The Nigerian insurance sector is encountering significant challenges as a result of the fluctuating value of the Nigerian Naira. This has led some insurance companies to seek business opportunities elsewhere. ODIMEGWUONWUMERE examines the fact that the Naira's value has been unstable over time due to various economic factors, which have directly affected insurers and policyholders in the industry. The article traces that one major concern arising from these fluctuations is the uncertainty it creates for insurers, as they rely on stable and predictable currency values for their long-term contracts and obligations. The article unearths that despite the government's implementation of various policies, the strain on the domestic currency has not been alleviated, and the parallel premium continues to rise. This contradicts one of the objectives of the naira float. The article suggests that government authorities address the issue of illiquidity in the foreign exchange market in order to strengthen the value of the Naira

Over time, the insurance sector in Nigeria has encountered uncertainty concerning its efficiency and effectiveness as a consequence of unforeseen fluctuations in exchange rates. Experts assert that these fluctuations affect local prices, including imported goods, exported goods, and domestic product prices denominated in foreign currencies. Consequently, specific insurance stakeholders are contemplating relocating to alternative African regions in pursuit of exchange rate stability.They said that the major obstacles to business and investment in Nigeria are the devaluation of the naira and the problems related to dollar liquidity. Lawrence Nazare, the CEO of Continental Reinsurance Plc, which is Africa's biggest private reinsurer, recently talked about the company's strategy to extend its activities in the eastern region of the continent to decrease their dependence on the Naira currency.

According to Nazare, "the company has always aimed to counteract the effects of naira volatility through its geographical diversification over the past decade. Currently, approximately 30% of Continental Re's business is located in Nigeria, compared to around 65% a decade ago. Furthermore, the weakness of the naira is partially mitigated by the fact that a substantial portion of the company's Nigerian operations involve reinsurance for oil and gas, which is denominated in dollars."

Devaluation of the Naira causing obstacles

Juxtapositing to that, in mid-June, the government made the decision to devalue the currency in order to stimulate economic growth and increase foreign investment. However, this action has had negative consequences for the financial industry. The Nigerian insurers said the value of the naira in the official market dropped by as much as 40%. Initially, the official and parallel market rates were comparable, but the disparity has grown due to a scarcity of dollars, resulting in a greater demand for foreign currency. As a result, the insurance sector has been significantly impacted.

Records had it that on Wednesday, the official market valued the naira at 767.21 per dollar, while the parallel trade valued it at 920. It was widely known that the devaluation of the naira was a result of demands from the International Monetary Fund and the World Bank, as well as complaints from businesses for more extensive reforms.

Enhancing liquidity and transparency

Stakeholders believed that enhancing liquidity and transparency was crucial for effective forex intervention by any central bank. This belief is based on the fact that authorities have made various attempts at different exchange arrangements over the years.

These arrangements have included fixed official rates, market-determined official rates, dual systems with fixed or lagging official rates, and even more depreciated rates determined through interbank dealings or auctions.

It is widely believed that upon the “attempts” yet institutions, particularly those in the insurance industry, face significant risks due to fluctuations in exchange rates.

These fluctuations have a negative impact on institutions that have securities traded on the money market and engage in foreign transactions, as they are exposed to currency fluctuations.

In recent developments, experts have argued that there is a long-term effect of insurance penetration on economic growth. When examined in different aspects, they have found evidence supporting the impact of insurance on both short-term and long-term economic growth.

Insurance sector not immune to the uncertainties

Furthermore, they have also revealed that the insurance sector is not immune to the uncertainties in economic policy. However, these uncertainties actually lead to an increase in insurance premiums in both the short-term and long-term, although the long-term impact is greater.

Adverse volatility in exchange rates negatively affects the insurance sector, resulting in losses, reduced investments, a decline in premium collection, and lower earnings. Nazare is confident in the company's presence in West Africa but also sees a promising future in East Africa.

This could be why he believes that the inclusion of the Democratic Republic of Congo in the East African Community in 2022 will further enhance prospects.

Prior to COVID-19, global rate increases had hindered the availability of insurance in Africa. Those who are knowledgeable claim that the absence of local insurance companies capable of providing coverage for large risks has allowed foreign insurers and brokers to step in and take on these activities, resulting in a loss of foreign earnings through capital flight.

Consequently, if an insurer takes on more of these specialized risks, the currency fluctuation resulting from the new floating FX policy would further increase capital flight.

Insurance companies need a fundraising system to meet needs

The fundamentals suggest that the naira's weakness, as indicated by the parallel market rate of ₦1250/$, should not be as severe.

Experts predict that the rate will stabilize at ₦1300/$ in the future. Nazare argues that African companies need a fundraising system to meet the continent's needs, which will involve unprecedented consolidations in the coming years.

He envisions a strong and sustainable reparations market in East Africa and sees potential for acquisition. Although the current focus is on organic growth, Nazare recognizes the advantages of participating in consolidation opportunities.

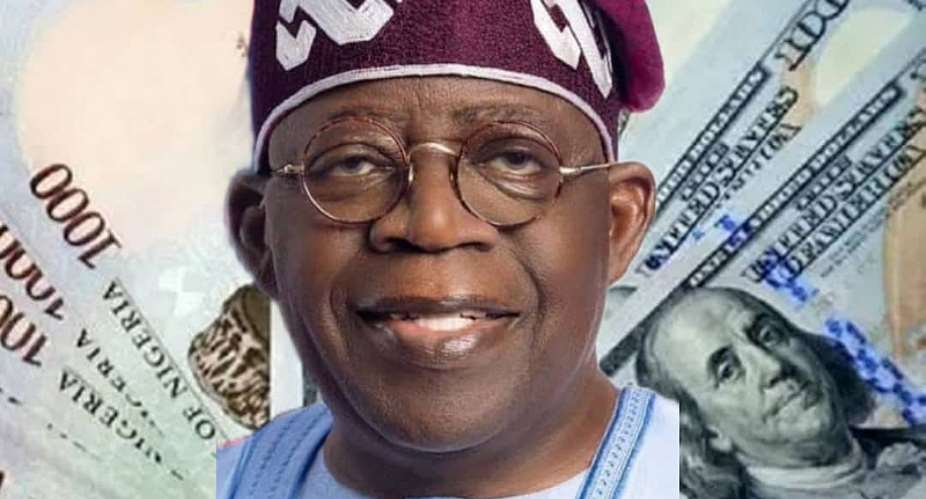

Continental Re's financial statement is in dollars, and the impact of President Bola Tinubu's decision to float the naira is decreasing due to diversification.

Insurance, which has been around since ancient times, was known as bottomry contracts in Babylon around 4000–3000 BCE. The Hindus also practiced bottomry in 600 BCE, and it was well understood in ancient Greece by the 4th century BCE. Nazare accepts Tinubu's decision but expresses a preference for earlier funds.

He believes that maintaining a strong income policy may not benefit everyone as insurers try to avoid changes in exchange rates. However, the company has a B financial strength rating from AM Best.

Tackling the issue of illiquidity in the foreign

Given the issue at hand, the National Insurance Commission is a government agency in Nigeria mandated by law to oversee and regulate the country's insurance industry. However, capital market experts have advised President Tinubu to tackle the issue of illiquidity in the foreign exchange market to bolster the value of the naira. Representing the Association of Capital Market Academics of Nigeria (ACMAN), they have requested the Central Bank of Nigeria (CBN) to reconsider the currency swap agreement with China with the goal of facilitating import payments.

In Abuja on September 15, 2023, Professor Uche Uwaleke, the President of ACMAN, stated that the government must prioritize the diversification of the economy. Professor Uwaleke expressed concern that the group believed the government's adoption of various policies had not alleviated the strain on the domestic currency.

ACMAN was concerned about the lack of liquidity in the forex market and the ongoing volatility in exchange rates, despite the implementation of the naira float policy and the unification of exchange rates. Additionally, the parallel premium has continued to increase, which appears to contradict one of the objectives of the naira float.

According to Uwaleke, “we believe that the Central Bank of Nigeria should reconsider the currency swap agreement with China in order to decrease the reliance on US dollars for imports from China, given the ongoing substantial amount of imports from China.

“A lasting solution on the supply side involves making deliberate efforts to diversify the export base. Meanwhile, the government should provide support to the CBN in implementing the RT 200 program, particularly in relation to port reforms, while also focusing on improving the ease of doing business to attract more foreign investments.”

Encountering significant challenges

The rating agency states that Continental Re has a rating indicating strong revenue and consistent performance. Moreover, the combined ratio, which calculates losses and expenses based on net income, has ranged from 95.4% to 105.9% between 2017 and 2021. Undoubtedly, checks have shown that the Nigerian insurance sector has faced significant challenges due to the fluctuating value of the Nigerian Naira.

As the official currency of Nigeria, the Naira's value has been unstable over time due to various economic factors. These fluctuations have directly impacted insurers and policyholders in the insurance industry. One major issue arising from the Naira's fluctuation is the uncertainty it presents for insurers. Insurers operate based on long-term contracts and obligations that require stable and predictable currency values.

Policyholders in the insurance sector are also affected

However, when the Naira experiences significant fluctuations, insurers struggle to accurately determine policy prices and effectively manage financial risks. This uncertainty has resulted in higher expenses for insurers, ultimately impacting their profitability. Additionally, policyholders in the insurance sector are also affected by the Naira's fluctuation.

Stakeholders stated that a decrease in the value of the Naira leads to increased expenses for imported goods and services, which affects many insurance companies that rely on reinsurance from global markets to mitigate risks. Consequently, the depreciation of the Naira results in higher reinsurance costs, leading to higher premiums for policyholders.

Finding insurance less affordable

Due to this, people and companies have found insurance to be less affordable, leading to a decrease in their desire to obtain insurance. The instability of the Naira also affects the investment profits of insurance companies. Typically, these companies allocate a portion of their premium income to invest in various financial assets, such as government bonds, stocks, and real estate.

However, when the value of the Naira decreases, it reduces the value of these investments, which are based on foreign currencies. As a result, this has caused a decline in investment profits for insurers, ultimately impacting their overall financial performance.

Minimizing the impact of Naira volatility

To minimize the impact of Naira volatility on the insurance sector, experts suggest several measures. Firstly, insurance companies can adopt risk management strategies like hedging to protect themselves against currency fluctuations.

Hedging involves using financial contracts to offset potential losses caused by unfavorable currency movements. Additionally, the presence of regulatory authorities is crucial for maintaining stability in the currency market. By implementing effective monetary policies and creating a stable macroeconomic environment, regulators can contribute to reducing Naira's volatility.

As a result, this would create a more favorable environment for insurance companies to operate. Lastly, promoting the development of local capacity in the insurance industry can also help mitigate the effects of Naira volatility. By nurturing domestic expertise and keeping premiums within the country, insurers can reduce their reliance on foreign reinsurance and minimize their vulnerability to currency value changes.

- Onwumere writes from Rivers State. He can be reached via: [email protected]

Ejisu by-election: Don’t condemn our officials, we’re probing content of envelop...

Ejisu by-election: Don’t condemn our officials, we’re probing content of envelop...

[VIDEO]: Ghanaian man catches wife in bed with younger lover; uses to juju cause...

[VIDEO]: Ghanaian man catches wife in bed with younger lover; uses to juju cause...

Social media has taken you away from your Bible; judgement day is coming — Eastw...

Social media has taken you away from your Bible; judgement day is coming — Eastw...

You’re not ministers; stop parading yourselves as such — Minority tells minister...

You’re not ministers; stop parading yourselves as such — Minority tells minister...

‘Fools have infiltrated NPP; it's no more attractive’ — A Plus

‘Fools have infiltrated NPP; it's no more attractive’ — A Plus

Gov’t committed to retooling Ghana Navy, Armed Forces – Akufo-Addo assures

Gov’t committed to retooling Ghana Navy, Armed Forces – Akufo-Addo assures

Stand and greet me: Akufo-Addo behaving like a child with inferiority complex — ...

Stand and greet me: Akufo-Addo behaving like a child with inferiority complex — ...

Mahama destroyed the ‘meaty’ better Ghana and built a ‘bony’ Ghana; we don’t wan...

Mahama destroyed the ‘meaty’ better Ghana and built a ‘bony’ Ghana; we don’t wan...

We won’t hesitate to sanction officials who violate our laws – EC warns official...

We won’t hesitate to sanction officials who violate our laws – EC warns official...

Proposed nationwide rebranding of Public Basic Schools is a misplaced priority –...

Proposed nationwide rebranding of Public Basic Schools is a misplaced priority –...