The Rest-Quadrant (TRQ) is a retirement theory propounded by Richmond Duafah, verified by up-to-date statistics of the state of Retirement and the gloomy ignorance of the average man to comprehend it entirety and prepare adequately after leaving active service. With over 9 years in the pension’s fraternity, ranging from corporate affairs, scheme administration and business development, Mr. Richmond Duafah has embarked on numerous retirement Education and Sensitization tours, teaching and impacting lives on the need to have a restful retirement that is independent of just a monthly annuity payment and a lump sum that is born out of statutory deduction. It is out of the passion to see people retire financially independent with all other areas covered that he discovered The Rest-Quadrant.

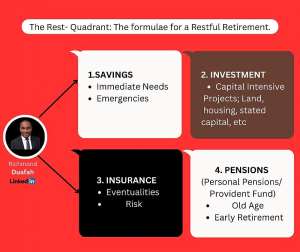

This theory postulates that no man can have a restful retirement without a comprehensive plan intentionally designed to cover Savings, Investment, Insurance and Pensions. If this is true then the regulators in such industries should be seen as rescue agents than mere profit making institutions.

The Plight of Retirees (POR)

There is no doubt that retirees are faced with countless plight, plaques and perils even as the age called “retirement age” approaches.

Retirement Plight refers to the challenges and difficulties that individuals face in planning and securing their financial stability during their retirement years. Retirement Plight has become an increasingly significant issue due to a combination of factors such as changing demographics, economic instability, and the inadequacy of retirement plans.

One of the primary reasons for Retirement Plight is the shift towards an aging population. With people living longer, the cost of healthcare and living expenses have gone up significantly. Medications for cardiovascular conditions, arthritis, diabetes, ophthalmic and musculoskeletal problems (to list just a few) which are very common with retirees needs more than savings to curb or cure them. Statistically speaking, more 85% of people retire with health problems.This has put a tremendous strain on retirement savings and has made it increasingly difficult for retirees to maintain their standard of living. Additionally, the decline in pension plans has also contributed to the Retirement Plight. Many people are unable to save enough money for their retirement, and the investment returns from their retirement accounts may not be sufficient to support their lifestyle during retirement.

Another major factor contributing to Retirement Plight is the economic instability. The global economy has been unstable over the last few decades, with financial crises, recessions, and other factors impacting the value of investments and pensions. This has made it harder for retirees to rely on their investments, and many have been forced to work longer or reduce their living standards to make ends meet. Again, I affirmed, my ancient methods on Education and Sensitization should be a polestar of this retirement agenda. The contributor builds confidence in the system when he is approached again and again on the why’s and how’s factor.

Furthermore, inadequate retirement planning has also contributed to the Retirement Plight. Many people do not plan for their retirement until they are close to retirement age, leaving them with limited options and fewer opportunities to save. Poor planning can also lead to inadequate financial literacy, which can leave retirees vulnerable to financial scams and fraud.

The Hidden Plaque. I called this the hidden plaque because it strikes through like an arrow in ever family, state, country and almost becoming a continental canker. Do you know that out of every 100 people who retire, only 2% retire financially adequate? Do you also know that the remaining 23% must continue to work even on retirement, for instance, the aged security men at our post who sleeps at night just to make a living, adjunct lecturers, etc. Are you also aware that the 75% must rely on family and friends for survival? These are the hidden plaques of retirees. Hence, the need for the Rest Quadrant.

To overcome Retirement Plight, it is important for individuals to start planning and saving for their retirement as early as possible. This may involve working with a financial planner to create a realistic budget, setting goals, and identifying investments that align with their financial goals. It is also essential to maintain good financial habits such as saving regularly and avoiding excessive debt.

In conclusion, Retirement Plight is a growing issue that affects many individuals as they approach their golden years. By taking proactive steps to plan and save for retirement, individuals can avoid the challenges and difficulties that come with inadequate financial planning.

Why then does it seem like we don’t care about our retirement despite these plight?

- Lack of financial knowledge: Many people do not have a good understanding of financial planning and may not know where to start when it comes to planning for retirement. This can lead to procrastination or avoidance of the topic altogether. I have to commend the National Pensions Regulatory Authority (NPRA) for their incessant pursuit in educating the masses especially the untapped informal on the need for retirement.

- Short-term thinking: Some people may prioritize short-term goals, such as paying off debt or saving for a vacation, over long-term retirement planning. This can lead to a lack of focus on retirement planning and inadequate savings. About 90% of retirees do not own their own homes hence they still pay rent or live with others. Utilities are also due on a monthly basis. The only investments they have is likely the pensions they expect to be paid them on monthly basis coupled with the lump sum received from the trustee at retirement. This is a plight we can’t turn a blind spot on. It has to be attacked.

- Underestimation of retirement expenses: Retirement can be more expensive than people realize, especially when it comes to healthcare costs. Some people may not fully understand the amount of money they will need to save to support themselves in retirement.

- Dependence on Social Security: Some people may rely too heavily on Social Security as a source of retirement income, even though Social Security benefits are often not enough to cover all of the expenses in retirement. This is where corporate organization must insist that every staff get on board with their Provident Fund or Personal Pensions even for the informal.

- Fear and uncertainty: Retirement planning can be overwhelming and may cause anxiety for some people. They may feel uncertain about their ability to save enough money or make the right investment decisions.

Overall, the reasons for not planning for retirement are varied and complex. However, it is essential to recognize the importance of planning for retirement and to take steps to overcome any obstacles or challenges that may prevent people from doing so. With the right knowledge and resources, anyone can start planning for a comfortable and secure retirement.

The Rest-Quadrant (TRQ)

|

|

|

|

TRQ seeks to make the restful retirement facts decipherable. That, it takes more than monthly annuity payment from SSNIT and a Tier 2 lump sum payment from a trustee to enjoy your retirement. These factors now known as The Rest-Quadrant must be in place. It is the responsibility of the Trustees, Regulators, Stakeholders and contributors to embark on these assignment to ensure that The Rest- Quadrant (TRQ) is reflective in the lives of the contributors. Retirement means rest from labor and the formulae for achieving this rest is The Rest- Quadrant becoming fully operational in your retirement preparation journey. The Rest- Quadrant can be simplified as SIIP Theory: Savings, Investment, Insurance and Pensions. Make your retirement count.

Richmond Duafah

([email protected])

We saved $57.9million from procurement of new verification devices, registration...

We saved $57.9million from procurement of new verification devices, registration...

Ejisu by-election: Aduomi is a betrayer – Ahiagbah

Ejisu by-election: Aduomi is a betrayer – Ahiagbah

Dumsor: I’ll be in police custody if I speak, I vex — DKB

Dumsor: I’ll be in police custody if I speak, I vex — DKB

We'll give daily evidence of Akufo-Addo's supervised thievery from our next gene...

We'll give daily evidence of Akufo-Addo's supervised thievery from our next gene...

Asiedu Nketia crying because they've shared the positions and left him and his p...

Asiedu Nketia crying because they've shared the positions and left him and his p...

Mahama's agenda in his next 4-year term will be 'loot and share' — Koku Anyidoho

Mahama's agenda in his next 4-year term will be 'loot and share' — Koku Anyidoho

If you're president and you can't take care of your wife then you're not worth y...

If you're president and you can't take care of your wife then you're not worth y...

Foreign Ministry caution Ghanaians against traveling to Northern Mali

Foreign Ministry caution Ghanaians against traveling to Northern Mali

GHS warns public against misuse of naphthalene balls, it causes newborn jaundice

GHS warns public against misuse of naphthalene balls, it causes newborn jaundice

Our education style contributes to unemployment - High Skies College President

Our education style contributes to unemployment - High Skies College President