businesses, for instance, under the Duty Drawback scheme. Following the liberalization of the export-import trade, in 1993, Ghana established a Duty Drawback scheme which entails the refund of all or part of import duties and taxes paid on imported materials used as inputs in the manufacture of goods which are then exported. This was done with the view to enhance private sector competitiveness internationally by boosting the production and export of value-added/processed goods rather than the export of raw materials which are susceptible to the vagaries of world market prices and hence expose businesses to high risks. Refunds have been very slow and in some cases not paid at all to businesses owed.[40]

Another important development relates to the ECOWAS Common External Tariff (CET) which essentially aims to form an external tax-barrier in order to protect domestic markets of ECOWAS countries. The Authority of Heads of State and Government of ECOWAS adopted in January 2006 in Niamey a decision establishing the ECOWAS-CET. The CET aims to enhance greater transparency and predictability of ECOWAS' trading regimes inside and outside the region. The four levels of customs duty under the ECOWAS CET initially agreed on were 0%, 5%, 10% and 20%, based on the degree of processing of products as well as other considerations. But in November 2008, the Governments of ECOWAS decided that a rate of 35% with a fifth band structure should also be applied.[41]

Analysis and Discussion of Key Policies/Bills/Laws

Selected policies/bills/laws discussed and analysed include: (i) Tax Administration bill under Act 592 and Revenue Administration bill under Act 896 (ii) Provisions of Act 896 which require review, namely, capital gains tax, punitive measure for defaulting, withholding tax on individuals' service fees and loss carried forward; (iii) Duty Drawback scheme; and (iv) ECOWAS CET bill.

To begin with, out of a population of about 6 million people supposed to be paying taxes, only about 1.5 million were recorded to be paying taxes. The informal sector has not been successfully captured by the tax-net owing to information constraints especially relating to identification of tax payers. The result was that medium-size companies, on average, made about 32 tax payments a year, spent about 224 hours a year filing, preparing and paying taxes and paid total taxes[42] amounting to as high as approximately 33% of profit generated according to the World Bank's Doing Business reports for the period under study. For the same tax revenue amount (that is, GHc 24,149.7 million as at December 2015), the tax burden of businesses would have been less if entities supposed to pay taxes were actually paying as mandated by law. The Tax Administration bill proposed in 2011 was never passed let alone implemented to improve tax collection. It was intended to simplify and harmonize various GRA tax laws, namely: the then Income Tax Bill, Vat law, Excise law and the Customs law in order to ensure easy reference for compliance. The Revenue Administration Bill associated with Act 896 is currently under consideration by Parliament and is expected to simplify and harmonize various tax laws as well as improve the efficiency of tax collection.

Additionally, it is important that the tax rates are not increased without paying close attention to the related incentives for investment and production. Experts such as the Chairman for the Ghana Stock Exchange (GSE) Dr. Sam Mensah have advised government to reconsider the increase in capital gains tax from 15% under Act 592 to 25% under Act 896 because it reduces the competitiveness of the GSE since it is the only market in the region that has the tax on listed securities.[43] A tax analyst Abdallah Ali-Nakyea has also stressed that Ghana is losing millions as a result of delayed reforms on the capital gains tax because government appears to be willing to make an amendment in that regard but has been painfully slow in doing so. The associated uncertainty created has made investors reluctant to enlist on the GSE.[44] Apart from the concerns raised, the capital gains tax could adversely affect risk-taking behaviour pertinent to entrepreneurship success and consequently job creation in the economy. The increased capital gains tax would also cause more incentive to consume today rather than save for investment tomorrow since it erodes not only gains made but could also eat into the value of the asset especially against the background of the high inflation rate in Ghana's economy.

Furthermore, the penalty for the failure of companies to meet their tax obligation under the new tax law (that is pay interest at 125% of Bank of Ghana discount rate of the tax unpaid for the period for which the tax is outstanding compounded monthly) requires reform. This is because not only is such a penalty unstable since the monetary policy rate changes but it could collapse businesses as well. Incidentally, periods of economic hardship in Ghana are usually associated with tightening of monetary policy as a result of supply-side inflationary pressures. Therefore the punishment for defaulting businesses is likely to be more magnified during times of major macroeconomic instability. This means that the punitive measure intended to ensure compliance is likely to have a detrimental unintended consequence for businesses. Punishments should not be too severe as to have the likelihood of putting businesses completely out of operation because the business defaulted once or twice. Under Act 592, failure of companies to pay taxes on the due date attracted a fine of GHS 4 a day. In the United Kingdom, the penalty for late filing of corporate tax returns is shown by Table 8 below[45]:

Table 8 Penalties for Late Filing of Corporate Tax Returns in the UK

| Time After Deadline | Penalty |

| 1 day | £ 100 (but changed to £ 500 if it happens 3 times in a row) |

| 3 months | Another £ 100 (but changed to £ 500 if it happens 3 times in a row) |

| 6 months | Corporation Tax bill and a penalty of 10% the unpaid tax |

| 12 months | Another 10% of any unpaid tax |

Source: UK Government/www.gov.uk

The United Kingdom ranked 15th as illustrated by figure 10 above on ease of paying taxes provides an example from which lessons can be drawn. More specifically, Table 8 shows that the penalties for late filing of corporate tax return in the UK are not overly punitive from the onset although the punishment increases with increasing non-compliance over time.

Also, the general withholding tax for services was initially increased from 5% to 15% but businesses complained that it is likely not only to eat away their profits but their working capital as well. Consequently, government of Ghana reduced the tax from 15% to 7.5%. However, withholding tax on individuals increased to 15% according to section 116 (2) (c) of Act 896 in the case of service fees remains at 15% and is likely to have adverse implications for individuals in terms of incentive to work and deliver quality. There have therefore been calls for its reduction but government remains firm on its positon with regards to withholding taxes on individuals.[46]

Moreover, under Act 896 section 17 (1), loss carried forward is up to 3 years for all businesses and up to 5 years for special industries such as those involved in the petroleum and mining operations. This provision which was only limited to particular industries under Act 592, is good for businesses in general because deducting losses reduces the tax liability of companies, especially start-ups, which usually incur losses at the beginning of their operations. However, the 5 year limit may yet be inadequate for companies involved in making heavy investments and thus have the potential of incurring losses for longer than 5 years at the beginning of their operations.

In relation to the Duty Drawback scheme, implementation has undermined the actual objectives in the sense that import costs have rather increased for businesses due to irregular and delayed payments of the refund. Indeed, against a macroeconomic background of a rising inflation rate as well as depreciation of the cedi, these delays result in reduction in the monetary value of refunds thus causing claimants to lose a lot of money due them. Research conducted by the Ghana Chamber of Commerce and Industry indicated that, on average, government owes about GHS 456,289 per individual company. The highest amount owed to businesses is about GHS 1,700,000 million and the minimum amount is about GHS 500. The research also revealed that on average payments could take about 10 months depending on follow ups. However in extreme cases, payment of refund could be made after 2 years while the shortest possible period is 5 months.[47]

Furthermore, Article 22 of LI 1060 stipulates that, if duty or value of imports is reduced, the businessperson should not have a refund for the full amount of duties actually paid. This implies a reduction in the net value of money paid as refunds to the importer/manufacturer in question.Article 23(a) of LI 1060 (1993) also provides for the payment of drawback of 95% of the duties actually paid. In spite of these provisions which necessitate adjusted payments coupled with complaints of inadequate funding for payment of refunds (especially from 2011-2013, since funding was from 0.16% of CEPS' monthly revenues), indications were that the provisions were not being applied, and claimants were repaid the full amount of drawback in some instances. There was also a clear implementation gap evinced in Article 25 of LI 1060 which gives the Commissioner of Customs Excise and Preventive Service (CEPS) absolute discretion to allow full or partial drawback where some provisions of LI 1060 seem unreasonable or impose hardship, subject to such stipulations as the Commissioner may determine in which case no appeal is authorized against a decision or determination made under this regulation. This left importers at the mercy of the Commissioner's discretion in some cases. Coordination between CEPS, MoF and MOTI for successful implementation of the scheme also requires improvement. In some instances, GRA has been willing to pay but has been unable to do so partly due to MOF's delay in releasing funds for payment. Exporters have on some occasions threatened to sue GRA and MOF as a result.[48] [49] It is vital that the refund mechanism under Act 896 be improved overall in order to encourage compliance.

Regarding the ECOWAS CET, there are important potential benefits for businesses. These include: a uniform trade tariff would ensure transparency in custom formalities; a successful integration will curtail the incidence of smuggling and thus improve custom revenue in the country and integration would promote a viable regional capital market that would attract investment from external markets, and consequently, inflows would contribute towards financing projects in order for the region to make major strides in industrialization.[50]

Despite the potential advantages, the CET has not been implemented in all ECOWAS countries. After approval by the authority of Heads of States and Governments of ECOWAS, the implementation of CET came into effect on 1st January, 2015. However, it is hoped that Ghana will join eight ECOWAS countries which are already implementing the CET should Parliament pass the CET Bill which is currently before the House. The immediate implication of the implementation is that some tariff lines will change which will result in a net increase in import duties. This could be detrimental for importers that import outside ECOWAS. Nevertheless, more generally, the CET will serve as a major platform for a Customs Union which will facilitate free trade and ensure greater economic integration within the region.

CONCLUSION AND RECOMMENDATIONS

Conclusion

The World Bank's Ease of Doing Business Indicator and the WEF's Global Competitiveness Indicator showed a declining trend with regards to the friendliness of the Ghanaian business environment since 2011. Against this backdrop, the report provided a comprehensive evaluation of five major problems faced by the business community since 2011 and further analysed related policy interventions with the view to provide robust recommendations to ultimately improve the predicament. The constraints selected and examined pertained to: cost and access to private sector credit, exchange rate volatility, inflation rate, cost and availability of power supply and tax rates and tax administration. In general, it was observed that the business community faced significant challenges in the period under study typically due to:

i) the dearth of planning and implementation of holistic private sector policies;

ii) inadequate consideration of potential costs and benefits of a policy before implementation;

iii) implementation of contradictory policies;

iv) no passage of some relevant bills into law; and

v) the absence and disregard of various laws/policies.

More specifically, inadequate access and high cost of credit to the private sector constrained the stable growth of private sector credit within the period under study posing a significant challenge to businesses. Admittedly, some positive achievements were also chalked in the review period under the MSME project and EDAIF Act. For instance, in relation to access to credit for MSMEs, under the MSME project, the total volume of bank credit to MSMEs increased by 236% (US$ 5.1 Billion from a baseline of US$ 2.2 Billion). However, policy inconsistencies, failures and in some cases, absence of relevant policy have adversely affected the willingness and ability of the private sector to obtain credit. Particularly, in 2011, GoG and BoG sent mixed signals to commercial banks since the banks were encouraged to reduce lending rates by moral suasion but, simultaneously, Treasury bill rates were generally high inciting banks to channel funds towards the purchase of Treasury bills. Consequently, lending rates only reduced marginally from 25.9% in 2011 to 25.7% in 2012: it was still high for the private sector. Also, interest rate spread was wide averaging about 15% in the period under study: indicative of weak degree of financial intermediation. Banks have profited from the wide spread. They have been reluctant to invest in research in order to generate more innovative ideas in attracting loanable funds to operate at lower cost (ultimately for the benefit of the private sector via lower lending costs). This is as a result of the absence of policy to contain the wide interest rate spread. Moreover, the implementation of relevant financial support programs especially for SMEs has been strongly tied to foreign aid/loans in some instances such that failure to obtain the aid/loan in full automatically affected the support program(s) adversely. There were also significant amount of assets or potential funds/collateral security to the private sector which lie unclaimed as there is currently no law or policy to compel the responsible institutions to consciously search for the relevant next of kin of various beneficiaries. Government therefore proposed under the Dormant Asset Scheme to manage the funds until they are reunited with the rightful owners.

The exchange rate was highly volatile, in general, in the period under study due to increasing rate of inflation, seasonal demand pressures on foreign exchange, speculative activity, and reduced foreign exchange inflows due to the declining commodity prices. In 2012, taxes on raw materials were automatically increased by the depreciation of the cedi against the US dollars since import duties were computed in dollars. Moreover, in 2015, public debt rose mainly due to exchange rate developments. Policies to stabilize the Ghana cedi proved futile and in some cases more harmful. In 2014, for example, the Bank of Ghana's administrative measures to restrict the use of foreign exchange aggravated the situation especially for businesses involved in the import-export trade since these businesses required more flexibility in the use of foreign exchange. Furthermore, government's proposal to increase the maturity profile of domestic debts under the MTDS was contradicted by government's actual behaviour in practice. This is because government's focus on reducing borrowing costs in order to meet fiscal goals resulted in rebalancing towards short-dated domestic debt instruments which are not accessible to non-residents hence reducing potential inflow of foreign exchange. Admittedly, more recently, in the 4th quarter of 2015 and the 1st quarter of 2016, the exchange rate has been relatively stable on the back of improved inflow from development partners, proceeds from Eurobond and the cocoa export finance facility. Although there were challenges across the borders such as in relation to the Duty drawback scheme, the EDAIF Act (now EXIM Act) contributed to improving and adding value to exports. Also, the issuance of the 5-year domestic bonds using the book-building process in November 2015 and March 2016 contributed to the stability of the cedi since offshore investors took up about 67 percent of total allotted bids for the 3rd March, 2016 issue for instance leading to increased inflow of foreign exchange.

The rate of inflation was generally high and trended upwards in the period under study. The non-food component mostly drove inflationary pressures although the food component has surpassed the non-food component more recently reflecting increased production costs associated with the energy predicaments and taxation. Over the review period, the rate of inflation increased owing to huge fiscal injections, exchange rate developments, weak transmission mechanism and supply-side inflationary pressures stemming mainly from increases in petroleum levies, utility tariffs and various taxes. Proposed fiscal consolidation and tight monetary policy under the IMF's ECF programme have not been effective because fiscal dominance of monetary policy still persists. Essentially, in 2015, by intending to reduce government's own cost of borrowing via reducing the Treasury bill rates, the transmission mechanism which works through both the interbank interest rates and the Treasury bill rates have been weakened. This culminated in a reduction in the lending rate from 29% in 2014 to 27.5% in 2015 although lending rates have weakly increased generally in the review period. It is worthwhile mentioning that the standing facility introduced by the Bank of Ghana in 2013 improved the response of the interbank interest rate to the Monetary Policy rate (MPR) but the consequent impact on the lending rate was in some instances contradicted by Government of Ghana's Treasury bill rate. Furthermore, CEPA has asserted recently that, based on its research, government is merely building up arrears instead of cutting expenditure significantly. This could be a countervailing development against gains made on reducing inflationary pressures should arrears be paid by government as Ghana approaches the elections. Also, the exchange rate-channel of influencing the rate of inflation was partly underutilized since non-residents who typically possess foreign exchange were not given adequate opportunity in some instances to bring in foreign exchange because they are not permitted by law to purchase short-dated domestic debt instruments whilst several auctions for 5-year and 7-year bonds were cancelled in 2014. There have also been instances where government has abused the Bank of Ghana Act and borrowed much more than 10% of the previous year's revenue from the Bank of Ghana (Auditor-General's report, 2012). This means that government, instead of generating revenue has in some instances worked with the Bank of Ghana to print money to finance its deficit even beyond the 10% cap set by law further increasing the rate of inflation.

The frequency of power outages increased and the cost of electricity rose substantially the period under study. AGI indicated that companies generally regard the quality of the electricity as average but have been adversely affected by the erratic supply of power in ways including: wasted raw materials during the abrupt curtailing of power, wages paid for work not done, market losses due to failure to deliver produce on time and damages to equipment. Although the demand for electricity increased at about 10-15% annually, existing installed generation capacity outweighed System peak demand. Director of Public Relations and External Affairs of the PURC, Nana Yaa Jantuah wondered why a country with an installed capacity of 3,200 megawatts (MW) and a demand of 2,100MW would be shedding load but for poor planning. Admittedly, about 50% of the energy input mix is from hydrologic sources thus posing hydrologic risk to actual power generation. Also, there was a disruption in the gas supply from WAGP due to a damage to the pipeline. However, inefficiency on the part of institutions such as ECG (who overbilled Ghanaians and had about 25% of its total purchases lost in distribution) as well as poor policy choices on the part of government has worsened the energy situation. More particularly, government policy focused on costly emergency power barges to increase the already high installed generation capacity instead of investing and accelerating projects such as the LNG projects which would have provided a cheap and reliable alternative source of input for power generation. Again, government did not pay its bills in some instances and also failed to keep its promise to pay for subsidies to absorb part of the price mark-up of proposed tariff increases. As a result government owes various institutions in the power sector huge sums of money and has therefore weakened their ability to perform optimally. Furthermore, government in more recent months has refused to release load-shedding schedule ahead of the elections although power outages remain. This is not consistent with LI 1935.

Businesses also faced high tax rates in the period under review coupled with the challenges of tax multiplicity and the difficulty of paying taxes under Act 592. Out of a population of about 6 million people supposed to be paying taxes, only about 1.5 million were recorded to be paying taxes due to information constraints associated with identification. Also, a proposed Tax Administration bill meant to simplify and harmonize scattered tax laws was not passed. Rather a similar bill: Revenue Administration bill was proposed for 2016. What is more, in some instances, policies by government to increase revenue typically had the unintended effect of increasing the variety of taxes and in some cases the number of tax payments made by businesses. As a result of the challenges being experienced under Act 592, Act 896 intended to improve compliance and simply the tax regime took effect in January, 2016 replacing Act 592.

The Income Tax Act, 2015 (Act 896) differs from the previous tax law in several respects including the following: permanent residents will be taxed not only on income obtained from Ghana but also abroad (world-wide source), capital gains tax has been increased from 15% to 25%, business loss carried forward is now 3 years for all businesses and 5 years for businesses in special industries (such as mining and petroleum industries), 15% withholding tax on individuals' service fees and a defaulting penalty of an interest at 125% of the prevailing Bank of Ghana's discount rate of the tax unpaid. It is early to accurately weigh the costs and the benefits of Act 896. Provisions such as 3 years of carrying forward losses for all businesses were found to be good for businesses but the time-limit for loss carried forward for special industries, increased capital gains tax,withholding tax on individuals' service fees and the punitive measure for defaulting require review. Furthermore, trading across borders was found to be challenging for businesses under the Duty Drawback Scheme, for example, which basically refunds part or whole of taxes paid by importers of raw materials who eventually export. Inconsistent actions of relevant ministries and deviation from laws were partly responsible for the predicament and the situation requires redress. The ECOWAS CET meant to facilitate trade in ECOWAS was discovered to have important advantages for businesses. The CET bill is currently before Parliament.

Recommendations