The Institute of Economic Affairs (IEA) is challenging the Bank of Ghana to change its approach in stabilizing the cedi.

The institute believes the Central bank needs to focus on its monetary policy role in maintaining a stable currency rather than what it considers forcing of an automatic drastic appreciation in the value of the local currency.

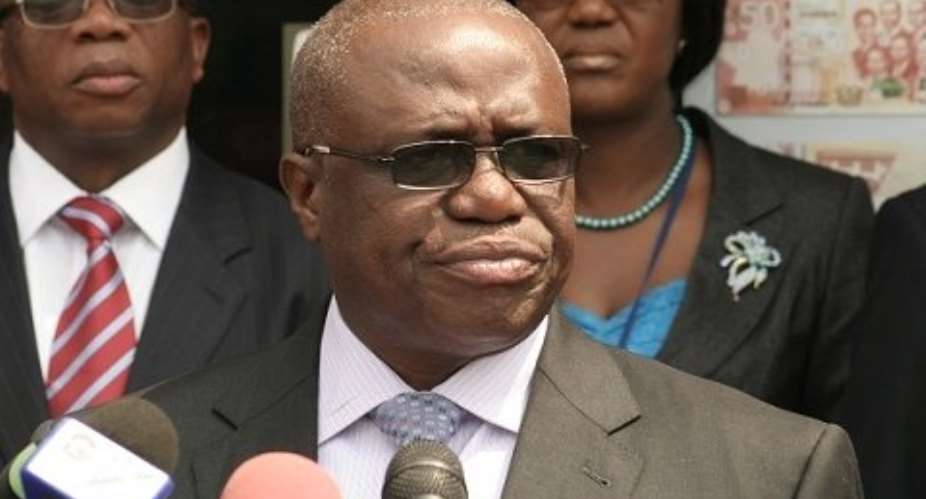

The Institute made this statement at a press conference.

Economist and visiting Fellow at the IEA Prof. Edward E. Ghartey said the Central Bank’s daily injection of 20 million dollars into the system is unhealthy for the economy.

The IEA is also accusing the Central Bank of breaching its own Act – Bank of Ghana Act 612, section 27 which establishes the Monetary Policy Committee and as well sets out its roles and responsibilities.

According to the IEA, the decision by the Central Bank to inject some 20 million Dollars into the economy weekly in a bid to arrest the depreciating Cedi not only smacks of an interference in the market forces but also a blatant attempt to cheat businesses and individuals.

Economist and visiting Senior Fellow at the IEA Prof. Edward E. Ghartey tells Joy Business the Central Bank’s action would go a long way to aggravate inflation.

He is also challenging the Central Bank to change its approach in stabilizing the cedi. Prof. Ghartey believes the Central bank rather needs to focus on its monetary policy role in maintaining a stable currency rather than what it considers forcing an automatic appreciation in the value of the local currency.

“The economic goal is a stable exchange rate. It is possible that the exchange rate can be allowed to depreciate or appreciate a bit but the desire is to get it stabilized. It the exchange rate was like 4.30 Cedis to 1 Dollar for example, and you inject money into the system to bring it to 2.9 Cedis to 1 Dollar, that would not cause the exchange rate to stabilize. If it is at for instance 4.30 Cedis to 1 Dollar, you would want to act to cause it to stay there so that if there is pressure which eventually pushes it to say 4.5 Cedis to 1 Dollar, then you can inject some money to bring it down to say 4.2 to stabilize it. The goal is stability” he said.

He advised the Central Bank not to intervene in altering the currency from where the market forces have placed it.

The exchange rate he said “should be allowed to stay where it is supported by market fundamentals. Somebody tells a sad story of how he lost 24,000 Cedis due to the Central Bank’s intervention.

“If somebody pegged his 20,000 US Dollars to the Cedi at the going Exchange rate and the BoG pumps in more money and the rate that he pegged his money was say 4 Cedis to the Dollar, and he ends up getting say, 2.7 Cedis to the Dollar, has the man not been cheated of his money?”

Akufo-Addo commissions Phase II of Kaleo solar power plant

Akufo-Addo commissions Phase II of Kaleo solar power plant

NDC panics over Bawumia’s visit to Pope Francis

NDC panics over Bawumia’s visit to Pope Francis

EC blasts Mahama over “false” claims on recruitment of Returning Officers

EC blasts Mahama over “false” claims on recruitment of Returning Officers

Lands Minister gives ultimatum to Future Global Resources to revamp Prestea/Bogo...

Lands Minister gives ultimatum to Future Global Resources to revamp Prestea/Bogo...

Wa Naa appeals to Akufo-Addo to audit state lands in Wa

Wa Naa appeals to Akufo-Addo to audit state lands in Wa

Prof Opoku-Agyemang misunderstood Bawumia’s ‘driver mate’ analogy – Miracles Abo...

Prof Opoku-Agyemang misunderstood Bawumia’s ‘driver mate’ analogy – Miracles Abo...

EU confident Ghana will not sign Anti-LGBTQI Bill

EU confident Ghana will not sign Anti-LGBTQI Bill

Suspend implementation of Planting for Food and Jobs for 2024 - Stakeholders

Suspend implementation of Planting for Food and Jobs for 2024 - Stakeholders

Tema West Municipal Assembly gets Ghana's First Female Aircraft Marshaller as ne...

Tema West Municipal Assembly gets Ghana's First Female Aircraft Marshaller as ne...

Dumsor is affecting us double, release timetable – Disability Federation to ECG

Dumsor is affecting us double, release timetable – Disability Federation to ECG