A team from the International Monetary Fund (IMF), led by Joel Toujas-Bernaté, visited Accra during February 19−26, 2015 to discuss the authorities' economic and financial program and possible financial support by the IMF.

The mission reached staff-level agreement with the authorities, subject to approval by IMF Management and the Executive Board, on an economic program that could be supported by a three-year Extended Credit Facility (ECF) arrangement. Proposed access could total SDR 664 million (around US$940 million), or 180 percent of Ghana's IMF quota. Consideration by the Executive Board is tentatively scheduled in early April 2015.”

Mr. Toujas-Bernaté released the following statement at the end of the mission:

“The IMF mission and the Ghanaian authorities reached staff-level agreement on an economic program aimed at overcoming the country's economic challenges, supporting stronger economic growth and lower inflation.

“Ghana experienced three difficult years characterized by declining economic growth, increasing inflation rates, rising debt levels and financial vulnerabilities. In 2014 economic growth reached its lowest level in many years, with non-oil GDP growing at 4.1 percent, in the context of high interest rates, a fast depreciating currency, low aggregate demand and a deepening energy crisis.

Inflation reached 17 percent, well above the central bank's inflation target. Large fiscal deficits caused by a ballooning wage bill, poorly targeted energy subsidies and commodity price shocks pushed government debt and financing costs to very high levels, and made the economy more vulnerable to roll-over risks, despite the implementation of corrective measures in the last couple of years.

These domestic imbalances resulted in a weakened external position and pressures on the exchange rate, with net international reserves covering just a few days of import coverage in September 2014, before rebounding on account of the issuance of a Eurobond and a syndicated loan obtained by the Ghana Cocoa Board.

“The main priority of the program is to restore debt sustainability through a sustained fiscal consolidation, and to support growth with adequate capital spending and a reduction in financing costs. The program rests on three pillars – restraining and prioritizing public expenditure with a transparent budget process; increasing tax collection; and strengthening the effectiveness of the central bank monetary policy. The program explicitly accommodates for the expansion and the safeguard of priority spending, in particular social protection programs such as the Livelihood Empowerment Against Poverty (LEAP).

“In the context of the program, total GDP growth is expected to decline further in 2015 to 3½ percent on the back of a severe energy crisis and fiscal consolidation. Growth is expected to rebound over the medium term on account of an improved macroeconomic environment and cost effective solutions to address the energy crisis.

Inflation should decelerate substantially, while the stronger fiscal consolidation will stabilize the debt ratio to GDP. The external current account deficit is projected to decline to 7 percent of GDP in 2015, which, together with increased donor support, should contribute to start rebuilding reserves.

“The 2015 Budget adopted by Parliament included a strong set of measures. Swift implementation of these measures, in particular the elimination of distortive and inefficient energy subsidies, the new tax on petroleum products, and stronger containment of the wage bill should contribute to a significant reduction in the fiscal deficit over the medium term, with the fiscal deficit projected to decline from 9½ percent of GDP in 2014 to 7½ percent in 2015 and about 3½ percent in 2017, including the repayments of all arrears outstanding at end-2014.

“Since the budget was adopted, the substantial decline in oil prices is projected to result in a shortfall of budget revenue of about 2 percentage points of GDP. To mitigate this shortfall, the government recently approved a set of additional measures totaling 1.2 percent of GDP through a reduction in budget ceilings for current and capital spending.

The remainder of the revenue shortfall will be covered by drawings from the oil stabilization fund – in line with the Petroleum Revenue Management Act. The mission welcomed these additional efforts, including the safeguards put in place to ensure that line ministries' spending commitments remain within the new ceilings.

“The government's ambitious reform agenda will support fiscal discipline and economic growth over the medium term. Key elements of the reforms include improving transparency in the budget process to prioritize spending, enhancing revenue mobilization and strengthening fiscal institutions, including through the review of possible fiscal rules. Additional public and financial management (PFM) reforms should contribute to improve predictability and control in budget execution.

"Tax administration reforms are underway, in particular to improve the effectiveness of the large taxpayer office and to streamline and accelerate VAT refunds. The government also initiated a review of existing tax exemptions with a view to reducing them. Public debt management will continue to be strengthened to ensure that financing needs and payment obligations are met at the lowest possible cost, consistent with a prudent degree of risk.

“To strengthen its control on the wage bill and address payroll irregularities, the government started implementing a detailed and time-bound action plan to detect and remove ghost workers, to secure and unify payroll databases, and to sanction those responsible of fraud. In addition, strict control on new hiring and the reduction in the number of subvented agencies will further help contain the wage bill.

“Monetary policy aims at achieving a single digit inflation rate over the medium-term, with the support of the government's fiscal consolidation. The independence of Bank of Ghana (BOG) will be strengthened, with central bank financing of the government gradually reduced to zero in 2016.

BOG reviewed its monetary operations to enhance monetary policy transmission and the efficiency of the inflation targeting framework, and took steps to unify the BOG and interbank exchange rates. Despite a challenging economic environment, compounded by low commodity prices, BOG assessed that the financial and banking sectors remain sound- with systemic risks remaining low.

“The ambitious economic reform program is supported by Ghana's international partners. The authorities have made significant progress in firming up financing assurances from their main bilateral donors and other international financial organizations.”

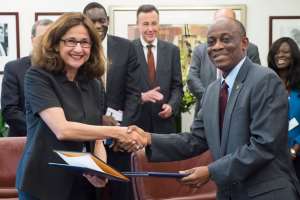

The mission met with Dr. Kwesi Botchwey, Chairman of the National Development Planning Commission; Finance Minister Seth Terkper; Bank of Ghana Governor Kofi Wampah; other senior officials, and the donor community. The mission team wishes to thank the authorities for their warm hospitality, the excellent collaboration, and the high-quality discussions.

Akufo-Addo commissions Phase II of Kaleo solar power plant

Akufo-Addo commissions Phase II of Kaleo solar power plant

NDC panics over Bawumia’s visit to Pope Francis

NDC panics over Bawumia’s visit to Pope Francis

EC blasts Mahama over “false” claims on recruitment of Returning Officers

EC blasts Mahama over “false” claims on recruitment of Returning Officers

Lands Minister gives ultimatum to Future Global Resources to revamp Prestea/Bogo...

Lands Minister gives ultimatum to Future Global Resources to revamp Prestea/Bogo...

Wa Naa appeals to Akufo-Addo to audit state lands in Wa

Wa Naa appeals to Akufo-Addo to audit state lands in Wa

Prof Opoku-Agyemang misunderstood Bawumia’s ‘driver mate’ analogy – Miracles Abo...

Prof Opoku-Agyemang misunderstood Bawumia’s ‘driver mate’ analogy – Miracles Abo...

EU confident Ghana will not sign Anti-LGBTQI Bill

EU confident Ghana will not sign Anti-LGBTQI Bill

Suspend implementation of Planting for Food and Jobs for 2024 - Stakeholders

Suspend implementation of Planting for Food and Jobs for 2024 - Stakeholders

Tema West Municipal Assembly gets Ghana's First Female Aircraft Marshaller as ne...

Tema West Municipal Assembly gets Ghana's First Female Aircraft Marshaller as ne...

Dumsor is affecting us double, release timetable – Disability Federation to ECG

Dumsor is affecting us double, release timetable – Disability Federation to ECG