Whether we call it the Great Economic Depression, “Occupy Wall Street”, the Mexican peso crisis, the Japanese crisis, the Asian crisis or the great economic melt-down, one central tendency is that capitalism, like any other economic system is vulnerable to the vagaries and vicissitudes of change. The Occupy Wall Street” phenomenon in Obama's America has been described as a protest against corporate greed which is a euphemism for exploitation of wage labour. It demonstrates that capitalism has had serious cracks in spite of attempts by bourgeois scholars to cover it up with intellectual sophistry.

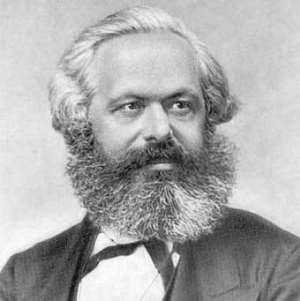

Some bourgeois scholars have been trying to diminish the achievements of Karl Marx by nicknaming him a prophet of doom, who never saw anything good in the industrialized world especially of the Western capitalist enclave. This essay considers the mystification of Marxism against the background of contemporary realities such as the Asian Financial crisis and the 2008 global economic meltdown. It is essentially an analysis that can open another vista of robust intellectual discourse.

Capitalism as popularly defined is an economic system in which the means of production and distribution is controlled by individual entrepreneurs or the bourgeois. Capitalism is treated as a specific mode of production, not simply a market economy. Capitalism posits that the economy is the superstructure, while all other institutions of state are substructure. As contended by Marxism, capitalism thrives on primitive accumulation, exploitation and alienation. Capitalism also thrives on rivalry on the assumption of perfect market competition, but as manifested in many nations, capitalism encourages class struggle, unequal income distribution even though liberal bourgeois scholars hold the view that capitalism is a rational and efficient competitive system.

Furthermore, capitalism exalts monopolism. Capitalism also polarizes society by creating socio-economic classes and in the process inflicts massive poverty. It is socio-economic polarization, increase in the mass misery index on one hand and primitive accumulation on the other. It is this tendency that brings about class struggle. Capitalism unfortunately evokes an ideological construction that is supposed to be sustained by the doctrine of liberalism, to follow feudalism and to be opposed to socialism and communism in a dialectical sense. Capitalism is a legal regime, an economic system and a social formation that unfolds in history and that is built upon two basic social relations: the market competition and the capital-labor nexus. Thus the disparity between capitalism and a market economy are not purely semantic. Capitalism can also constitute a powerful tool for analysis.

Capitalism is based on social production, but the sharing and use of what is produced is anchored on the principle of private property. This brings about alienation and frustration. Social polarization also increases the gap between the rich and the poor. Capitalism concentrates wealth in the hands of a small number of captains of industries while the workers become poorer. With the advent of hi-tech and globalization, capitalism has undergone some dramatic changes in tandem with the dynamics of global markets. There are three identifiable variants of capitalism.

There is Entrepreneurial Market Capitalism, which celebrates entrepreneurs who believe in free market economy. This is the type of capitalism commonly found in the massive industries such as Apple, Microsoft and the Silicon Valley. Most of the developing countries are yet to embrace entrepreneurial capitalism.

Cultural capitalism focuses less on the individual than on communities, and ultimately on entire cultures. It is a brand of capitalism deeply embedded in the norms and values of culture such as the European Community, the Swiss Cows and the French restrictions on working hours. “Cultural capitalism” may also be likened to Nigeria's attempt of rebranding her image because of the fast fading values, cherished ideas and patriotism occasioned by corruption and moral decadence. The third variant is “community capitalism”, which places premium on wealth creation within the context of the community. Community capitalism derives its strength from community entrepreneurship and enterprise; it does not emphasize government and politics but harnesses the brain power of it citizens more efficiently to create a commodious living.

Sadly, African communities are still wrestling with the demands of globalization and other multifarious socio-economic challenges hence there are less visible signs of innovation, change and entrepreneurship. Analysis of the aforementioned typologies of capitalism shows that entrepreneurial capitalism measures its success in wealth generation and innovation, cultural capitalism tends to preserve seemingly old economic activities for the sake of cultural continuity and identity, while entrepreneurial capitalism, which promotes free enterprise, blossoms in Europe. Community capitalism is designed to serve the entire cultural entity. On the other hand, cultural capitalism does not merely promote culture but helps in building on cultural myths that would serve as social bonds of society. It is a brand of capitalism designed to innovate quickly in the service of its core motivations. It thrives in nations like Singapore, Malaysia and other Asian countries. In Singapore for example, there is now a determination and co-ordination efforts to transform into a “knowledge Island”, a key node in a fast globalizing economy.

As Karl Marx wrote, nature requires long cycles of birth, development and regeneration, but capitalism requires short-term returns. The entire spirit of capitalist production, which is oriented towards the most immediate monetary profits, stands in contradiction to agriculture, which has to concern itself with the whole gamut of permanent conditions of life, required by the chain of human generations.

Flaws of Market Fundamentalism

Capitalism emphasizes the role of market as only one component of a capitalist economy that does not exclude other coordinating mechanisms or actors than markets and firms. Ostensibly, too, capitalism is not by nature only an economic system, since it requires legal rules and a suitable political power that respects and defends property. This explains why the literature on capitalism stresses so much the existence of stages and brands of capitalism such as commercial, industrial, financial variety of capitalism in the global system.

In a capitalist economy, the interplay of market competition with the conflicting nature of the capital-labour nexus promotes the accumulation of capital. Capitalist economies are dynamic systems, putting into motion structural change and innovation within the context of history in a dialectical sense. Eskor Toyo (2001) describes capitalism as a contest between grabbers. He posits that capitalism is an economy based on merchandized industrialism, a master-servant economy, in which the means of production and commerce is owned by the profit-seeking businessmen called capitalists. In capitalism, the bourgeois are the masters in production, who employ the servant “labourers or wage earners,” who are kept alive by slavish wages. The output and the profit belong to the bourgeois who typically accumulate a large part of the profit with a view to enhancing and controlling political and social power. Thus in a capitalist economy the consuming aim of production and commerce is profit accumulation.

Capitalism is characterized by two forms of capital accumulation namely; primitive accumulation and accumulation from profit already generated by capitalist enterprises. Primitive accumulation refers to the accumulation from the surpluses generated in recapitalized sectors of the economy. It is through primitive accumulation that money gets into the hands of new capitalists. Usually, the sources of primitive accumulation are numerous; gains from domestic and foreign commerce; government contracts, sales of government Corporations under the rubrics of privatization, government loans and subsidies, and outright peculation such as the dishonest appropriation of government wealth, perquisite and forcible taxation. Other sources include land grabbing and compradoring.

Capitalism is characterized by the assumption that the profits being accumulated by the bourgeois are simply surplus. The term surplus refers to the excess of product over reproduction needs. The two categories of reproduction needs are what may be required to replace equipment and replenish inputs, and what is needed to maintain production levels including the wages of workers. The capitalist accumulates these surpluses through the joint stock companies, in which the capitalist dictates who owns shares and how much the subscription would be.

Writing from his own experience, admittedly not of the real economy but only of financial markets, Soros challenges the equilibrium theory: Market fundamentalists have a fundamentally flawed conception of how financial markets operate. They believe that financial markets tend towards equilibrium… Financial markets are characterized by booms and busts and it is quite amazing that economic theory continues to rely on the concept of equilibrium, which denies the possibility of these phenomena, in face of the evidence. The potential for disequilibrium is inherent in the financial system; it is not just the result of external shocks" (Soros, 1998: 16)

Soros (1998) posits that the "breakdown" or "disintegration" of global capitalism is not the collapse of the world-wide system of production. He opines that capitalism thrives on profits based on the exploitation of wage labour, and this trend is legitimized when states come together to adopt measures that impede the free movement of finance capital. According to him, there are two main misconceptions about market capitalism. First, that free-market thinker hold the view that markets have an in-built tendency towards creating a stable situation through supply and demand being in balance, while this is not the case. Secondly, they preach that the market is the best way to regulate all human activities.

Capitalists are essentially businessmen who manifest tendencies such as individualism, commercialism, grabbing disposition toward monetizable wealth, insatiable avarice and kleptomania. Capitalists also engage in vicious competition with a profit and loss consciousness. Ideally, the competition in a capitalist state should promote innovation, technology and higher standards of living, these positive tracts all often subservient to avarice and selfishness, opportunism and philistinism. In the United States and a Western Europe, capitalism has established very strong monopolies that have extended their powers across transnational borders; now it has manifested in the form of globalization.

Karl Popper in his book titled “The Open Society and Its Enemies” argues against the attempts at establishing a "perfect" society in favour of accepting an "open" society as one subject to permanent improvement by piecemeal social engineering, by which he understood capitalism with a political structure involving elected institutions, the rule of law and pluralism. For Popper the main enemies of his "open society" were the totalitarian ideologies of fascism and Marxism.

Capitalism and Globalization

Capitalism and globalization are Siamese twins; for while capitalism thrives on competition, globalization is a strategy for freeing the global business arena of any obstacles to that competition. Following the great depression in the mid 1970's through the mid 1980's, capitalist economies had tangentially resolved to accentuate monopolism so as to compete favourably with others. The World Development Report (1986) observes that: Although dozens of multinationals are now larger than many national economies as long as countries have kept their economies fairly open to trade, competition between all these big firms has proved to be open and intense too (World Development Report, 1986: 16).

Globalization is a conscious policy and a process; it is a call for lifting restrictions on private imperialist direct investment. With the advent of Information and Communication Technology (ICT) coupled with the dynamics of international migration of capitals and the enormous increase in labour productivity have all combined to intensify the need to open national door for internationalized monopolies. Whereas the process of globalization may be universal, the degree of a country's exposure to the phenomenon depends, to a large extent, on its historical and geo-strategic significance and its democratic economic structure.

The LDCs have the propensity to industrialize and this has compelled them to protect their infant industries, banking and insurance services. They need patent right like the advanced capitalist nations, but the advanced capitalisms are opposed to such ideas as they would engender foreign competition. Marxist scholars posit that globalization is designed to enable the industrial giants penetrate all the markets to dump their goods. Globalization would enable leading capitalist communities commit more investments offshore hence the new thinking among the developing economies is to “swim” against the tide of globalization. In Africa, Asia and Latin America, there are some countries without the know-how, which have been pressured by the G-8 to liberalize their economies to create room for Foreign Direct Investment (FDI) and short-term capital inflows.

Blair (2005) states pointedly that in this modern world, there is no security or property at home unless we deal with the global challenge of conflict terrorism, climate change and poverty. He stated: It all happens as a result of what people themselves are doing, occasionally, we debate globalization as if it were something imposed by governments or business on unwilling people. Wrong it is the individual decision of million of the people that is creating and driving globalization. Globalization is not something done to us. It is something we are, consciously or unconsciously doing to and for ourselves.

The world is integrating at a fast rate, with enormous economic, cultural and political consequences. Globalization is designed to create a single global economy to provide unlimited opportunities for International Managers. From the financial perspective, globalization is a triad of the IMF, the World bank and the World Trade Organization (WTO). Anti-globalists fault the neo-liberal economists concerning where neo-liberalism has failed to transform the economies of Eastern Europe. Anti-globalists believe in the culpability of the IMF, WB and WTO of chimerical alternative economic systems. They allege that globalization is corporate capitalism which aims to regulate world linkages by sidestepping regional lack of economic growth. Stern (2003) defends globalization by arguing strenuously that ICT raises living standards; creates new jobs and wealth; and nobody can disown the widely held view that through neo-liberalism, most nations have been able to design institutions to increase the level of competition, lower inflation rates, and improve general living standards.

The nexus between capitalism and globalization is that the LDCs which have very low export potential would be dependent on the capitalist West. The external dependence would derive from the existing economic and institutional structure. If therefore the economy remains the superstructure upon which democratic institutions are built, it would be very difficult to deepen democratic institutions and good governance in fragmented nations such nations would be tied to the apron-string of the Bretton Woods institutions, which would offer in measured doses, loans with very stringent conditions such as budgetary stability, deregulation, privatization and other neo-liberal economic therapies that would, on the long-run plunge them into painful debt peonage and crass poverty.

One grim consequence of globalization is that in plural societies globalization brings about inequity. While it may be true that few persons especially in the extractive, export-oriented industries may benefit from the phenomenon, a huge number of people are adversely affected by the globalization. The beneficiaries are the advanced capitalist countries through the emigration of high calibre professionals, consultants, contractors, and giant importers benefiting from a liberalized trade regime. The essential corollary is social polarization, concentration of political power and wealth in the “comprador class”.

Globalization also seeks to entrench a New International Economic Order (NIEO). The goal was to build a more democratic world order, which would eradicate the structural dysfunctionalities of the global economic system and give the LDCs a voice. Sadly however, most countries have witnessed tremendous economic downturn. Examples abound. There was the “East Asian” economic crisis in 1997, and other similar crises in Latin America. The escalation of protectionism also crystallized in the Structural Adjustment Programmes (SAP) in the LDCs.

In Nigeria for Instance, the Structural Adjustment Programme (SAP) failed because the programme did not take into account the structure of the Nigerian Economy. The belief that SAP could alter the structure and aid in building a modern, market-driven economy was illusionary because all macroeconomic variables such as inflation, external sector indices, growth of GDP showed that the economy was not on the path of sustained growth. Azizul (1999) posits that a globalization reform has been transformed into a clandestine process negotiated within the context of Breton Woods Institutions outside public scrutiny. This explains why there is massive on-going demonstration against globalization, at every international event; indeed, there is dissent, whether pervasive or episodic suppressed or vocal against globalization.

Globalization is even worse for the LDCs because while the capitalist countries have access to the market in developed countries, the LDCs have no such access to such markets. The LDCs essentially produce primary products and can hardly compete with the advanced capitalist economies. For the LDCs to be integrated into the globalized economy, they must be provided with effective access to global markets. This would mean a substantial revision in the World Trade organization (WTO) provisions such that their capacity would be enhanced to negotiate commerce in favourable terms. This gesture has to be complemented by duty–free and quota free access to markets in addition to the technological know-how that would enhance their access to ICT. For the LDCs to savour the fruits of sustainable development, it is imperative to build strong democratic institutions, strengthen civil society, improve the terms on which the LDCs relate with the entire process of globalization. This would also require the restructuring of their economies.

There is sufficient evidence that most LDCs have adverse governance environment. In the absence of strong capitalist structures, government has been committed to playing major developmental roles. Thus, apart from political legitimacy, these nations need fiscal prudence to contain spiraling inflation, ensure budgetary discipline and economic stability. Such feats are already being achieved in Bangladesh, Sri-Lanka, India, Malaysia, Singapore, South Africa and other nations. In Sub-Saharan Africa, SSA, such development surprises can hardly be realized because of the absence of good governance.

The inevitability of Crisis in Capitalism

Since the “Keynesian Revolution” most economies in Africa, Asia and Latin America had adopted peripheral capitalism as a leading economic paradigm. Promoted by concreted experiences, economists in the LDCs embraced the “Dependency Theory” that until they embraced capitalism, their economies would remain subservient to those of the metropolitan economies. In south Korea and Taiwan, they even attracted global monopoly “partners” to their economies by diversifying exports, yet such partnerships did not cure their dependency syndrome.

In principle capitalism tends to spread prosperity among entrepreneurs but in practice, pauperizes the masses. This is evident in the chasm between the rich and the poor in the United State, Britain and other countries in Western Europe. Capitalism does not ameliorate the conditions of the proletariat, hence it is an economic system that concentrates wealth in the hands of the few.

Britain and France have undergone radical economic changes brought to bear on them by external pressures related to globalization and European integration. The changes were prompted by internal economic vulnerabilities, loss of competitiveness and the need for industrial disharmony. For both nations, the change involved instituting monetarist macroeconomic policies, deregulation and privatizing businesses, increasing labour flexibility and reduction of social expenditure. While in Britain, government has expressed commitment to neo-liberal reforms, in France the reforms were prompted by the need to use European integration as a shield against globalization. These reforms were basically targeted at narrowing the interest of large parts of the population.

Under the socialist President Mitterrand, France instituted a moderate neoliberal policy in 1983 in response to major crisis. They legitimized their economic policies with emphasis on the necessity of globalization. These reforms were slightly different from those in Thatcherite Britain designed to restore the traditional values of social solidarity, even amidst mounting unemployment and economic exclusion of large segment of the populace. As the pillars of capitalism began to tremble and the economic crisis deepened, it became obvious that neo-liberalism was in conflict with the European monetary integration.

The World Bank (2009), reports that the current global economic meltdown is the worst in at least 70 years. Around the world, a million jobs have been lost every six days of this year. Between 200,000 and 400,000 more children will die every year from now to 2015 - the target year for the MDGs. The present Obama administration in America has injected massive stimulus policies in to economy, yet the signs are still ominous. In effect America - the capitalist giant is adhering to the tenets of Keynesianism. Increased regulation of financial markets is being put forward to avoid new crisis in the future. As the pillars of capitalism are trembling, it is becoming more obvious that neo-liberalism is in conflict with the European Monetary integration.

There is no contention that in recent times, capitalism is witnessing a global crisis. During the Great Economic Depression in the 1930's, financial markets in the advanced industrial countries were hammered as a result of a global economic “go slow”. The United States and Europe had no quick- fix solutions to the problem. The IMF also took a hard look at the financial regime implemented over the years. The contradictions inherent in capitalism seem to be rendered more complex by the excessive concern for domestic price stability on the part the financial institutions around the world.

Way back in 1944 Karl Polanyi (1944) published a book titled “The Great Transformation” in which he argued that markets could exist outside the web of social relations for long without tragic consequences. He interpreted the collapse of the gold standard, the decline of protectionism and bilateralism, the rise of Fascism and Nazism and ultimately, the World War II as the corollary of protection from the onslaught of the market. The core of the argument is that markets are not self-regulating, self-stabilizing and self-legitimizing. This is the underpinning factor for the existence of regulatory bodies that set the rules of competition, monetary and fiscal institutions. It is trite argument, therefore that global capitalism is in some form of crisis and not even globalization can come to the rescue.

Even Keynesian thinkers - the main brick-makers of the Breton Woods System never contemplated a capitalist system that would seek to maximize the international outflow of goods and capital. The objective of these financial institutions was to prevent nations from exporting their economic difficulties to their trade partners thereby avoiding excessive volatility of currencies, destabilizing capital flows and eventual protectionism. It was for that reason that the General Agreement of Tariffs and Trade (GATT) was concerned with policies pertaining to the restrictions and tariffs on imports, leaving room for national government to develop along divergent paths. Much of East Asia including Japan and China generated economic miracles by relying on those quantitative restrictions, export subsidies and other domestic variables.

Free market capitalism seduces people into serving the interest of corporations and a privileged few. Capitalism turns citizen into consumers and in the words of Adorno and Horkheimer (1972) capitalism integrates different art forms into one work and integrate them into a “pre-arranged harmony” and these stereotypes seems to legitimize the assumed dictatorship of monopoly capital. It is this myth that necessitates the removal of barriers to investment, enterprises and flow of capital. Capitalism promises that deregulation would create jobs encourage investment and liberalize governance. But as could be seen in the Asian Financial crisis 1997 and the global economic meltdown in 2008, capitalism appears more like a conjuring trick, which confuses political freedom with corporate impunity.

A major assumption of the magic of market capitalism is that the public sector is inefficient and this becomes a self fulfilling prophecy when government ceases to provide basic services to improve the lives of the people. Capitalism therefore accelerates the privatization of transportation, education and health care; the dismantling of the social safety networks, increases the misery index and afflict the poor, the elderly and the sick in the society. Because of the contradictions inherent in capitalism, the mass media are used to disseminate views that promote capitalism. This viewpoint was corroborated by Robert Mc Chesney when he said: Much of the ideological strength of market as a regulatory mechanism for the media comes from the metaphor of the marketplace of ideas”. . . the Market is assumed to be a neutral and value –free regulatory mechanism . . .but the capitalist markets tend to reproduced social inequality economically, politically and ideologically. The metaphor serves to mystify the actual corporate domination…. Therefore provide the commercial interests with value shield from rightly public criticism and participation in the policy making process.

Thus capitalism struggles to protect itself from indignation against itself in spite of the global crisis it is facing for example, the united States under George Walker Bush propagated that America is inherently good and righteous, yet the U.S Government blatantly refuses to sign the Kyoto Protocol; treaties on ban of cluster bombs and land mines, her military uses water torture, sleep deprivation and stress position on prisoners at Guantanamo Bay. The unilateral invasion of Iraq forced several million Iraqi's to become refugees in their homeland. The actions of successive administrations of the United States showed that the sole aim of US capitalism was to regain control of Iraqi oil. This has plunged humanity into ecological destruction and war without end.

Thus market fundamentalism disseminates a series of myths that freezing up markets will open the floodgate to prosperity; that foreign investment was key to expanding employment; that free capital flows would instill monetary and fiscal discipline in governments etc are not wholly true in the real world hence the global crisis of capitalism may loom large in the foreseeable future. In most LDCs, privatization - a brain child of capitalism, has become an acceptable paradigm in political economy. Privatization is a strategy of reducing the size of government and transferring public corporations to private ownership and control. In Nigeria, privatization has not conferred any substantial advantage of the market system; rather it has weakened the delivery of essential social services, relaxation of wages and price control (Urgoji, 1995).

With the current economic crisis harassing the capitalist enclave, the Wall Street has collapsed. Today, the capitalist bloc is in quandary as to the efficiency of capitalism as a dominant economic paradigm. But amidst the deepening crisis, there exists a bourgeoning exploitative class, which comprises profiteers, speculators, swindlers and shylocks including a vast underworld of wealthy criminals, who operate a pseudo-formal economy. As the developing countries suffer the excruciating pains of stagnation, unemployment, spiraling inflation and debt servicing, they strive to be integrated into the global capitalist system. For example, the oil producing countries formed the Organization of Petroleum Exporting Countries (OPEC) in the 1970's. However, the major oil giants in the world use undue influence to fix very low prices for oil. In cases where the prices soar, they adopt quota and oil ceiling to control the price of the commodity.

Capitalism and its efficacy have been called to question since August 2007. The shock waves generated by the crisis are reverberating across the world like a tsunami. The impact is felt in the stock markets and banks on every continent, and pundits believe that the crisis is still looming. Financial experts around the world are making hectic interventions, but such fire-fighting measures as stimulus packages and deficit financing by states and central banks have not stopped downsizing, diminishing interest rates and general anomie. The global crisis of capitalism is not a myth but an inescapable reality. It is difficult to dismiss the original sin of capitalism as alleged by Marxism.

The current economic meltdown ravaging all nations across the world has fueled fears about the inevitability of conflict and the collapse of capitalism. Capitalism is now being haunted by the specter of the great depression. The system also faces a profound moral crisis in that spectacular gains of capitalism are based on theft and violence. Primitive accumulation plays the same role in capitalism as the idea of original sin in Judeo-Christian theology. Adam ate the apple and sin fell upon humanity. The system is bound to destroy itself because there is hatred on a class basis, which would intensify political instability, economic chaos and disintegration. The initial fascination of capitalism as capable of bringing about a harmonious, liberal and integrated prosperity has evaporated like the morning cloud. Marx's proposition that capitalism is an inherent barrier that seeks continuously to surmount these immanent challenges is now a self-fulfilling prophecy.

Nigeria operates a peripheral capitalist system characterized by low industrial production, unemployment, alienation and poverty of the many characterized by the expropriation of the commonwealth by the few. Nigeria's case has been compounded by a crude oil mono-culture. The implication is that Nigeria is solely dependent on the capitalist West without basic industrial infrastructure. The situation is worsened by the near absence of democratic infrastructure and good governance. The demon of capitalism may continue to haunt the world until the world de-legitimizes the false hope placed on the system.

Within the Nigerian context, the economy is characterized by lack of much-needed infrastructure for industrial take-off, low capacity utilization and unemployment. Under the tricky policy of privatization, the commonwealth has been largely transferred to the hands of a few political – bourgeois classes, leaving the masses in abject poverty. With the increase in crime rate associated with poverty, greed and self-aggrandizement, the crisis precipitated by capitalism may result in a violent revolution.

Amidst the current global crisis of capitalism, the negative impact on the peripheries is more severe than the metropolitan States because the peripheries are essentially producers of primary products. The interplay between politics and the economy has conspired to widen the rich-poor gap and aggravated the alienation of a large part of the population. The only way out of the global crisis is to strengthen democratic institutions, entrench good governance and pursue industrialization with greater vigour. It logically follows that if the peripheries continue to depend on the centre, the economic development of these countries may be short-changed for short-term gains in favour of prolonged debt peonage, a cauldron of instability and avoidable chaos. Whichever way we look at it, the fall of capitalism, as evidenced in the global economic crisis, is a self-fulfilling prophesy.

Idumange John

Is Gubernatorial Aspirant in Bayelsa State

Saglemi Housing Project will not be left to rot – Kojo Oppong Nkrumah

Saglemi Housing Project will not be left to rot – Kojo Oppong Nkrumah

Transport fares hike: GPRTU issue two-day ultimatum

Transport fares hike: GPRTU issue two-day ultimatum

ARC endorses Alan as presidential candidate – Buaben Asamoa

ARC endorses Alan as presidential candidate – Buaben Asamoa

Akufo-Addo appoints Kwasi Agyei as new Controller and Accountant-General

Akufo-Addo appoints Kwasi Agyei as new Controller and Accountant-General

PNC dismiss reports of mass resignations

PNC dismiss reports of mass resignations

PAC advocates for revenue collectors to be engaged on commission basis, not full...

PAC advocates for revenue collectors to be engaged on commission basis, not full...

Genser Energy commissions 110km of natural gas pipeline at Anwomaso

Genser Energy commissions 110km of natural gas pipeline at Anwomaso

Naa Torshie calls for tolerance, peace ahead of 2024 election

Naa Torshie calls for tolerance, peace ahead of 2024 election

Asantehene commends Matthew Opoku Prempeh for conceiving GENSER Kumasi Pipeline ...

Asantehene commends Matthew Opoku Prempeh for conceiving GENSER Kumasi Pipeline ...

Let’s do away with ‘slash and burn politics’ in Ghana — Dr Adutwum

Let’s do away with ‘slash and burn politics’ in Ghana — Dr Adutwum