Introduction

Islam is a religion and state. That is why the Holy Quran addresses all areas of life in a state of symbiosis between spirituality and secularism. One Islamic concept which is critical to the economic governance and development of contemporary society is Islamic Banking and Finance. Available literature reveals that the Shariah-based concept of Banking and Finance emerged about 40 years ago. At its infant stage, it was confined to the Middle East where it was conceptualized.

Over the years, however, the concept of Islamic Banking and Finance has grown progressively. And today, it has spread to over 70 countries and has become a $2 trillion market at the global level. Many experts regard Islamic Banking and Finance as a viable option in a global market characterized by conventional banking and financial system.

Conference

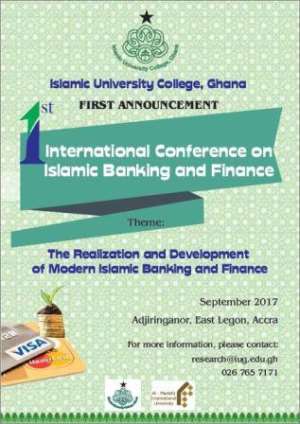

In view of the above, Islamic University College, Ghana (IUCG) has decided to organise an international conference on Islamic Banking and Finance in September this year. The conference is on the theme: 'The realization and development of modern Islamic Banking and Finance.' In an interview, Alhaji Dr. Adam Mahama, Head of Research, IUCG, describes the conference as the first of a series of programs outlined to actualize the Scientific Thinking of the University College and to promote service to community.

He explains that the conference will be an assemblage of scholars and practitioners to examine the contemporary trends of Islamic Banking and Finance and related benefits for national development. This implies that academic papers will be presented by experts, and experiences shared by industry players. Therefore, participants may discuss sub-themes such as 'Islam and Investment', 'Banking from the Quranic perspective in a secular community', and 'The role of Islamic Finance In poverty alleviation.'

Benefits of Islamic Banking and Finance

Research is conclusive on the benefits of Islamic Banking and Finance. Among these benefits are encouragement of financial inclusion, reduction of the impact of harmful products, and promotion of financial justice. Others are encouraging stability in investments and accelerating economic development.

Conclusion

Conclusively, It is significant to urge students, researchers, and practitioners to patronize the maiden conference on a relatively virgine displine in Ghana. Certainly, the conference promises to open opportunities for scholars and practitioners to discover new ways of collaboration in their service to humanity. Staff of relevant state institutions and policy makers could also attend to gain new insights into the Islamic Banking and Finance as an alternative system as well as strong tool for economic growth and national developmen.

Abubakar Mohammed Marzuq Azindoo

Lecturer, University of Applied Management, Germany - Ghana Campus, McCarthy Hill, Accra.

Supreme court declares payment of wages to spouses of President, Vice President ...

Supreme court declares payment of wages to spouses of President, Vice President ...

Publish full KPMG report on SML-GRA contract – Bright Simons to Akufo-Addo

Publish full KPMG report on SML-GRA contract – Bright Simons to Akufo-Addo

Kumasi International Airport to begin full operations by end of June

Kumasi International Airport to begin full operations by end of June

Election 2024: Our ‘real challenge’ is getting ‘un-bothered’ youth to vote – Abu...

Election 2024: Our ‘real challenge’ is getting ‘un-bothered’ youth to vote – Abu...

[Full text] Findings and recommendations by KPMG on SML-GRA contract

[Full text] Findings and recommendations by KPMG on SML-GRA contract

Renegotiate SML contract – Akufo-Addo to GRA, Finance Ministry

Renegotiate SML contract – Akufo-Addo to GRA, Finance Ministry

J.B Danquah-Adu murder trial: Sexy Dondon to Subpoena Ken Agyapong, Ursula Owusu

J.B Danquah-Adu murder trial: Sexy Dondon to Subpoena Ken Agyapong, Ursula Owusu

Galamsey: Five Burkinabes jailed 20 years each for mining

Galamsey: Five Burkinabes jailed 20 years each for mining

'It's no crime' – Abu Sakara defends Alan's exit from NPP

'It's no crime' – Abu Sakara defends Alan's exit from NPP

'We know all your houses, pay your bills now or we’ll disconnect you; we're all ...

'We know all your houses, pay your bills now or we’ll disconnect you; we're all ...