Marrakech/Addis Ababa, 23 March 2019 (ECA) – A new report by the UN Economic Commission for Africa (ECA) says it is urgent for African countries to broaden and deepen their tax and revenue collection bases while leveraging digital technologies to boost collection and compliance, to achieve pressing development goals. [Download your copy here: www.uneca.org/era2019 ]

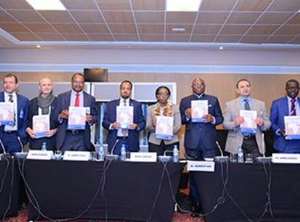

Launched today in Marrakech, Morocco, where ECA’s 52nd Session is taking place, the 2019 Economic Report on Africa (ERA 2019), regrets the continent’s weak state revenue-to-GDP ratio which stood at 21.4 per cent in 2018, noting that the continent must significantly augment that figure in a bid to adequately finance crucial development national programs as well as those set out in Agenda 2030 and Agenda 2063.

The Report, whose theme is “Fiscal Policy for Financing Sustainable Development in Africa,” argues that government revenue on the continent can be increased by 12–20 per cent of GDP through the rigorous pursuit of tax and non-tax income collection especially by aligning fiscal policy with the business cycle.

It makes a case for states to invest in strong institutions and advanced data collection methods that better monitor non-tax revenue streams while urging them to boldly venture into hard-to-tax areas such as agriculture, the informal sector and the digital economy.

Reforming tax administration systems through the use of digitization, refraining from issuing unproductive tax incentives and becoming highly debt-disciplined, are other propositions made for expanding the public purse to finance development in Africa.

The continent could increase tax revenue by as much as $99 billion or 4.6 per cent of gross domestic product (GDP) annually if it sets out quickly to implement these recommendations, the Report projects.

There is much to be achieved by leveraging digital systems for revenue harvesting. For instance, Rwanda increased revenue collection by 6 per cent of GDP by introducing e-taxation and South Africa used online tax payments to reduce compliance cost by a whopping 22.4 per cent while lessening the time to comply with the value-added tax by 21.8 per cent.

However, improved tax/revenue performance cannot be hinged on tax efficiency alone but also on the provision of essential public services to reduce inequality and encourage economic growth and compliance, the Report advises.

This should go with combating corruption and reinforcing accountability to reduce inefficiencies in tax collection.

The Report also notes the importance of multinational and state-owned corporations that are dominant in this sector of natural resource exploitation.

“However, multinational corporations also have the ability to undertake complex international tax avoidance strategies that shift profits from where the underlying economic activities take place to low- or no-tax jurisdictions, a behavior referred to as base erosion and profit sharing,” it says.

Closing loopholes in existing agreements with the multinationals could boost tax revenues accruing to concerned governments by about 2.7 percent of gross domestic product (GDP), funds that can be deployed for achieving the Sustainable Development Goals (SDGs), the Report adds.

Africa has a huge financing gap estimated at 11-13 percent of GDP per annum if it must achieve the targets of the UN sustainable Development Goals and Agenda 2063, but ERA 2019 shows how this gap can be quickly plugged.

“To achieve these two agendas, Africa needs to increase its domestic investment rate to 30-35 percent of annual GDP and triple its 3.2 percent growth rate to about 10 percent per annum,” said Mr. Adam Elhiraika, Head of ECA’s Macroeconomics and Governance Division which coordinated work on the Report.

“ERA 2019 is very timely for Africa as it explores comprehensive ways of financing development at a period when funding resources have been squeezed as fallouts of the global financial meltdown of 2008 and the nose-dive in commodity prices in 2014,” said ECA’s Executive Secretary – Ms. Vera Songwe following the Report-launch.

She was upbeat that “though these precedents have rendered the task of pursuing the implementation of the UN 2030 Agenda for Development and the AU’s Agenda 2063 for a prosperous, integrated and peaceful Africa, difficult, I have no doubt that the imperative of raising additional revenues for financing these development agendas will be much easier for African countries that heed the carefully crafted recommendations in this Report.”

“ECA has done such a good job with the 2019 Economic Report on Africa to the extent that we are asking the Commission to go further” said Mr. Mambury Njie, Minister of Finance and Economic Affairs of the Gambia, who added that “we now know where the problem [with mobilizing internal resources for development] is.”

One way of going further resides in the question: “How can we make fiscal policy support structural transformation in Africa?” quizzed Egypt's Deputy Planning Minister Dr Ahmed Kamaly

Debaters at the launch also requested that ECA deepens research on how tax incentives influence investments and revenue collection, though experts tended to agree on growing evidence that incentives did not make a great difference.

Others suggested that the Commission undertakes studies on how to mainstream the informal sector into the formal economy for more revenue wins and seeks to start accompanying member States in playing out the findings and recommendations of the Report.

A global message to retain from ERA 2109 “is that in Africa we have a challenge of financing the SDGs but this challenge is not insurmountable, it can be addressed with serious, focused efforts to mobilize more domestic revenue through fiscal policy,” Mr. Elhiraika summed up.

Critics fear Togo reforms leave little room for change in election

Critics fear Togo reforms leave little room for change in election

Flooding: Obey weather warnings – NADMO to general public

Flooding: Obey weather warnings – NADMO to general public

Fire in NDC over boycott of Ejisu by-election

Fire in NDC over boycott of Ejisu by-election

NDC to outdoor Prof Jane Naana Opoku-Agyemang as running mate today

NDC to outdoor Prof Jane Naana Opoku-Agyemang as running mate today

Ejisu: CPP seeks injunction to stop April 30 by-election

Ejisu: CPP seeks injunction to stop April 30 by-election

Dismiss ECG, GWCL, GACL bosses over losses – United Voices for Change tells gov’...

Dismiss ECG, GWCL, GACL bosses over losses – United Voices for Change tells gov’...

Submit 2023 audited financial statements by May – Akufo-Addo order SOEs

Submit 2023 audited financial statements by May – Akufo-Addo order SOEs

Current power outages purely due to mismanagement – Minority

Current power outages purely due to mismanagement – Minority

ECG hoists red flag to fight Ashanti Regional Minister over arrest of General Ma...

ECG hoists red flag to fight Ashanti Regional Minister over arrest of General Ma...

Mahama’s 24hr economy will help stabilise the cedi; it’s the best sellable polic...

Mahama’s 24hr economy will help stabilise the cedi; it’s the best sellable polic...