China and Hong Kong saw the biggest investor outflows from banking stocks among emerging markets in the last six months, according to Copley Fund Research, which monitors 767 funds managing a total $1.2 trillion of assets.

Average allocations dropped to 2.28% of global emerging market funds from 2.82% six months earlier.

"A trifecta of slowing GDP growth, the still unresolved trade tensions with the US and the risk of prolonged Hong Kong protests have taken their toll on investors' sentiment," said Steven Holden, CEO of Copley Fund Research.

Bank of China, China Construction Bank and ICBC were among the biggest stock reductions.

China and Hong Kong have the lowest investment from global emerging markets fund managers relative to the benchmark MSCI Emerging Markets index.

By contrast, global equity fund managers are showing signs of betting on a European resurgence,

A record 80.5% of funds are now overweight Europe ex-UK equities, the highest proportion since Copley started gathering data in 2011. Funds increased allocations to 20.7% for developed European countries, from 20% in late 2018. Their weighting is 6.45% above the benchmark MSCI All Country World Index.

“Expansionary policy from the European Central Bank and some improved economic indicators are signposting investors towards expectations of growth in Europe,” said Holden. ��Against a backdrop of the long-running high performance for US equities, cheaper European stocks are suddenly winning attention again."

France is benefiting most from the newfound appetite for European equities, led by Danone, Sanofi and Total among the top overweight holdings.

“This is a clear signal that managers are positioned for a European rebound, with all major continental countries now held overweight by global equity managers,” said Holden.

While holdings of UK stocks are also above the benchmark weighting, investors continue to trim allocations to near a record low amidst the uncertainty of Brexit and a general election.

Meanwhile, the growing mass of investment funds applying environmental, social and corporate governance, or ESG standards to their portfolio, are avoiding some of the biggest consumer brands along with oil and tobacco producers.

McDonald's Corp. shares, which are held by nearly one in five global equity funds, along with Wal-Mart Stores Inc. attract zero allocation from ESG funds included in the survey by Copley.

“While ESG funds are less exposed to sectors with obvious social and sustainability challenges — notably tobacco and oil and gas — the food and staples sector is also vulnerable to being shunned by the growing mass of environmental and socially minded investors,” said Holden.

These stocks are losing out on a growing investment base. Assets in dedicated Global ESG strategies in Copley’s survey have doubled since 2017.

The performance of ESG funds has improved too. While 10-year performance for ESG funds lags those unconstrained by such filters, it’s the opposite picture for the last five years, with ESG returning an extra 3.2%.

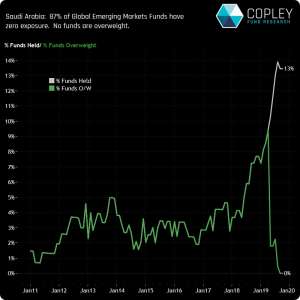

In other regions, emerging market investors are avoiding Saudi Arabian equities ahead of the world’s biggest IPO by Saudi Aramco, according to Copley’s analysis.

Saudi Arabia has the third lowest investment allocation worldwide relative to the country’s weighting in the benchmark MSCI Emerging Markets index, with 87% of emerging market funds having no exposure whatsoever.

“Investors have been staying out of Saudi Arabia because of the reputation risk since the Khashoggi debacle as well as concern that Aramco will swamp the market,” said Holden. “The massive underweight does imply there is plenty of dry powder in emerging market portfolios to deploy on Aramco."

About Copley Fund Research

Copley Fund Research provides data and analysis on global fund positioning, fund flows and fund performance.

This report is based on the latest published filings as of 31 October 2019 from three fund categories:

Global: $760bn total AUM, 430 funds

Global EM: $350bn total AUM, 223 funds

Asia Ex-Japan: $75bn total AUM, 104 funds

Akufo-Addo spotted ordering chiefs to stand for his handshake

Akufo-Addo spotted ordering chiefs to stand for his handshake

Akufo-Addo ‘disrespects’ every chief in Ghana except Okyenhene — NDC Communicato...

Akufo-Addo ‘disrespects’ every chief in Ghana except Okyenhene — NDC Communicato...

Supreme Court clears way for dual citizens to hold key public positions

Supreme Court clears way for dual citizens to hold key public positions

Be transparent, don’t suppress the truth – Prof. Opoku-Agyemang to Jean Mensa

Be transparent, don’t suppress the truth – Prof. Opoku-Agyemang to Jean Mensa

‘I won’t tell the world I was only a driver’s mate during challenges’ – Prof Jan...

‘I won’t tell the world I was only a driver’s mate during challenges’ – Prof Jan...

We’ll prosecute corrupt officials of Akufo-Addo’s govt – Prof Jane Naana

We’ll prosecute corrupt officials of Akufo-Addo’s govt – Prof Jane Naana

[Full text] Acceptance speech by Prof Jane Naana Opoku-Agyemang as 2024 NDC Runn...

[Full text] Acceptance speech by Prof Jane Naana Opoku-Agyemang as 2024 NDC Runn...

Election 2024: Don’t be complacent, we haven’t won yet – Asiedu Nketia cautions ...

Election 2024: Don’t be complacent, we haven’t won yet – Asiedu Nketia cautions ...

Election 2024: Stop fighting over positions in Mahama’s next govt – Asiedu Nketi...

Election 2024: Stop fighting over positions in Mahama’s next govt – Asiedu Nketi...

Prof Jane Naana Opoku-Agyemang will restore dignity of vice presidency – Fifi Kw...

Prof Jane Naana Opoku-Agyemang will restore dignity of vice presidency – Fifi Kw...