Ghana’s population of 30.8 million people is endowed with abundant mineral resources especially gold. The country is governed by laws and so the right of ownership and the exploitation of her mineral resources are determined by legislations, policy and regulatory frameworks including the 1992 Constitution of the Republic of Ghana, the Minerals and Mining Act, 2006, Act 703 and the Companies Act, 2019, Act 992

On right of ownership of Ghana’s mineral resources, Article 257 (6) of the 1992 Constitution (https://lawsghana.com/constitution/Republic/Ghana/1)and Section 1 of the Minerals and Mining Act, 2006, Act 703 (https://www.mincom.gov.gh/wp-content/uploads/2021/06/Minerals-and-Mining-Act-2006-Act-703.pd) state that “Every mineral in its natural state in, under or upon any land in Ghana, rivers, streams, water courses throughout Ghana, the exclusive economic zone and any area covered by the territorial sea or continental shelf is the property of the Republic of Ghana and shall be vested in the President on behalf of, and in trust for the people of Ghana”.

The Ghanaian government, vested with the right of ownership of the country’s mineral resources made a decision in 1995 to promote livelihoods of the local people. They blocked out 72km2 area of land in the Gbane community in the Talensi District of the Upper East Region of Ghana for small scale mining activities. The local people welcomed the government’s decision by forming and registering over 41 small scale mining groups with each group given 25 acres of land as concession for mining activities.

However in 2016, the owner of these mineral resources, the Government of Ghana was influenced by a large scale mining company, Cassius Mining Limited, (CML) to set aside its earlier decision of keeping the place exclusively for small scale mining activities for improved livelihoods of local people. The area was unblocked, and mineral right granted to Cassius Mining Limited (CML) to undertake large scale mining operations.

Image showing the mining area before and after it was awarded to CML (Source: Minerals Commission)

Cassius Mining Limited was incorporated on the 10th of May, 2016 with registration number CS079902016 to undertake exploration and mining of gold in Gbane community in the Talensi District of the Upper East Region of Ghana.

Motivated by the assertion of the Natural Resource Governance Institute (NRGI, 2015) (https://resourcegovernance.org/analysis-tools/publications/owning-options-disclosing-identities-beneficial-owners-extractiv), that “in cases where a particular firm appears to be given a preferential treatment or uncommon deal by the government, this may be an indication of risk worthy of a deeper investigation”, the researcher decided to investigate the beneficial and legal owners of CML and the integrity history of the company with this power of influence over the government to change its decision. Sources of information for the investigation were key informants, Office of Registrar of Companies, Minerals Commission, Ghana Police Service-CID, Office of Attorney-General and Ministry of Justice, Security experts and online publications.

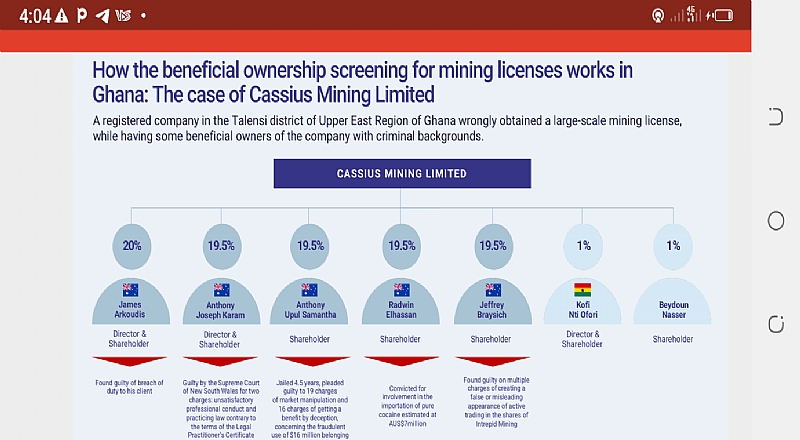

Unravelling company ownership: Ghana’s law on beneficial ownership disclosure

To begin with, Ghana’s Companies Act, 2019, (Act 992) retrieved from https://rgd.gov.gh/docs/Act%20992.pdf mandates companies to submit information about their ultimate beneficial owners to the Registrar General's Department (RGD). Section 393 of the Companies Act defines a “beneficial owner” as, among other things, any “individual who directly or indirectly ultimately owns or exercises substantial control over a person or company”. For mining, oil and gas companies, this applies to anyone who commands 5% or more ownership interest or controlling rights. Data accessed and assessed from the Office of the Registrar of Companies (ORC), previously Registrar General Department (RGD), as of August 2022 lists James Arkoudis, Anthony Joseph Karam, Anthony Upul Samantha, Radwin Elhassan, Jeffrey Braysich, all of Australian nationality as each having significant shareholding of between 20% and 19.5 % as of June, 2016 in CML. As per the law, these five Australian nationals can be categorised as the beneficial owners of CML. The Table below shows who owns and controls Cassius Mining Limited

Who owns and controls Cassius Mining Limited?

| Total number of shares—1,225,640 | |||||

| TIN | Name | Nationality | Date of birth | Designation | No. & % of individual shares |

| P0003490912 | James Arkoudis | Australian | 17/10/1965 | Director &Shareholder | 245,128 (20%) |

| P0003490955 | Anthony Joseph Karam | Australian | 26/07/1972 | Director & Shareholder | 239,000 (19.5%) |

| P0004528506 | Kofi Nti Ofori | Ghanaian | Director & Shareholder | 12,256 (1%) | |

| P0006480772 | Anthony Upul Samantha | Australian | 31/03/1971 | Shareholder | 239,000 (19.5%) |

| P0006480764 | Radwin Elhassan | Australian | 23/09/1969 | Shareholder | 239,000 (19.5%) |

| P0007307281 | Jeffrey Braysich | Australian | Shareholder | 239,000 (19.5%) | |

| P0007217455 | Beydoun Nasser | Shareholder | 12,256 (1%) | ||

Knowing your clients: a look at the background of the beneficial/legal owners of CML

The investigation further established that each of these owners of the CML has criminal records and convicted by courts of competent jurisdiction in Australia including the Supreme Court. They are convicted on crimes of narcotic drugs (cocaine), fraud, market manipulation, unprofessional conduct and breach of duty as can be read from the links against each of them below.

For purposes of illustration, James Arkoudis is a beneficial owner of CML with 20 % shares and currently listed as the Principal/Director of CML . CML website describes James’s background as having nearly twenty years commercial experience as a solicitor. What it does not say is his historical criminal record. As per information retried from https://www.bransgroves.com.au/mortgage-case-notes/bakovski-v-lenehan-2014-nswsc-671.html, https://www.carternewell.com/icms_docs/231510_Professional_and_Management_Liability_Gazette_2nd_edition.pdf, https://jade.io/article/335449 and http://www8.austlii.edu.au/cgibin/viewdoc/au/cases/nsw/NSWSC/2014/671.html)

The Supreme Court of New South Wales, Australia found James Arkoudis guilty of breach of duty to his client, Bakovskis for failing to exercise reasonable skill, care and diligence in the provision of legal service.

The prosecution in the case of Radwin Elhassan by the New South Wales Court of Appeal August, 2002 convicted him for possession of 28 kgs of narcotic drugs, cocaine. An appeal was made against his conviction in 2003 but it was dismissed and the Judge described his previous sentence as manifestly inadequate. (https://jade.io/article/137683?at.hl=Regina+v+El+Hassan).

In the case of Anthony Upul Samantha, he was jailed four and half years after pleading guilty to 19 charges of market manipulation and 16 charges of getting a benefit by deception, concerning the fraudulent use of $16 million belonging to Cogent Securities. ( https://jade.io/article/131928).

Anthony Joseph Karam was found guilty by the Supreme Court of New South Wales for two charges; unsatisfactory professional conduct and practicing law contrary to the terms of the Legal Practitioner’s Certificate (jade.io/article/196621) and Jefrey Braysich found guilty on multiple charges of creating a false or misleading appearance of active trading in the shares of Intrepid Mining. (https://www.theaustralian.com.au/business/mining-energy/convicted-market-riggers-back-in-business/news-story/54309cb3f8eb14293b52a2524fe94f2f)

Below is an infographical presentation of the beneficial and legal owners of CML and their criminal records

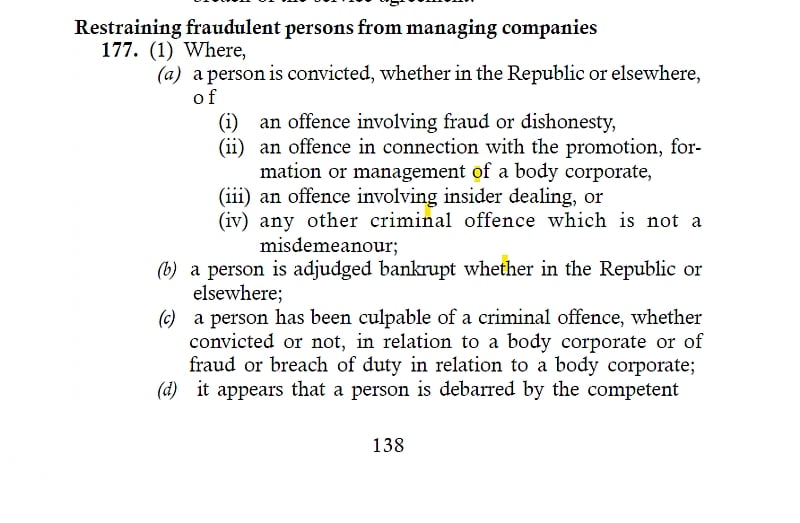

What does the law say about persons with criminal records doing business in Ghana?

The laws of Ghana forbid persons with criminal records, ex-convicts and fraudulent persons from doing businesses in Ghana. This is according to Section 186 of the Companies Act, 1963, (Act 179) which was in force at the time of Cassius Mining Limited’s incorporation and Section 177 of the current Companies Act, 2019, Act 992 also restrains fraudulent persons from managing companies.

Knowing Your Clients, How Effective is the Due Diligence process?

The investigations sort to reveal how due diligence is conducted on mining companies before awarding licences. The first point of call was the Minerals Commission. An officer of the Minerals Commission stated that, “We as a Commission do due diligence on every mining company before granting licence. We do this by setting up two committees, namely a technical committee and a technical board to review applications of mining companies for mineral rights. In the review process, the Criminal Investigation Department (CID) of Ghana Police Service is requested to do criminal background checks of the company under review and furnish the Commission with its report. Where there are no adverse issues raised against the individuals and company, the Commission considers the application and recommends to the Minister of Lands and Natural Resources for a grant of the mineral right applied for”.

The Ghana Police Service-CID, when contacted confirmed the narration of the Minerals Commission. The officer said, “Yes, we collaborate with the Minerals Commission in doing due diligence on mining companies for grant of licences, is there any problem?”

The above responses from the Minerals Commission and the Ghana Police Service imply that due diligence was conducted on Cassius Mining (Ltd) and nothing was found wrong hence the decision to grant mineral rights for exploitation of mineral resources in the Gbane community in Upper East Region.

However, the Office of the Attorney-General and Minister of Justice in a response to the question on whether or not a foreign ex-convict by the laws of Ghana can do business in the country was that “convicted persons are barred from being directors by virtue of Section 177 of the Companies Act, 2019 (Act, 992). However, in respect of Section 35 (1) of the Companies Act 2019, (Act 992), there is no restriction as to the qualification of a shareholder of a company”.

Aside the BO and due diligence issues, Cassius Mining Ltd on the 25th of January, 2017 also entered into joint venture with Gulf Industrials without the notice and approval of the Minister of Lands and Natural Resources, an action that contravenes Section 14 (1) and Section 67 (1) of the Minerals and Mining Act, 2006, Act 703.

Beyond borders

CML in its Third Quarter Activities Report dated 29th April, 2022 stated that the Company’s flagship Soalara Limestone Project is in Madagascar, consisting of two contiguous mining permits totalling 18.75 km2. Both were granted to mine limestone, valid for 40 years to 2055. Data collected from Madagascar to establish whether or not there are restrictions imposed by Malagasy laws concerning qualifications of persons to do business or otherwise shows similarities with the Ghanaian law on ex-convicts doing business in the country. According to Article 2.5 of the Malagasy Commercial Code, “No one may exercise a commercial activity directly, or through an intermediary, if he has been the subject of (1) a permanent or temporary general prohibition pronounced by a judicial court, whether this prohibition was pronounced as the main penalty or as an additional penalty,(2) a final sentence of at least one year of imprisonment without suspension for theft, fraud, breach of trust, concealment, forgery, bankruptcy, corruption, breaches of company laws or economic and financial offences. In this case the ban is applicable for five years”

What has been done?

The Ghanaian authorities especially the Ministry of Land and Natural Resources and the Office of the Attorney-General and Minister of Justice having had their attention drawn to suspected criminal backgrounds of some directors and shareholders of Cassius Mining Ltd through a petition by a Civil Society Organization (CSO), Northern Patriots in Research and Advocacy, (NORPRA) in 2019 took a decision against Cassius Mining Ltd. While the Office of the Attorney-General and Minister of Justice directed the Registrar-General of the Registrar-Department to strike out names of Anthony Upul Samantha and Radwin Elhassan as directors of Cassius Mining Ltd, the Hon Minister responsible for Mines in January, 2020 instructed the Minerals Commission not to renew the licence of Cassius Mining Ltd on grounds of convictions of the directors of the company by courts of competent jurisdictions in Australia.

What can be done?

One thing that stands clear is regulatory institutions of the state did not use beneficial ownership data to conduct due diligence of Cassius Mining Ltd before granting it mineral rights to operate. The Minerals Commission and Ministry of Lands and Natural Resources should consider undertaking a broader screening or audit of license award in the sector to identify risks, vulnerabilities and potential breaches and to strengthen frameworks and practices to mitigate such risk and avoid further breaches. Beneficial owners of companies who apply for licenses must be checked as part of due diligence processes to check corporate ownership chains and other that their backgrounds as well as environmental, Social and Governance (ESG) indicators are within the remits of the law before awarding mining rights.

Putting this into context, Edwin Wuadom Warden, a Country Officer at the International Secretariat of the Extractive Industries Transparency Initiative (EITI) noted that as global demand trends for critical minerals are expected to rise, the pace at which new projects will emerge in countries like Ghana is expected to increase. In Ghana, some small-scale mining/galamsey continue to cause so much damage while very few ultimately benefit from it. According to him, the public ability to access and scrutinize who actually owns and controls companies, what the terms of awarded licenses/contracts are and following revenues from mining, oil and gas/energy projects will be needed now more than ever.

The Minerals Commission and Ministry of Lands and Natural Resources should consider undertaking a broader screening or audit of license award in the sector to identify risks, vulnerabilities and potential breaches and to strengthen frameworks and practices to mitigate such risk and avoid further breaches.

It is important that institutional collaborations of all relevant stakeholders including the regulatory authorities (such as the Minerals Commission), law enforcement agencies (such as the Ghana Police Service) is strengthened to promote beneficial ownership transparency and screening of companies to avoid government handing over mineral rights to the country’s most valuable natural resources to companies whose ultimate owners may have a history of corporate misconduct and illegal activity including drug offences, tax evasion, money laundering among others.

This study was undertaken by Northern Patriots in Research and Advocacy (NORPRA) led by its Executive Director, Bismark Adongo Ayorogo. The study was supported by the Opening Extractives Programme jointly implemented by the Extractive Industries Transparency Initiative (EITI) and Open Ownership (OO), and supported by the BHP Foundation. Its contents are however the sole responsibility of the author and can, in no way, be taken to reflect the views and positions of the EITI, OO nor BHP Foundation. Any errors or omissions are the responsibility of the authors

Minority will expose the beneficial owners of SML, recover funds paid to company...

Minority will expose the beneficial owners of SML, recover funds paid to company...

Prof. Opoku-Agyemang has ‘decapitated’ the NPP’s strategies; don’t take them ser...

Prof. Opoku-Agyemang has ‘decapitated’ the NPP’s strategies; don’t take them ser...

Abubakar Tahiru: Ghanaian environmental activist sets world record by hugging 1,...

Abubakar Tahiru: Ghanaian environmental activist sets world record by hugging 1,...

Prof. Naana Opoku-Agyemang will serve you with dignity, courage, and integrity a...

Prof. Naana Opoku-Agyemang will serve you with dignity, courage, and integrity a...

Rectify salary anomalies to reduce tension and possible strike action in public ...

Rectify salary anomalies to reduce tension and possible strike action in public ...

Stop all projects and fix ‘dumsor’ — Professor Charles Marfo to Akufo-Addo

Stop all projects and fix ‘dumsor’ — Professor Charles Marfo to Akufo-Addo

Blue and white painted schools will attract dirt shortly – Kofi Asare

Blue and white painted schools will attract dirt shortly – Kofi Asare

I endorse cost-sharing for free SHS, we should prioritise to know who can pay - ...

I endorse cost-sharing for free SHS, we should prioritise to know who can pay - ...

See the four arsonists who petrol-bombed Labone-based CMG

See the four arsonists who petrol-bombed Labone-based CMG

Mahama coming back because Akufo-Addo has failed, he hasn't performed more than ...

Mahama coming back because Akufo-Addo has failed, he hasn't performed more than ...