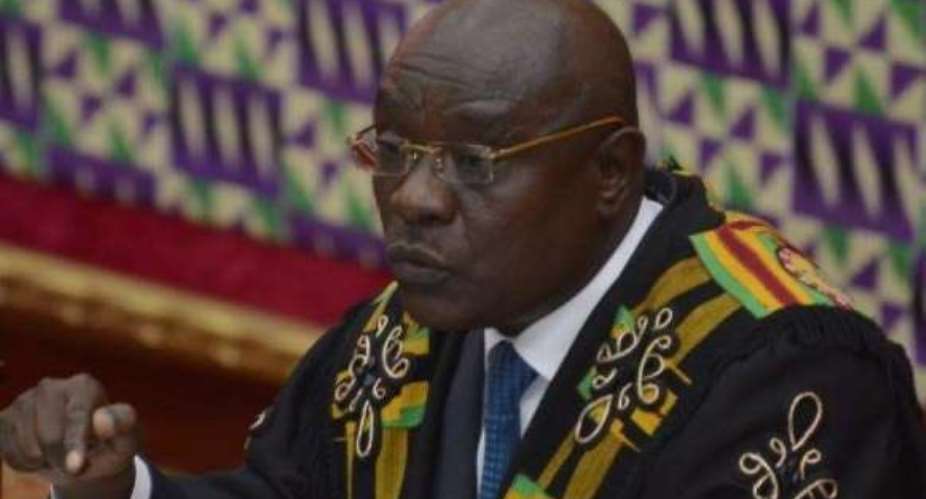

The Speaker of Parliament, Edward Doe- Adjaho has ruled to disallow a proposed amendment by the Member of Parliament for New Juaben South, Dr Mark Assibey –Yeboah, to the Banks and Special Deposit taking institutions bill, currently at the consideration stage.

The proposed amendment could have put a temporary ban on mobile money services until proper regulations are put in place by the Bank of Ghana.

The MP had asked Parliament to compel the Minister of Finance to bring before the House regulations governing mobile money transactions for amendment.

Dr. Assibey-Yeboah, argues that he was forced to take such a move in the interest of the country, since there is no Legislative Instrument (LI) backing such transactions.

He explained that currently, the only rules governing e-money business which covers Mobile money transactions, are only administrative guidelines issued by the Bank of Ghana saying they are sometimes not adhered to.

“I am saying that the Minister of Finance should come to Parliament and do the proper thing by bringing a Legislative Instrument , and Parliament setting up proper regulations governing e-money business…We shouldn't sit down idle and wait for some mishap to happen in the e-money business front before we set in,” Dr. Assibey-Yeboah intimated.

But passing ruling on the matter, the Speaker explained that the amendment was introduced at the wrong stage of the ongoing process even though his concern is legitimate.

“Indeed where we have reached now, it is too late in the day to go to where you us to go to…We are on regulations and nowhere in the Bill did we make or mention e-money. We are making laws and sanctity of the law is a whole mark of a good law.” He noted.

Edward Doe Adjaho further urged the MPs to consider relevant legislations on the matter and act on them accordingly.

“So let's look for the proper law that governs these issues and then we can then ask the Ministry of Finance or Bank of Ghana (BoG) to come out with that legislations and if it is not coming, we as a Parliament that is concerned will initiate a process and if it is not contrary to Article 108 of the constitution, I will allow it to go through.”

Bankers demand clarity from BoG

The MD of CAL Bank, Frank Adu and Banking Consultant, Nana Otuo Acheampong have both urged that the Central Bank reviews its current guidelines on mobile money transactions in the country.

They believe this will clarify the apparent overlapping roles played by the telecommunications and financial institutions.

Meanwhile the head of Payment Systems at the Bank of Ghana, Dr. Settor Amediku has assured of a review of the current guidelines in July this year.

Mobile money transaction

For the third year running however, the value of Mobile Money transactions a substantial jump — from GH¢2.4billion as at 2013 to about GH¢11.6billion in 2014.

When put into perspective, the value of mobile money transactions is more than a third of the total deposit liabilities of the 28 banks in Ghana as at the end of 2015.

Currently, only three of the six mobile telcos — MTN, Airtel and Tigo– are involved in the mobile money business, which has grown from a transaction value of GH¢171million in 2012 to the multi-billion cedi sector.

–

By: Pius Amihere Eduku/Duke Mensah Opoku/citibusinessnews.com/Ghana

'Kill whoever will rig Ejisu by-election' – Independent Candidate supporters inv...

'Kill whoever will rig Ejisu by-election' – Independent Candidate supporters inv...

Ashanti Region: ‘Apologize to me for claiming I owe electricity bills else... – ...

Ashanti Region: ‘Apologize to me for claiming I owe electricity bills else... – ...

Ghana is a mess; citizens will stand for their party even if they’re dying — Kof...

Ghana is a mess; citizens will stand for their party even if they’re dying — Kof...

Internet shutdown an abuse of human rights — CSOs to gov't

Internet shutdown an abuse of human rights — CSOs to gov't

Free SHS policy: Eating Tom Brown in the morning, afternoon, evening will be a t...

Free SHS policy: Eating Tom Brown in the morning, afternoon, evening will be a t...

Dumsor: A British energy expert 'lied' Ghanaians, causing us to abandon energy p...

Dumsor: A British energy expert 'lied' Ghanaians, causing us to abandon energy p...

What a speech! — Imani Africa boss reacts to Prof. Opoku Agyemang’s presentation

What a speech! — Imani Africa boss reacts to Prof. Opoku Agyemang’s presentation

Dumsor: Tell us the truth — Atik Mohammed to ECG

Dumsor: Tell us the truth — Atik Mohammed to ECG

Dumsor: Don't rush to demand timetable; the problem may be temporary — Atik Moha...

Dumsor: Don't rush to demand timetable; the problem may be temporary — Atik Moha...

Space X Starlink’s satellite broadband approved in Ghana — NCA

Space X Starlink’s satellite broadband approved in Ghana — NCA