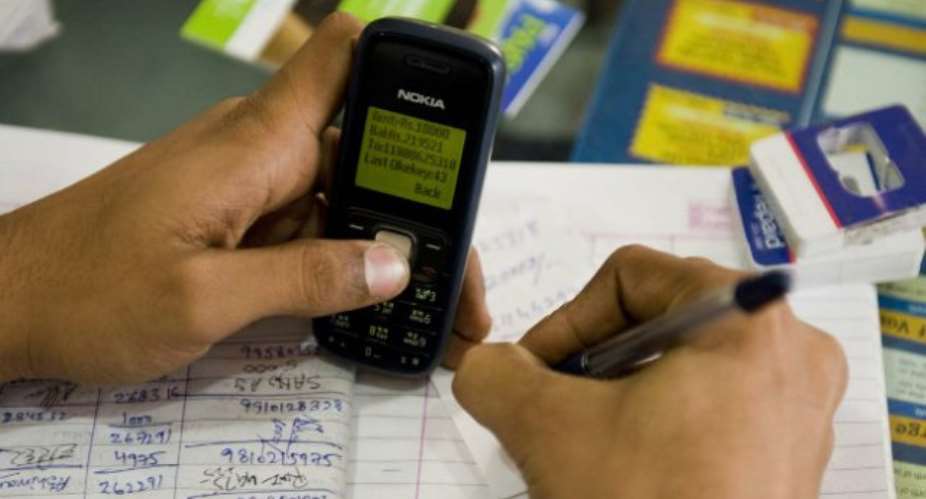

The ministry of communications will be very disappointed as the Bank of Ghana (BoG) has come out that it won't be compelled in anyway to release data on mobile money users as being demanded.

According to the Governor of BoG, Dr Ernest Addison, his office is doing everything to protect data of mobile money customers in the country.

The Governor’s comment comes at the time that communications ministry is pushing to have access to mobile money data for purposes of revenue assurance.

Speaking at the launch of the second phase of the Mobile Money Interoperability in Accra, Dr Addison said BoG has the sole responsibility for the sector.

“…as the sole regulator of the Mobile Money sector, the Central Bank will ensure that right things are done by the various players in the sector. We will continue to regulate and monitor activities within the space and ensure that all participants play by the rules.”

He said the Bank of Ghana has a key responsibility to safeguard the integrity of the financial system to underscore the trust that is central to financial deepening and development.

Dr Addison added, “it is therefore critical to ensure the confidentiality of transactions, privacy of data collected by operators in this space (including personal and financial data), the security of transactions, and smooth operations of all stakeholders and regulators providing complementary services in this space.”

Fintechs

The Governor also challenged fintechs to work closely with the banks to harness the numerous opportunities presented by financial inclusion in the economy.

He said, “The interoperability that exists between e-zwich, bank accounts and mobile money wallets, offer participants an endless opportunity to develop various value-added services to the public.

Let me, therefore, challenge Fintechs to work closely with banks, non-bank financial institutions and especially rural and community banks to come out with several other products and services that will further bring banking and financial transactions closer to the public.”

Dr Addison added, “I see endless opportunities with this financial inclusion triangle and I hope the players also realise the enormity of opportunities it presents.”

---MyJoyOnline

SSNIT must be managed without gov’t interference – Austin Gamey

SSNIT must be managed without gov’t interference – Austin Gamey

Ejisu by-election could go either way between NPP and independent candidate — Gl...

Ejisu by-election could go either way between NPP and independent candidate — Gl...

We never asked ministers, DCEs to bring NPP apparatchiks for returning officer r...

We never asked ministers, DCEs to bring NPP apparatchiks for returning officer r...

No one denigrated the commission when you appointed NDC sympathizers during your...

No one denigrated the commission when you appointed NDC sympathizers during your...

Used cloth dealers protests over delayed Kumasi Central Market project

Used cloth dealers protests over delayed Kumasi Central Market project

A/R: Kwadaso onion market traders refuse to relocate to new site

A/R: Kwadaso onion market traders refuse to relocate to new site

Dumsor: Corn mill operators at Kaneshie market face financial crisis

Dumsor: Corn mill operators at Kaneshie market face financial crisis

Jamestown fishermen seek support over destruction of canoes by Tuesday's heavy d...

Jamestown fishermen seek support over destruction of canoes by Tuesday's heavy d...

Election 2024: EC to commence voter registration exercise on May 7

Election 2024: EC to commence voter registration exercise on May 7

Public schools rebranding: We’re switching to blue and white, we’re painting all...

Public schools rebranding: We’re switching to blue and white, we’re painting all...