What do you fall on in the events of financial crisis and emergencies? How long are you able to survive emergencies without feeling the stress on your finances? Is there a way to still cater for your necessities when you lose your job or when faced with unforeseen events? These are very important questions to ask yourself since times and seasons are as changeable as the weather. The past few months have shown that crisis are bound to happen and if we are not prepared, our lives will come to a standstill just as the economies of the nations.

What Is An Emergency Fund?

Business Dictionary defines an emergency fund as money which is set aside for an emergency situation, such as unexpected unemployment or injury, or a natural disaster which destroys one’s home and belongings. We live in a world of uncertainties and life happens when one is least expectant. Undesired, unexpected events come to disrupt our financial health. Dire financial conditions create encumbrances and if not handled well may lead to depression. When you lose your job, there is no certain period it will take you to find another one. As a result, you will have to depend on what you have (i.e. if there is any) for the period of the unemployment or the crisis. When the Corona virus pandemic crept into our world, economies across continents were shut down, employees’ salaries were either frozen or cut down, and some people unfortunately lost their job. The impact of the joblessness may even be more than that of the pandemic on the individual. The question to ask is, how will you survive the period of this emergency without a job? According to the Washington Post, more than 22 million Americans have filed for unemployment since President Trump declared a national emergency.

How Much Do I Need To Save Up?

The rule of thumb is to save between 3 to 6 months of living expenses but there is nothing wrong with saving for more months. The amount to save up varies from person to person and it is based on one’s expenses. You must note that, you must not stress yourself to save more than necessary so as to not put pressure on yourself during the period of the savings. Once you hit the target for the emergency fund, you can save up for other things you might need or want so to cater for your lifestyle. Due to the current pandemic, it assumed that it will take more than 2 years to recover from the economic slides which may lead to higher periods of unemployment so you might need to save up for more than the 6 months rule of thumb.

How Do I Start The Whole Processes?

Calculate Your 6 Month Expenses

The first step in the process of starting an emergency fund is to calculate your 6 months expenses as stated by the rule of thumb above. Begin by listing your expenses for the month and in this case, list your expenses that are necessary (on essentials). Emphasis is on the fact that in times of crisis and emergencies, you will not want to be spending on eating out, entertainment, vacations, the gym, and other non-essentials. With a pre-existing budget, one can just pick the figures upfront from the budget. In the case of a non-existing budget, you must monitor your expenses over a period of one month and multiply it by 6. These critical expenses often include housing, healthcare, food, transportation, debt, utilities and personal expenses. The table below shows the monthly expenses of a client with a 1-month total expenses of 1,800 cedis and a 6-month total expenses of 10,800 cedis.

| Items | Monthly Expenses |

| House | 300.00 |

| Groceries | 600.00 |

| Transportation | 400.00 |

| Utilities | 200.00 |

| Personal Expense | 100.00 |

| Healthcare | 200.00 |

| Total of 1 Month Expenses | 1,800.00 |

| 6 Month Expenses (6*1800) | 10,800.00 |

Table: List of Monthly Expenses and 6 month expense

Set Monthly Savings Goal

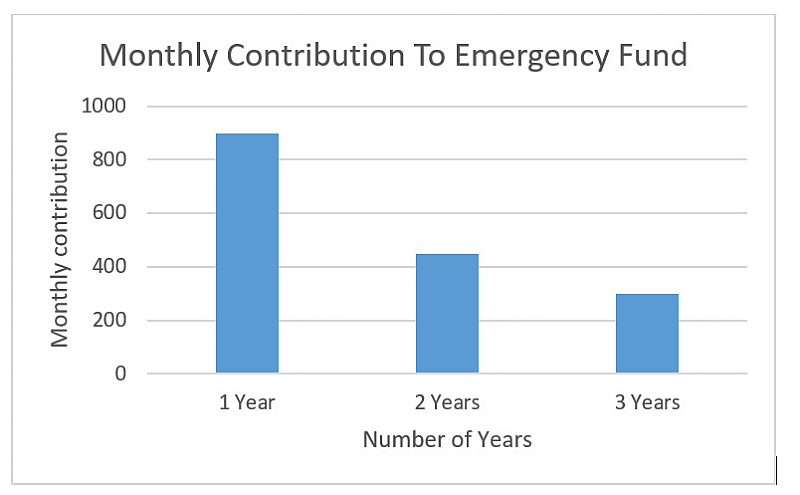

After coming up with the total amount to save for the fund, you should now determine how much to save each month to be able to meet the emergency fund target. The monthly savings will also be based on your budget as in how much do you have left after all expenditure to save up. For this reason, you should revisit or draw your budget and fix the monthly saving towards the fund in there. Do it well so you don’t get stressed financially in the process of creating the fund. You can decide to do it within a year or 2 so you split the required funds over the number of months in the year you’ve chosen. The chart below is an extension of the table above. From the chart, if you want to be done with your emergency fund within 1, 2 and 3 years; you will need to make a monthly contribution of 900 cedis, 450 cedis and 300 cedis respectively. The more the number of years, lesser the monthly contribution.

Chart: Monthly Contribution Towards Funds

Chart: Monthly Contribution Towards Funds

Set Automatic Transfer Instructions On Your Account

After knowing how much to contribute monthly, it is crucial to set a direct debit on your account to the emergency fund. This helps your bank transfer the money from your current or savings account at a particular time in the month before you are tempted to withdraw it for other things that you might need. The emphasis here is on direct debit not a standing order as you will be charged for the standing order by your bank. But if you don’t mind, the standing order will help achieve the same goal too.

Define Emergencies

A proper definition of what you consider as emergencies will prevent you from unnecessary spending. This is important since you can just go and withdraw the money because anything has happened to you. Emergencies often should be loss of job; health issue; car maintenance; natural events like a pandemic, earthquake, flood; and couple of others. You should be able to come up with what an emergency is to you so you know exactly when to and when not to touch the funds.

Where Should I Keep The Funds?

We live in a world where inflation keeps going up and this reduces the value of your money. To protect your money against inflation, it is ideal to invest the money in a money market mutual fund. The account must be different from your main bank account to prevent you from having easy access to it but it must also be liquid so you can get it as and when the emergency occurs.

Your emergency fund is very essential to surviving in times of crisis. The rule of thumb of 3 to 6 months save up of expenses to make the fund will save you, don’t forget that you can save more especially due to pandemics like the current one. It is crucial to calculate your total 6 months expense, set monthly goals, put a direct debit on your account as well as define what emergencies are to you. Keep the funds in a different account from your main account but it must be in liquid account preferably a money market mutual fund. The best time to Start is now.

Enoch Dzah

[email protected]

https://www.linkedin.com/in/enochdzah

TUC tells informal sector employers to pay their employees the minimum wage

TUC tells informal sector employers to pay their employees the minimum wage

Prof. Marfo urges good civilian-security relations to promote peace

Prof. Marfo urges good civilian-security relations to promote peace

I was nearly jailed because of NPP; I’m still ‘pained’ — Hopeson Adorye

I was nearly jailed because of NPP; I’m still ‘pained’ — Hopeson Adorye

Rising against NPP after being a minister for 15 years is a sin; God will judge ...

Rising against NPP after being a minister for 15 years is a sin; God will judge ...

Cecilia Dapaah: Reasons behind AG’s advice to EOCO not grounded in law – Martin ...

Cecilia Dapaah: Reasons behind AG’s advice to EOCO not grounded in law – Martin ...

NPP should have reported Kingsley Nyarko’s conduct to police – Inusah Fuseini

NPP should have reported Kingsley Nyarko’s conduct to police – Inusah Fuseini

Akufo-Addo cuts sod for MIIF Technical Training Centre

Akufo-Addo cuts sod for MIIF Technical Training Centre

NPP didn’t struggle to win Ejisu by-election – Samuel Ayeh-Paye

NPP didn’t struggle to win Ejisu by-election – Samuel Ayeh-Paye

A/R: Achiase Chief arrested for acid attack on community members

A/R: Achiase Chief arrested for acid attack on community members

Naa Ayemoede returns to school

Naa Ayemoede returns to school