How strategic sourcing can stretch a limited financial kitty-Part2- Reasons why there is relatively limited impact from Strategic sourcing in Ghana and on the continent as a whole

Introduction

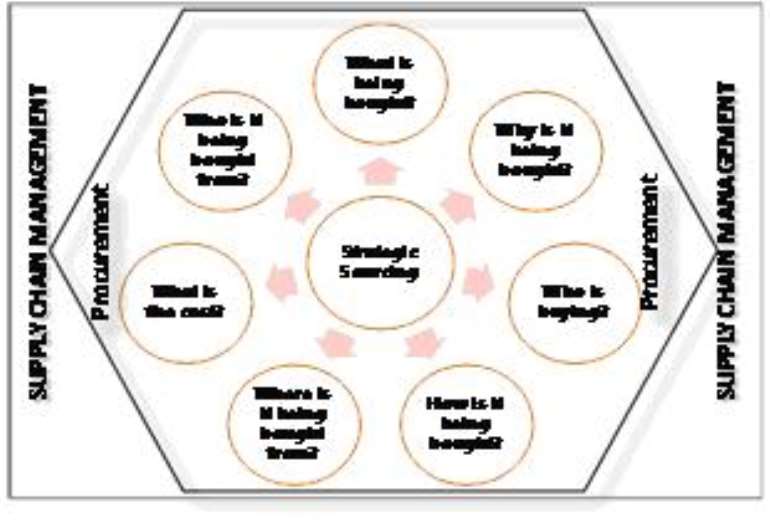

In part 1 of this series, it was explained that strategic sourcing sub process within procurement that assists organisations to optimise the total cost of ownership of a tangible and/or intangible commodity. As a systematic process, it objectively encourages the critical analysis of product acquisition and associated usage patterns within an organisation.

Procurement, on the other hand, is a mega-process (like customer service or logistics), within a supply chain. Supply Chain Management (SCM) is the seamless management of the entire value chain which includes, amongst others, the actions of procurement, customer service, and logistics.

Figure 1. Strategic sourcing, Procurement and Supply chain management

Strategic sourcing has been successfully applied in various public and private sector organisations. Today, it continues to help organisations achieve quantifiable savings, often between 4% and 12% on procurement spend. However, in much of the African continent, there is still a general focus on price rather than a holistic product lifecycle management view of sourcing and long term supplier development.

By adopting strategic sourcing, buying organisations (especially in the public sector) can begin to seriously move towards value chain sourcing and productivity improvements.

As a process, strategic sourcing is geared towards ensuring that resources are utilised for optimal value chain and potentially national benefit. It does not merely concentrate on what an organisation IS BUYING, BUT RATHER PROMPTS THE PROCESS CUSTODIAN TO CONTINUOUSLY APPRAISE A SOURCED-in product using various value adding benchmarks to evaluate the total acquisition cost.

Reasons why there is relatively limited impact from strategic sourcing in Ghana and on the continent as a whole

1. Still generally perceived as a tactical, operational and paper pushing activity as opposed to a strategic function

Supply chain management and in particular procurement is still mainly seen as a tactical and operational function in South Africa and on the continent. In all cases, where sourcing has been successfully applied for both organisational and national development, the supply chain management function is fully recognised as been on strategic parity with Finance, IT, Marketing, legal etc. with the functional custodian a fully fledged EXCO member and reporting directly to the Chief Executive Officer .

2. Information systems are seen as panaceas and not business enablers

Although information systems has a strategic role to play in sourcing decisions, most organisations see its implementation as the ultimate solution as opposed to just an enabler requiring the relevant human capital and support systems for successful implementation. To date the return on investment enterprise wide systems continues to be sketchy especially within the public sector. Yet organisations and governments continue to invest in more systems without undertaking some reflective stock taking to understand why the existing and previous systems failed to produce the desired outcome.

3. Limited support for innovative SMME development and local long term job creation

Across the entire continent there is generally politically driven pontificating from business executives and policy makers than real actionable policies for SMME development. Success stories from the automotive, food processing, chemical, financial services, electronics, and other industries have clearly proven that strategic sourcing can support SMME development, long term creation of new industries and empowerment of indigenous suppliers with real jobs. With successful support of SMMEs, the genuine long term spread of wealth and economic activity is realised .

4. Relatively non Win-win supplier relationship management

Buyer supplier relationships on the continent are still adversarial and short term gain driven. On the contrary strategic sourcing tends to lead to the rationalisation of suppler base, leading to a more co-operative relationship between buyer and critical suppliers. The automotive, electronics, pharmaceuticals, food processing, selected services industries have demonstrated that mutually beneficial relationships can lead to value chain improvements, cost reductions, product innovation and throughput efficiencies

5. Government still not fully harnessing buying power for job creation and long term national development

Creative but legitimate ways are needed to address the chronic unemployment in Ghana and the rest of the continent at large. From a long term developmental perspective, there is nothing wrong in governments setting aside a portion of the procurement budget to strategically source from local suppliers whose total acquisition costs are relatively higher but within reason. In the short term, smaller local suppliers (due to lack of economy of scale) may not be able to compete on total acquisition cost but in the long term, with volume growth, they may. Unfortunately, such initiatives continue to be hijacked by politically-driven box-ticking initiatives and short term self interest, stifling government efforts to create and support a new generation of local and indigenous suppliers - the undoubted engine for sustainable long term growth and job creation. It is worth noting that for every 10 SMMEs created; 2-3 may survive to become another major industrial conglomerate!

6. Focus is on short term organisational interests and not on supplier development

Unlike current quick fix and often self interest practices, strategic sourcing encourages the buying organisation to work with suppliers to improve performance. In some cases, it has resulted in higher short term acquisition cost. Most supply chain-driven organisations work with suppliers to learn problem solving techniques, improve quality, and better financial management, especially among emerging suppliers. The end result of such collaboration is competitiveness and lower long term acquisition costs and increase in shareholder value.

7. Procurement is still not extricably linked to, supply chain and overall business strategy growth and even national development

Unlike current practices in Africa, Strategic sourcing compels the linking of product and service sourcing decisions more closely with strategic planning processes by connecting the type of product or service with the requirements of the value chain.

8. Major challenges with the systematic evaluation of value chain requirements

Major obstacles continue to impede the evaluation of value chain requirements within organisations...One of the major challenges continue to be associated with information systems and related processes used in collating and analysing sourcing data. With the right and up to date information, strategic decisions can be taken on a sourced in item or commodity. For example, a company used to have over 150 printer classifications for its various offices to choose from. After a critical sourcing analysis the number of printers was reduced to 10. Not only did the company save over 15% in total acquisition costs over 12 months but also the rationalisation lead to significant reductions in the consumption of paper, electricity, space needed, cartridges, improvement in print quality etc.

9. The Government and local companies are not leveraging the potential for bulk procurement and associated total acquisition gain share

With information comes the opportunity to leverage total acquisition spend across locations. With volume comes strength in negotiating total acquisition cost. There is clear evidence that bulking can lead to best price, quality delivery schedules and inventory management. In some cases, savings of up to 30% can be generated over a 3-5 year time frame.

10. Opinionated acquisitions as opposed to Information driven sourcing

Unlike current practices within most organisations, strategic sourcing forces a move away from atypical purchasing to fact-based acquisition. In so doing, it allows the process custodian and buyer to clearly understand the nature of its value chain and the potential implication for cost and services delivery

11. Price is still the Focus and not total acquisition cost

From initial acquisition to ongoing usage and to ultimate disposal, there are costs associated with a product. For example a printer may be priced at hundreds of cedis less than the competition, but may cost more if when taking into account the price of consumables for the device. Reliability issues, energy consumption, warranties, disposal issues all come into the total acquisitions cost that needs to be considered

12. Limited teamwork

With fact based sourcing comes detailed knowledge about a product, its supplier, markets and more. Cross-functional teams are mostly employed in strategic sourcing. This eliminates 'silo thinking' and creates an open and collaborative culture within organisations and with external partners. Current practices on the continent as a whole generally points to the contrary.

Conclusion: Food for thought

1. Governments in Africa must look at sourcing from an economic development agenda point of view, and not just in terms of competitive pricing.

2. Business leaders must view strategic sourcing as a means to sustainably increase shareholder value

3. Strategic sourcing is different from the increasingly and precarious practice of 'box ticking' and self interest empowerment.

4. Real strategic sourcing goes beyond the number crunching and finance/treasury function. As such the reporting structure of the process custodian must be revisited by the policy makers and Chief Executives. For example in an increasing number of organizations the Chief Procurement Officer is either in an EXCO role or reports indirectly to the Board via the Chief supply chain officer.

5. Government must seriously consider a supply chain focused strategic team within National planning or Economic Development team with responsibility for continuously looking at value chain linkages and its potential impact on socio economic growth.

6. Supply chain and procurement-related human related capital must be professionally capacitated and truly empowered to act and make decisions

7. It is necessary to always look at sourcing from a total acquisition perspective and not just price

8. Pool resources and demand to enable leveraged acquisition. This applies to organisations and also to Governments in Africa. For example, ECOWAS can pool requirements for certain pharmaceuticals and negotiate better acquisition terms with the international majors

9. Continually improve procurement processes by tying it into key activities, information system enablers, the supply chain and budget process

10. Develop win-win strategic partnerships with critical suppliers who can clearly demonstrate value-add

11. Process custodians and management must be held accountable for the quality and results of the sourcing process

12. Seek minority and small business procurement opportunities for indigenous suppliers which may not necessarily be able to compete on total acquisition in the short term

13. Choose big and small suppliers who are socially responsible

14. Innovative strategic sourcing by government could encourage service providers to relocate to certain regions to service local needs at a reasonable price, thereby spreading economic activity and creating jobs. Through targeted tax incentives government can encourage local and foreign companies which seek to supply products or services to locate to selected rural areas as part of the qualifying criteria. Such initiatives can lead to the creation of new industries and halt rampant rural urban migration.

15. Recognise that continuous data collection and quality information is critical for strategic sourcing.

About the author

Dr Douglas Boateng is the Founder, President and CEO of PanAvest International a 5PSCM niche business advisory, education, training, coaching and mentoring company. The organization's goal is to assist companies to profitably extend their market reach through the application of long term innovative, Business Development Logistics and Supply Chain Management solutions. Dr Boateng is an external examiner and project supervisor on supply chain management at UNISA' SBL and President of the Institute of Operations Management Africa. He is also Founding President of the West African Institute for Supply chain Leadership in Ghana. (aka WAISCL). WAISCL is an exclusive supply chain training institutional partnership between Kwame Nkrumah University of Science and Technology and PanAvest International. Dr Boateng is a FELLOW of the (a) Institute of Directors-UK & Southern Africa (b) Chartered Management Institute -UK (c) Chartered Institute of Logistics and Transport-UK and South Africa (d) Institute of Operations Management-UK.

Video: John Kumah to be buried in big glass-gated house surface, gets Ghanaians ...

Video: John Kumah to be buried in big glass-gated house surface, gets Ghanaians ...

Bryan Acheampong’s Rock City submitted the best proposal for our hotels – SSNIT ...

Bryan Acheampong’s Rock City submitted the best proposal for our hotels – SSNIT ...

Petition to impeach Kissi Agyebeng: Martin Amidu has embarrassed us – Movement a...

Petition to impeach Kissi Agyebeng: Martin Amidu has embarrassed us – Movement a...

President Akufo-Addo is safe – Presidency allays fears after accident involving ...

President Akufo-Addo is safe – Presidency allays fears after accident involving ...

Bawumia is either joking or lying on his campaign tour; he can't be Ghana’s Pres...

Bawumia is either joking or lying on his campaign tour; he can't be Ghana’s Pres...

‘Invest in hospitals and stop wasting money on holes’ — Beatrice Annan to NPP go...

‘Invest in hospitals and stop wasting money on holes’ — Beatrice Annan to NPP go...

5 ways I’ll build a stronger cedi with my GTP if elected president — Alan reveal...

5 ways I’ll build a stronger cedi with my GTP if elected president — Alan reveal...

‘We found no survivors’ — Iranian President confirmed dead after helicopter cras...

‘We found no survivors’ — Iranian President confirmed dead after helicopter cras...

Mepe flood victims still in tents 8months after Akosombo Dam spillage

Mepe flood victims still in tents 8months after Akosombo Dam spillage

Kpemka’s appointment as Deputy BOST MD is unconstitutional – Kwabena Donkor

Kpemka’s appointment as Deputy BOST MD is unconstitutional – Kwabena Donkor