Dean of the University of Cape Coast Business School, Prof John Gatsi has told Finance Minister Ken Ofori-Atta that he should ensure that the National Investment Bank (NIB) is recapitalized as was stated in the 2024 budget statement.

Prof Gatsi mentioned the important role that the NIB has played in the development of the country for which it must be supported at all costs to remain in business.

He said the government would be blamed if the bank collapsed.

The government has made a provision of GH¢4 billion to address the liquidity issues of the NIB and other distressed Special Deposit-taking Institutions (SDIs) in the country.

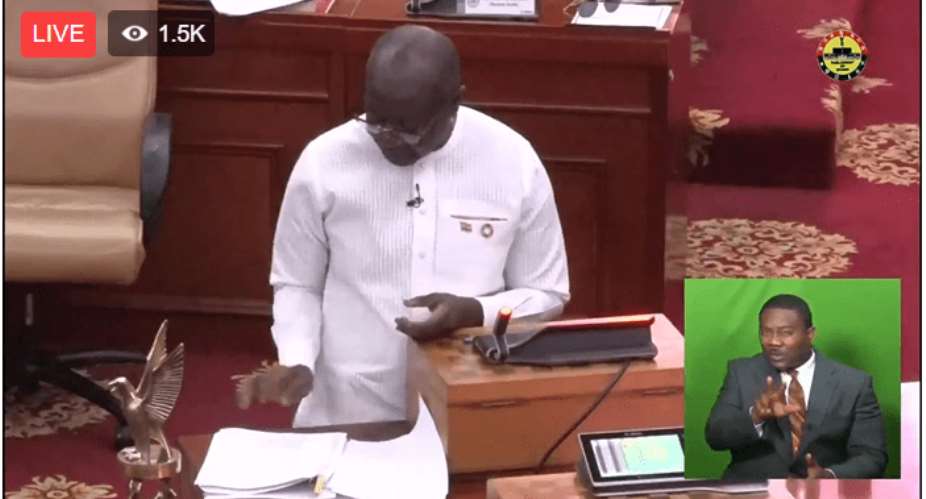

Presenting the 2024 budget statement in Parliament on Wednesday, November 15, the Finance Minister said “Mr. Speaker, the Financial Sector Strengthening Strategy (FSSS), which was developed to mitigate the impact of the GoG debt operation on the financial sector, provides for the design of the Ghana Financial Stability Fund (GFSF) as a programme in the Ministry of Finance.

“It also aims to address outstanding legacy issues following the 2017-2019 financial sector clean-up.

“This Fund offers a solvency window consisting of two distinct sub-funds –namely a US$250 million World Bank supported sub-fund targeted at qualifying banks and SDIs; and a cedi equivalent of US$500 million GoG-funded sub-fund that will help to recapitalise state-owned financial institutions as well as potentially support other indigenously-controlled financial institutions to improve their post-DDEP solvency.”

He added ” Mr. Speaker, in addition, a provision of GH¢4 billion has been made in the 2024 Budget to address National Investment Bank (NIB), distressed SDIs, and other outstanding legacy challenges in the financial”.

Speaking on this issue on the Ghana Tonight show on TV3 Thursday November 16, Prof Gatsi said “It has been on the table for a long time that the Minister should use his office to help capitalize NIB. NIB has long been financing development projects in the country that cut across agriculture, the investment in rubber plantations, they support all kinds of construction in the country so it is supposed to be a strategic bank to foster a lot of developments.

“So this was the expectation long time. But for about four or five years one could not tell why the government decided not to mind NIB. The only important thing that has happened was the continued restructuring that has actually downsized the bank but the real investment that is needed was not coming.”

He added “The bank has been struggling sometimes so if the government now decides to recapitalise it that will be welcome news but there is some noise around the bank to the extent that ADB wanted to merge with that bank and there was a hue and cry.

“So now that the Minister had indicated in the budget that they are going to capitalize the bank, the only thing one could say is that they should be focused and recapitalize the bank if not so, the demise of the bank will be blamed on the government.”

-3news.com

List of 24 ministerial nominees approved by Parliament

List of 24 ministerial nominees approved by Parliament

You were my inspiration, made me who I am today – Lilian Kumah

You were my inspiration, made me who I am today – Lilian Kumah

Rainstorm destroys Hohoe E.P. Senior High School building

Rainstorm destroys Hohoe E.P. Senior High School building

John Kumah strongly supported me to become NPP flagbearer – Bawumia reveals

John Kumah strongly supported me to become NPP flagbearer – Bawumia reveals

Late John Kumah urged me to run for NPP flagbearer, strongly supported me — Bawu...

Late John Kumah urged me to run for NPP flagbearer, strongly supported me — Bawu...

Akufo-Addo appoints Joseph Kpemka as Deputy MD of BOST

Akufo-Addo appoints Joseph Kpemka as Deputy MD of BOST

Ablakwa petitions CHRAJ to investigate sale of SSNIT's hotels to Rock City Hotel

Ablakwa petitions CHRAJ to investigate sale of SSNIT's hotels to Rock City Hotel

MoF to provide new bailout for defunct Gold Coast Fund investors – Bawumia revea...

MoF to provide new bailout for defunct Gold Coast Fund investors – Bawumia revea...

OMCs implement price adjustments despite International petroleum price declines

OMCs implement price adjustments despite International petroleum price declines

Petition to remove Kissi Agyebeng will disrupt operations of OSP – Martin Kpebu

Petition to remove Kissi Agyebeng will disrupt operations of OSP – Martin Kpebu