About 19 banks are likely to meet the new capital requirement of GH₵400 million by December this year, Governor of the Bank of Ghana has said.

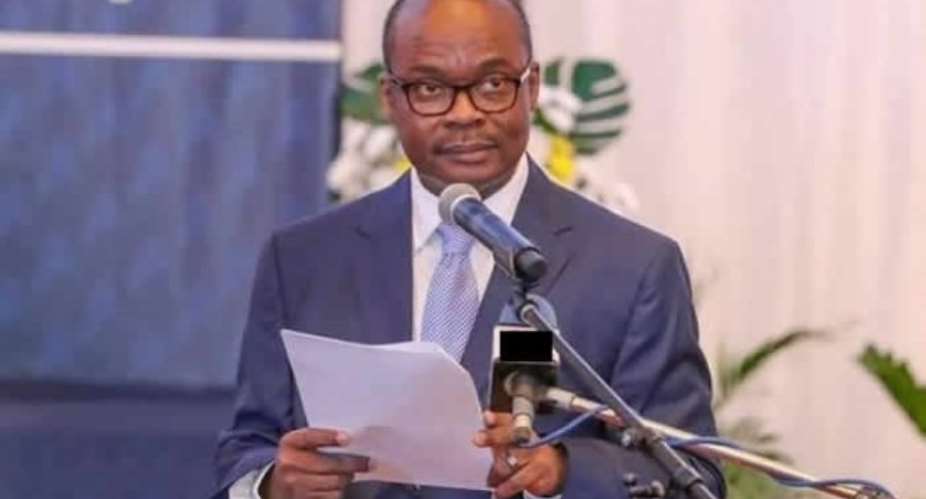

According to Dr. Ernest Addison, this is based on documents submitted by the commercial banks, as well as BoG’s own analysis.

Dr. Addison disclosed this during an interaction with journalists after meeting to review health of economy last week.

Currently there are about 30 commercial banks in the country, according to the list of licensed banks issued by the Bank of Ghana in August this year.

Background

The Bank of Ghana (BoG) revised the minimum capital levels for banks in response to developments in the banking industry and the economy at large.

In 2003, the minimum capital requirement was raised from GH¢2.5 million to GH¢7.0 million to enable all banks convert to universal banks. The minimum capital requirement was also increased to GH¢60 million in 2007.

In 2013, BoG again raised the minimum capital requirement to GH¢120 million for new entrants and advised existing banks to take steps to increase their capital in line with their risk profiles.

BoG issued a Minimum Capital Requirement Directive in September 2017, increasing the minimum capital requirement for all banks to GH¢400 million from GH¢120 million.

Banks are therefore required to meet this requirement by December 2018 through the injection of fresh equity capital.

The recent GH¢400 million minimum capital increase was deemed necessary for a number of reasons; Solvency, Macroeconomic impact on capital, Credit expansion and good corporate governance.

According to the Bank of Ghana, it will closely monitor banks’ plans to recapitalize to ensure an orderly recapitalization process.

Directives

The BoG recently issued its Corporate Governance Directive, which it expects banks to comply with to strengthen their corporate governance practices, thereby promoting investor confidence in them and thereby facilitating access to new capital.

BoG has encouraged banks that may be unable to raise new capital on their own, to explore opportunities to merge with other banks.

Such mergers and acquisitions should lead to larger, stronger, and better capitalized banks for shareholders of the merging banks.

Akufo-Addo’s govt is the ‘biggest political scam’ in Ghana’s history – Mahama ja...

Akufo-Addo’s govt is the ‘biggest political scam’ in Ghana’s history – Mahama ja...

Performance Tracker is not evidence-based — Mahama

Performance Tracker is not evidence-based — Mahama

Four arrested for allegedly stealing EC laptops caged

Four arrested for allegedly stealing EC laptops caged

$360 million IMF bailout not enough for Ghana – UGBS Professor

$360 million IMF bailout not enough for Ghana – UGBS Professor

Shrinking Penis Allegations: Victim referred to trauma hospital due to severity ...

Shrinking Penis Allegations: Victim referred to trauma hospital due to severity ...

Adu Boahen Murder: Case adjourned to May 9

Adu Boahen Murder: Case adjourned to May 9

‘I've health issues so I want to leave quietly and endure my pain’ — Joe Wise ex...

‘I've health issues so I want to leave quietly and endure my pain’ — Joe Wise ex...

Let’s help seek second independence for Ghana before NPP sells the country – Law...

Let’s help seek second independence for Ghana before NPP sells the country – Law...

New Force aims to redeem Ghana and West Africa — Nana Kwame Bediako

New Force aims to redeem Ghana and West Africa — Nana Kwame Bediako

‘I didn't say I would buy Ghana if voted against; I said I’ll buy it back from f...

‘I didn't say I would buy Ghana if voted against; I said I’ll buy it back from f...