Ghana's oil and gas sector has scored a satisfactory 67 out of 100 points in the global Resource Governance Index, and is said to be best governed in the sub-Saharan Africa.

However, according to the global index compiled by Natural Resource Governance Institute (NRGI), there are still challenges needed to be addressed without any further delays.

Challenges in relation to national budgeting, including rules specific to petroleum revenues,

did not provide for adequate safeguards against budget deficits and debt accumulation.

The Ghana Stabilization Fund is the index's second-best-governed sovereign wealth fund.

Ghana's state-owned oil company is well governed but said it should aim even higher to achieve global best practices.

Index also showed significant gap in governance quality between Ghana's oil and gas and mineral sectors while Ghana's mining sector scored 56 of 100 points and ranked 24th among 89 assessments made worldwide.

Ghana is one of eight countries in the index for which both mining and oil and gas sectors were assessed, and researchers reported significant variations in governance between the two sectors.

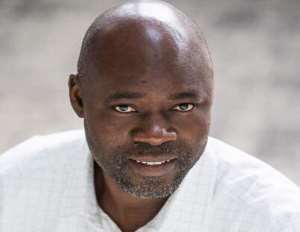

Adams Fusheini, NRGI Africa Parliamentary Capacity Development Officer, admitted at the launch in Accra yesterday that “resource governance in Ghana is improving, and the media and civil society are well positioned to hold governments and companies to account here. The country has performed well as an oil producer, but macroeconomic concerns threaten the chances of benefits reaching citizens.”

He said that the Ghana Stabilization Fund is the index's second-best governed, behind only Colombia's Savings and Stabilization Fund, adding that “Ghana's fund was found to be better governed than many with much greater assets, including those of many oil-rich states in the Persian Gulf.”

“Ghana's good performance is a result of clearly defined rules for deposits, withdrawals and investments, audit and parliamentary oversight mechanisms and adherence to these requirements.”

He said that in spite of the positive findings, “governance of revenue management in Ghana falls behind that of some other states with emerging hydrocarbons sectors,” adding “Uganda, for instance, scores more than 10 points higher than Ghana in the national budgeting category.”

According to Mr. Adams, the mining sector performed better than equivalents in many of its African neighbours.

“It is older and longer established than Ghana's hydrocarbons industry.”

“The latter has evolved during an era of more stringent governance and of more modern institutional structures. This has led to an 11-point performance gap between the two sectors' governance scores. Indeed, Ghana's gold mining company, Sankofa Prestea, scores far below its petroleum sector peer and parent company, Ghana National Petroleum Corporation (GNPC).”

He said that Ghana performed well in taxation in both sectors, saying “disclosures are better and more timely for oil and gas, as compared to mining, though contracts with extractive companies are not disclosed.”

“It is good news that Ghana is performing better than many other African countries – particularly in terms of the governance of its sovereign wealth fund,” Mr. Adams said, adding “but there should be no complacency in Ghana – there is still plenty of room for improvement to bring the nation up to international best standards.”

The Resource Governance Index is the sum total of 89 sector-specific assessments in 81 countries (in eight countries NRGI assessed both oil and gas and mining sectors), formulated using a framework of 149 critical questions answered by 150 researchers, drawing upon almost 10,000 supporting documents.

For each assessment, NRGI has calculated the composite score using the scores of three index components.

Two of the components comprise new research based on expert answers to the questionnaire, and directly measure governance of countries' extractive resources.

By William Yaw Owusu

Tuesday’s downpour destroys ceiling of Circuit Court '8' in Accra

Tuesday’s downpour destroys ceiling of Circuit Court '8' in Accra

SOEs shouldn't compromise on ethical standards, accountability – Akufo-Addo

SOEs shouldn't compromise on ethical standards, accountability – Akufo-Addo

Father of 2-year-old boy attacked by dog appeals for financial support

Father of 2-year-old boy attacked by dog appeals for financial support

Jubilee House National Security Operative allegedly swindles businessman over sa...

Jubilee House National Security Operative allegedly swindles businessman over sa...

Nobody can order dumsor timetable except Energy Minister – Osafo-Maafo

Nobody can order dumsor timetable except Energy Minister – Osafo-Maafo

Mahama wishes National Chief Imam as he clock 105 years today

Mahama wishes National Chief Imam as he clock 105 years today

J.B.Danquah Adu’s murder trial: Case adjourned to April 29

J.B.Danquah Adu’s murder trial: Case adjourned to April 29

High Court issues arrest warrant for former MASLOC Boss

High Court issues arrest warrant for former MASLOC Boss

Align academic curriculum with industry needs — Stanbic Bank Ghana CEO advocates

Align academic curriculum with industry needs — Stanbic Bank Ghana CEO advocates

Election 2024: We'll declare the results and let Ghanaians know we've won - Manh...

Election 2024: We'll declare the results and let Ghanaians know we've won - Manh...