The E-Levy bill should exempt transfer payments for school fees at tertiary institutions. The E- Levy bill has created certain exemptions, however, excludes transfer payment for school fees at public and private tertiary institutions.

The increased use of mobile money means that E-Levy would affect every individual who engages in electronic transfer, including students and parents who would be paying fees and other costs via banks and mobile money transfers. Therefore, there is the need to consciously exclude students who may rely on such transfers to pay their school fees. Since the government has already exempted transfers for payment of taxes, fees, and charges on Ghana - GOV activities. It would be prudent to expand the exemption to cushion students and parents especially during payment of school fees and other bursaries to public universities.

Government has no source of money other than to borrow our future savings or by taxing us more, either way, citizens would pay. Adam Smith, the father, and classical liberal economist has stated that ‘there is no art which one government sooner learns of another than that of draining money from the pockets of people’.

The problem with government spending is that it is inefficient in neither knowledge nor budget. The government spends other people’s money on someone else hence giving little or no incentive to spend wisely.

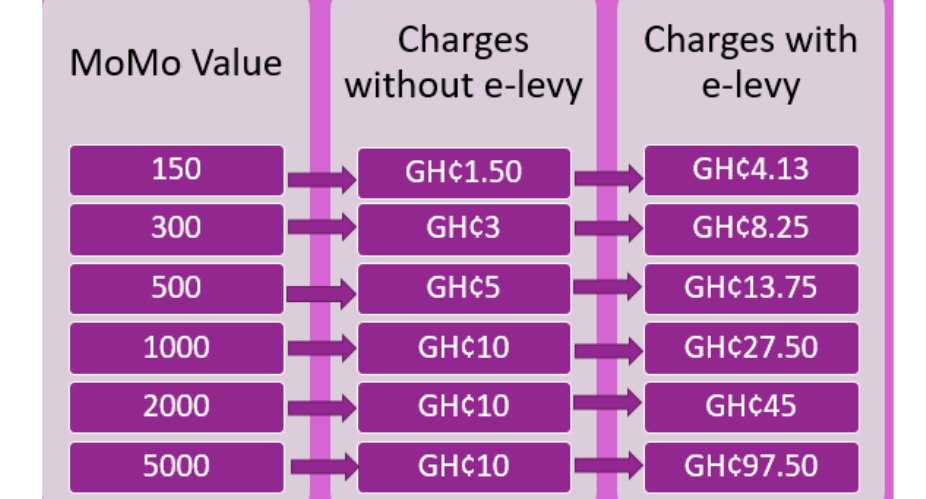

The introduction of the E-Levy bill in Ghana only confirms the determination to increase government revenue and spend more. Though the E-Levy has generated public uproar from the majority of most Ghanaians, the government is bent on doing everything possible to carry on its agenda and including the shadow economy in the tax net; which is estimated to generate GHS6 billion in revenue for the government. The focus is always about taxing the private informal with little effort to develop it.

The E-levy bill despite everything has seen the need to create certain exemptions as provided under section 2 of the Bill to include; cumulative transfer of $15 (GHS100.0) made per day by the same person, transfer between the accounts owned by the same person, electronic payment for taxes, fees, and charges to government, specified merchant payment, and transfer between a principal, agent and master-agent account.

We deem it important to exclude transfers for the payment of school fees at the tertiary level. This should possibly include private tertiary education institutions as well. This would be helpful to cushion students and parents from the double agony of school fees payment and E-levy charges on school fees payment.

It is imperative that exempting school fees payment would not only deepen government commitment to education but would lessen the tax burden on students as well.

Former Kotoko Player George Asare elected SRC President at PUG Law Faculty

Former Kotoko Player George Asare elected SRC President at PUG Law Faculty

2024 elections: Consider ‘dumsor’ when casting your votes; NPP deserves less — P...

2024 elections: Consider ‘dumsor’ when casting your votes; NPP deserves less — P...

You have no grounds to call Mahama incompetent; you’ve failed — Prof. Marfo blas...

You have no grounds to call Mahama incompetent; you’ve failed — Prof. Marfo blas...

2024 elections: NPP creates better policies for people like us; we’ll vote for B...

2024 elections: NPP creates better policies for people like us; we’ll vote for B...

Don’t exchange your life for wealth; a sparkle of fire can be your end — Gender ...

Don’t exchange your life for wealth; a sparkle of fire can be your end — Gender ...

Ghana’s newly installed Poland train reportedly involved in accident while on a ...

Ghana’s newly installed Poland train reportedly involved in accident while on a ...

Chieftaincy disputes: Government imposes 4pm to 7am curfew on Sampa township

Chieftaincy disputes: Government imposes 4pm to 7am curfew on Sampa township

Franklin Cudjoe fumes at unaccountable wasteful executive living large at the ex...

Franklin Cudjoe fumes at unaccountable wasteful executive living large at the ex...

I'll 'stoop too low' for votes; I'm never moved by your propaganda — Oquaye Jnr ...

I'll 'stoop too low' for votes; I'm never moved by your propaganda — Oquaye Jnr ...

Kumasi Thermal Plant commissioning: I pray God opens the eyes of leaders who don...

Kumasi Thermal Plant commissioning: I pray God opens the eyes of leaders who don...