Banks are the blood of every economy because it deals with the pecuniary matters of the country and connects it with the citizens and government while helping in the creation of new money and capital which help in the growth of the country. Banks have helped not only in the expansion of the economy; but also, in facilitating international and internal trade. Like any other business, banks also need to earn an income for smooth running.

In recent years, the changing nature of the banking industry has become an increasing focus of policy interest. It has been argued that widespread deregulation accompanied by technological development has changed the environment in which banks are operating. Ghana’s banking industry has undergone a challenging period in recent years, weathering an economic downturn and a rising tide of non-performing loans. While high non-performing loans have undermined sector stability and remain a key challenge, the country’s lenders continue to grow their assets and remain profitable. With this, the banking industry has undergone drastic changes in recent years in terms of structure and business model. One aspect of overall financial change is a shift in the pattern of business undertaken by banks, which is thought to be manifested in a relative increase in fee and other non-interest income vis-à-vis net interest income.

In this article, we focused attention on the patterns of the components of banks income and changes therein. Following the line of argument above, income components is considered to be a particularly fruitful area to look for indications of changes in the nature of the banking industry.

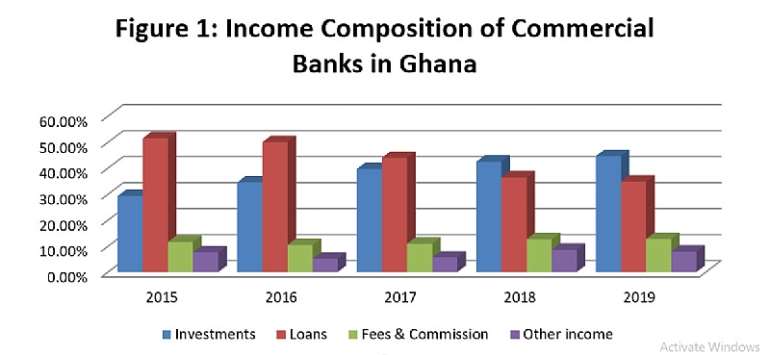

Data from the Bank of Ghana shows that, there is a change in income composition of commercial banks from the traditional interest income through lending to non-interest income in recent years. Thus, banks in Ghana have focused on non-interest income streams to complement their income from traditional interest earning activities for some years now. Streams of income by commercial banks in Ghana are

- Loans (Interest income): Income earned from loans and advances by commercial banks.

- Investments (non-interest income): This comprises income from treasury bills, government of Ghana bonds and equity investments.

- Fees and commissions (non-interest income): This entails income from trade finance related services; payment and money transmission services; fund management services; financial consultancy and advisory services; underwriting services; clearing and settlement services; derivative, COTs, e-banking charges, agency fees, cheque books and foreign exchange trading services.

Data from the Bank of Ghana shows that the total profit before tax recorded in 2015 by the banking industry amounted to GH¢ 2.5 billion. With this, an amount of GH¢1.29billion representing 51.50% was generated from loans. Besides, total income generated from investments and fees & commission were GH¢ 730 million (29.30%) and GH¢ 290 million (11.60%) respectively.

In 2016, a total of GH¢ 2.71 billion profit before tax was earned by commercial banks in Ghana. With regard to the sources, an amount of GH¢ 1.36 billion representing 50.0% was generated from loans. Moreover, total income generated from investments and fees & commission amounted GH¢ 930 million (34.50%) and GH¢ 280 million (10.40%) respectively.

Again, the total profit before tax recorded in 2017 by the banking industry amounted to GH¢ 3.32 billion. With this, an amount of GH¢ 1.46 billion representing 43.90% was generated from loans. Income generated from investments and fees & commission at the same period of time amounted GH¢ 1.31 billion (39.60%) and GH¢ 360 million (10.90%) respectively.

In 2018, a total of GH¢ 3.66 billion profit before tax was earned by commercial banks in Ghana. With regard to the sources, an amount of GH¢ 1.33 billion representing 36.40% was generated from loans. Besides, total income generated from investments and fees & commission amounted GH¢ 1.55 billion (42.40%) and GH¢ 460 million (12.60%) respectively.

Finally, profit before taxes earned by commercial banks in 2019 from investments, loans and fees & commission were GH¢ 2.19 billion (44.60%), GH¢ 1.71 billion (34.80%) and GH¢ 620 million (12.70%) respectively.

Therefore, it can be deduced that commercial banks in Ghana are accruing a large percentage of their income from investments in various government securities in the past two years. The sharp growth in total investments in 2018 was largely due to the special (long-term) resolution bonds issued to Consolidated Bank Ghana (CBG). This led to long-term investments increasing by 115.8 percent in December 2018 as reported by the Central Bank, while short term investments contracted by 24.5 percent. A year after this development, growth in long-term investments (securities) normalised to 30.1 percent (GH¢33.03 billion) in December 2019, while short-term investments (bills) picked up by 21.1 percent to GH¢14.98 billion as at end- December 2019. However, the larger growth in securities in December 2019 compared to the short-term bills reflected banks’ preference for longer dated instruments in 2019.

To sum up, Ghana’s banking industry has undergone a challenging period in recent years, weathering an economic downturn and a rising tide of non-performing loans. In spite of all this, shareholders of banks expect good returns on their investments at all times. With this, commercial banks in Ghana must continue to diversify their income streams in order to minimize the possibility of loses in challenging period. An increase in the share of noninterest income in banks total income will decrease the volatility of banks’ profits, since income from services and fees does not usually depend as much on the business environment as interest income does. Also, for small commercial banks to remain competitive and also generate good return to their shareholders, then diversification of income streams cannot be ignored because, high reliance on income from loans could be vulnerable in the future due to increased competition. Large banks, for example, could make use of new technologies to make loans to the current customers of small banks, increasing the competition for small banks and reducing how much they can earn from lending.

Commercial banks in Ghana have played a key role in the development of the country through granting of loans to businesses and government agencies to undertake numerous projects in the country. However, high non-performing loans (NPL) in recent years have forced banks to focus more on fees and commission activities than granting of loans to businesses and this development can affect the economic growth of the country negatively. The banking sector would be very solid and well equipped to perform their financial intermediation role if all the stakeholders play their respective roles. With this, measures to reduce the chronic high non-performing loans in the country must be pursued by the various stakeholders in order to induce banks to grant more loans to businesses to boost economic activities and ultimately to stimulate economic growth in the country.

AUTHORS;

Edmund Obeng Amaning is a researcher/consultant. Contact: [email protected] , Cell: +233 54 347 5499

James Afful holds a Master’s degree in Economics, MBA Finance and Professional certificate in Risk Management. He is experienced in credit risk management, financial modeling and data analysis, investment banking and project finance. Contact: [email protected], Cell: +233 24 296 9042.

Akufo-Addo commissions Phase II of Kaleo solar power plant

Akufo-Addo commissions Phase II of Kaleo solar power plant

NDC panics over Bawumia’s visit to Pope Francis

NDC panics over Bawumia’s visit to Pope Francis

EC blasts Mahama over “false” claims on recruitment of Returning Officers

EC blasts Mahama over “false” claims on recruitment of Returning Officers

Lands Minister gives ultimatum to Future Global Resources to revamp Prestea/Bogo...

Lands Minister gives ultimatum to Future Global Resources to revamp Prestea/Bogo...

Wa Naa appeals to Akufo-Addo to audit state lands in Wa

Wa Naa appeals to Akufo-Addo to audit state lands in Wa

Prof Opoku-Agyemang misunderstood Bawumia’s ‘driver mate’ analogy – Miracles Abo...

Prof Opoku-Agyemang misunderstood Bawumia’s ‘driver mate’ analogy – Miracles Abo...

EU confident Ghana will not sign Anti-LGBTQI Bill

EU confident Ghana will not sign Anti-LGBTQI Bill

Suspend implementation of Planting for Food and Jobs for 2024 - Stakeholders

Suspend implementation of Planting for Food and Jobs for 2024 - Stakeholders

Tema West Municipal Assembly gets Ghana's First Female Aircraft Marshaller as ne...

Tema West Municipal Assembly gets Ghana's First Female Aircraft Marshaller as ne...

Dumsor is affecting us double, release timetable – Disability Federation to ECG

Dumsor is affecting us double, release timetable – Disability Federation to ECG