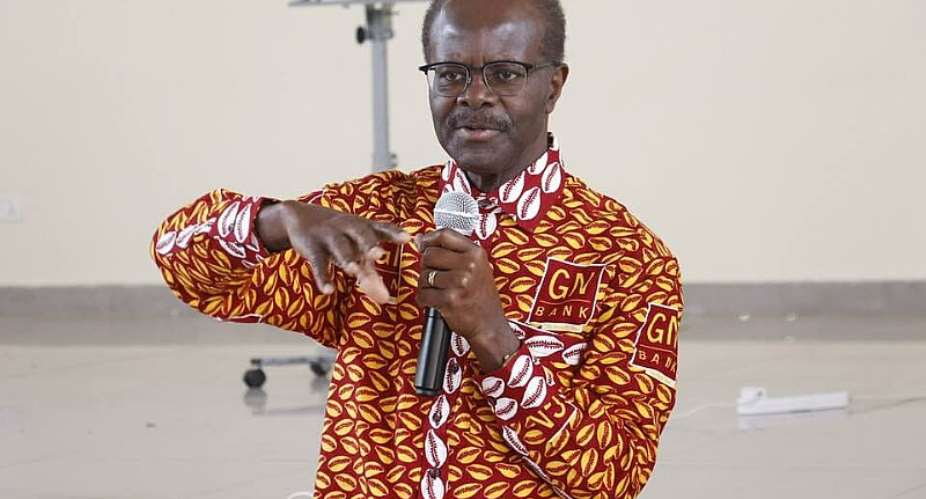

Papa Kwesi Nduom, the founder of GN Bank, which was recently downgraded to a Savings and Loan Company, says the challenges confronting his business is being resolved.

He said some of the challenges such as the delay in the payment of workers’ salaries have already been solved.

The businessman has been under pressure over the past few months following the company’s difficulty in meeting customer demands.

The financial institution was among the many that were affected in the country’s banking crisis that saw eight local banks collapse.

Nduom has also come under serious criticism over the challenges his GN Savings and Loans company as well as Gold Coast Security is going through, but in a Facebook post on the matter, he said the company is making gradual progress in getting back on its feet.

He confirmed that GN Bank had completed its transition into a savings and loans company and restructured its operation.

“GN Bank/Savings completed the six month transition from universal bank to Savings and loans at the end of June, under the supervision of the Bank of Ghana. Products and services have been changed and a lot of restructuring has happened to ensure concentration on financial inclusion and strengthening the field operations. Some of the problems encountered last year have been solved. Others are being addressed. For example, workers' salaries that were locked up have been released throughout the country. Selected branches are back to delivering remittance/money transfer services successfully,” he said.

He claimed that through a new banking approach the company has introduced, it is attracting old and new customers “to actively transact business with us through new deposits.”

He gave assurances that GN Savings and Loans will be working to raise more funds in order to meet the demands of customers who still have deposits with them from last year.

Nduom in the post also indicated that the company has got potential partners who are ready to inject capital into the company after they are cleared by the Bank of Ghana.

“Existing shareholders have also pledged to put in new money to provide liquidity by the end of the year,” he said, adding that he is “ confident that the revival of this business will continue.”

We’ll no longer tolerate your empty, unwarranted attacks – TUC blasts Prof Adei

We’ll no longer tolerate your empty, unwarranted attacks – TUC blasts Prof Adei

Bawumia donates GHc200,000 to support Madina fire victims

Bawumia donates GHc200,000 to support Madina fire victims

IMF to disburse US$360million third tranche to Ghana without creditors MoU

IMF to disburse US$360million third tranche to Ghana without creditors MoU

Truck owner share insights into train collision incident

Truck owner share insights into train collision incident

Paramount chief of Bassare Traditional Area passes on

Paramount chief of Bassare Traditional Area passes on

Two teachers in court over alleged illegal possession of BECE papers

Two teachers in court over alleged illegal possession of BECE papers

Sunyani: Victim allegedly shot by traditional warriors appeals for justice

Sunyani: Victim allegedly shot by traditional warriors appeals for justice

Mahama vows to scrap teacher licensure exams, review Free SHS policy

Mahama vows to scrap teacher licensure exams, review Free SHS policy

Government will replace burnt Madina shops with a new three-story, 120-store fac...

Government will replace burnt Madina shops with a new three-story, 120-store fac...