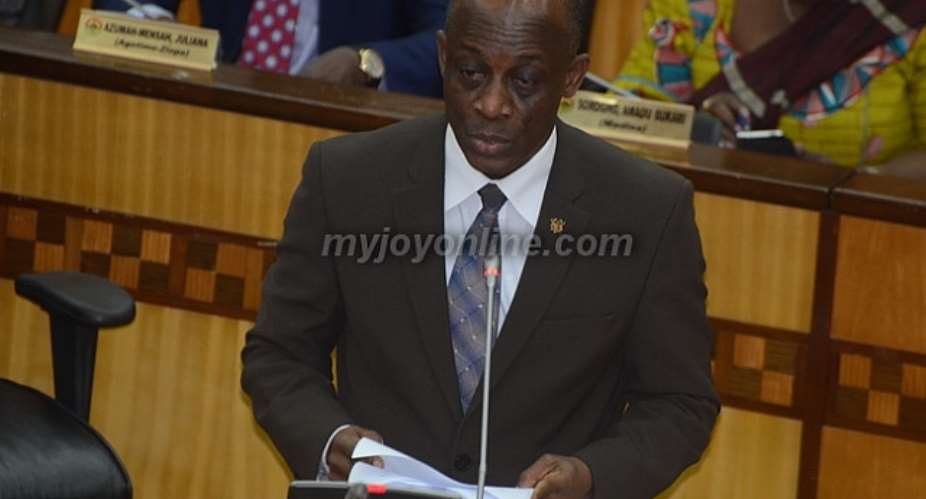

PRESENTED BY SETH E. TERKPER MINISTER FOR FINANCE

SECTION ONE: INTRODUCTION

Right Honourable Speaker, on behalf of His Excellency, President John Dramani Mahama, and in accordance with Article 179(8) of the 1992 Constitution, I stand before this august House, to present a Mid-Year Review and revised budget and macroeconomic targets for 2014. These are necessitated by recent, and in some cases, longstanding global and domestic developments. Consequently, we seek approval for Supplementary Estimates for the 2014 fiscal year.

Mr. Speaker, permit me to convey to you and Honourable Members, the appreciation of His Excellency, President John Dramani Mahama, for the cooperation we receive any time we present major policy statements in the House. While presenting an Urgent Policy Statement on the fiscal consolidation measures for the Ghanaian Economy to this august House in April 2014, I indicated that, if necessary and as required by our laws, I will appear before you with a Mid-Year Review and a Supplementary Budget.

Let me also convey through you, Mr Speaker, and the People's Representatives, President John Mahama's commitment, focus and determination to lead this nation out of our current temporal economic challenges. In doing so, I wish to communicate Government's appreciation of the sacrifices, fortitude, and support of the people of Ghana. As a nation we have risen above many challenges before, and we shall rise again. Indeed, the signs of recovery are already beginning to show.

Mr Speaker, since 2006/2007, when we faced difficulty as a nation, we opted for debt relief under the HIPC Initiative, which gave us significant borrowing space to accelerate our development. In 2010 when we rebased our GDP, we became a Lower Middle Income Country (LMIC) with some pride but also with serious implications. Then in 2011 when we started to export crude oil, our LMIC status got consolidated. As at today, the World Bank has changed our status, moving us from softer loan terms (that is, 10-year grace period, with 30-year repayment) to stricter terms (that is, 5-year grace period and 20-year repayment). The African Development Bank has also introduced and implemented similar strict loan repayment measures. Again, in the last few months, the World Bank has started the process of upgrading Ghana to a “blend” status, which will make us eligible to access the resources of both the International Development Agency (IDA) and International Bank for Reconstruction and Development (IBRD) at the same time. Following on from this, Ghana is now experiencing limited options to concessional loans and dwindling access to concessional loans and grants from development partners.

Furthermore, Mr. Speaker, since March 2013, when the 2013 Budget was presented and approved by Parliament, the economy has experienced a number of pressures, which continue to pose challenges to the attainment of our 2014 economic targets. Notable among these challenges are:

the continuing shortfalls in tax and non-tax revenues, notably from grants and concessional financing – in the case of tax revenues, also partly due to the lower national output.

the consequential depreciation of the Cedi, which is having significant adverse effects on economic activity, public expenditure and other macroeconomic variables; and

declining gold and cocoa prices in 2013 which continue to have a lingering effect on the economy. Although cocoa prices have recovered, the continuous decline in the prices and volumes of gold still poses risks to the country's external position and domestic revenue mobilization;

The factors that disrupted power production and output have also resulted in our reliance on higher imports of crude oil for thermal power generation. These include the year-long shortages in gas supply from the West Africa Gas Pipeline and the frequent downtime of the TICO and BUI projects, amongst other disruptions. Mr. Speaker, these factors have adversely affected the nation's growth and output, domestic revenue mobilization effort, as well as balance of payments and reserves position. In addition, they have considerably undermined the implementation of policy decisions, such as the automatic utility price adjustments, thereby, giving rise to the payment of higher subsidies. These have added to the complexity in managing an economy in transition to a Middle Income Status—a complexity reinforced by the cuts in grants and in the terms on which the country can now attract grants and concessional financing, notably from the development partners, including the World Bank and African Development Bank.

Mr. Speaker, going forward, a very important lesson arising out of this situation is the need to further sharpen and enhance our economic management systems so that we can better manage volatilities such as disruptions in power supply and commodity price shocks. The new realities associated with the implementation of the Single Spines Salary Structure, and our Lower Middle Income Country status are also being confronted head-on by this Government. We shall continue to rely on the cooperation of all stakeholders. We must also improve on various proposals that are emerging and which we are implementing to manage our transition to LMIC status. Furthermore we must endeavour to address the risks posed by events in the global environment, including the difficulty with which the global economy continues to emerge from the worldwide financial and economic crisis.

Mr. Speaker, notwithstanding these challenges—and our bold efforts to address them with measures that include those approved by this august House—we wish to reiterate that the short-to-medium term prospects for Ghana remain positive. This encouraging assertion is supported by the following:

expected increases in oil and gas exploration and production, particularly from the Jubilee, Sankofa-Gye Nyame and Tweneboa-Enyenra-Ntomme (TEN) fields backed by factual evidence such as the building of a second Floating Production Storage and Offloading (FPSO) vessel and ongoing negotiations for gas pricing.

the recovery in cocoa prices, a stable outlook for petroleum prices (with positive impact on revenue yields), and further expansion of the services sector;

public-private sector investments, including FDI, in key sectors of the economy, contributing to the diversification and value addition into the economy; reduction of the infrastructure deficit; and boosting Ghana's growth potential. A notable example is the imminent completion of the gas pipelines and processing plant to stabilize and improve the supply of energy and domestic output;

effective and more durable long-term public financial management systems, including GIFMIS, that will lead to better control of extra-budgetary expenditures as well as increased efficiency in public expenditure management; and

benefits from the next generation of revenue reforms, to improve efficiency—mainly, by moving all GRA tax processes to an electronic platform in order to enhance tax administration and compliance.

It is estimated that strategic infrastructure investments in the oil and gas sector could generate an additional US$2.5 billion in revenues, and increase our GDP growth: they also form the basis for tailoring our “Home Grown” Fiscal Consolidation Programme to overlap with firm goals that help achieve our medium term targets.

Mr. Speaker, we are presenting these Supplementary Estimates to ensure that we maintain the pursuit of our growth and macroeconomic stability agenda. It has, therefore, become necessary to make adjustments to accommodate the following:

higher interests costs due to rising interest rates, borrowing, and exchange rate depreciation;

higher foreign-financed capital due to the exchange depreciation; and

higher subsidies due to slower-than-expected implementation of utility and petroleum price adjustments

higher payments on compensation to employees despite the moderation in wage negotiations – with cooperation of organised labour and Employers Association- that has led to the implementation of a 10 percent Cost of Living Allowance (COLA), effective May 2014; and

lower than expected tax revenues and grants.

Mr. Speaker, let me use this opportunity to caution MDAs and MMDAs, that this Revision and Supplementary Estimates will not necessarily result in automatic increases across the board.

Mr. Speaker, against this background, I beg to move that this august House approve the Supplementary Estimate of GH¢3,196,855,671 in conformity with Article 179(8) of the Constitution and Standing Order 143 of this House.

Mr. Speaker, this year's Mid-Year Review and Supplementary Estimates aim to:

update Honourable Members of this House on the performance of the economy in 2013 and the first five months of 2014;

revise the macroeconomic targets for 2014;

revise our budget estimates based on current information;

request for approval of the 2014 Supplementary Estimates; and

outline measures for addressing our Nation's International Reserves to restore the value of the Ghana Cedi

SECTION TWO: MACROECONOMIC PERFORMANCE IN 2013

Mr. Speaker, we now present the macroeconomic performance of the economy in 2013. At the time of presenting the 2014 Budget in November 2013, we did not have full year information. Hence we projected the outturn for 2013 based on actual data for January to September, 2013 which we wish to update to December 2013.

GDP Performance

Mr. Speaker, GDP data for 2013 released by the Ghana Statistical Service (GSS) showed an overall GDP growth of 7.1 percent against the target of 8.0 percent. Mr. Speaker, I wish to emphasize that the 7.1 percent growth shows a robust and strong performance, especially when compared to the Sub-Saharan average of 4.9 percent and global average of 3 percent for 2013. Even though the 2013 GDP growth rate was lower than projected, both the real and nominal GDP values were higher than projected. The real GDP in 2013 was GHȻ32,507 million against a target of GHȻ32,109 million for the year. In nominal terms, GDP was GHȻ93,461 million, against a projected GHȻ88,764 million. It is also important to note that GSS has also revised the growth rate for 2012 to 8.8 percent.

Inflation

Mr. Speaker, inflation ended 2013 at 13.5 percent against the target of 9 percent within the band of ±2 percent and 9.2 percent in 2012. The increase is mainly on account of cost push pressures emanating from frequent adjustment of petroleum and utility prices, higher transportation costs, and the pass through effect of exchange rate depreciation.

Interest Rate Developments

Mr. Speaker, developments in interest rates for 2013 in general indicated a downward trend on year-on-year basis. The Bank of Ghana Policy Rate which was increased to 16.0 percent in May 2013 remained unchanged till the end of the year. The various market rates also trended downwards in 2013.

Exchange Rate Developments

Mr. Speaker, the Ghana Cedi generally traded weak against the currencies of the major trading partners during the review year. In the Inter-Bank Market, the Ghana Cedi recorded cumulative annual depreciation of 14.6 percent against the US dollar during the review period. This is lower than the 17.5 percent annual depreciation recorded in 2012. The Ghana Cedi recorded relatively higher depreciation of 16.7 percent and 20.1 percent against the Pound Sterling and the Euro, respectively, in 2013.Anchor

Fiscal Performance

Mr. Speaker, fiscal policy outlined in the 2013 Budget aimed to achieve fiscal prudence and debt sustainability by reducing the budget deficit from 11.5 percent of GDP in 2012 to 9.0 percent of GDP in 2013.

Provisional end-year fiscal data for 2013 indicate that both revenue and expenditure were below their respective targets for the year. However, the shortfall in revenue far exceeded the shortfall in expenditure, resulting in a cash fiscal deficit equivalent to 10.1 percent of GDP against the original budget target of 9.0 percent and the revised target of 10.2 percent. This compares to a deficit equivalent to 11.5 percent of GDP recorded in 2012.

Mr. Speaker, total revenue and grants for the period was GH¢19,471.6 million, equivalent to 20.8 percent of GDP, against a target of GH¢22,533.4 million or 25.4 percent of GDP. The shortfall in total revenue and grants was partly due to low disbursement of grants from our development partners and lower than anticipated performance of domestic revenues.

Mr. Speaker, the additional measures approved by Parliament yielded revenue of about GH¢168 million or 0.2 percent of GDP in 2013. The full effect of these measures are expected to have a strong impact on revenue performance in 2014 and contribute to the continuing fiscal consolidation, in line with the multi-year adjustment effort.

Mr. Speaker, the performance of tax revenue from the traditional sources was weak, but oil revenue performance was very strong as a result of higher than expected crude oil prices, production and corporate income tax levels. Total oil revenue for 2013, amounted to GH¢1,634.0 million (1.7% of GDP), against a target of GH¢1,103.9 million (1.2% of GDP).

In contrast, grant disbursement from our development partners was 41.2 percent lower than the budget target of GH¢1,258.5 million and 36.3 percent lower than the outturn recorded during the same period in 2012. In absolute terms the shortfall in grants was GH¢519.0 million. The lower than expected outturn of grants was mainly due to the non-disbursement of some project grants and budget support by some Multi-Donor Budget Support (MDBS) and other partners.

Total expenditure, including payments for the clearance of arrears and outstanding commitments for 2013 amounted to GH¢28,926.2 million (31.0% of GDP), against a target of GH¢30,544.3 million (34.4% of GDP). The outturn was 5.3 percent lower than the budget target but 14.3 percent higher than the outturn for the corresponding period in 2012.

Mr. Speaker, as a result of the shortfall in revenue and grants, government reduced spending on goods and services as well as other expenditure items. This led to total expenditures being lower than budgeted, even though spending on wages and salaries as well as interest cost were higher than budgeted.

Mr. Speaker, based on the revenue and expenditure outturns for 2013, the overall budget balance on cash basis registered a deficit of GH¢9,454.6 million, equivalent to 10.1 percent of GDP. This was against a deficit target of GH¢8,010.8 million, equivalent to 9.0 percent of GDP.

Mr. Speaker, the overall budget deficit for the period was financed from both domestic and foreign sources. Domestic financing amounted to GH¢6,920.4 million, against a target of GH¢5,700.8 million. Foreign financing of the deficit was GH¢3,212.0 million, against a target of GH¢2,536.0 million. The higher foreign financing was as a result of partially utilising the 2023 Eurobond to finance some capital expenditures in the Budget and to refinance high-interest maturing domestic debt.

Developments in Public Debt

Mr. Speaker, Ghana's total public debt stock, which stood at GH¢35,999.64 million (US$19,150.78 million) as at end-December 2012, increased to GH¢52,125.91million (US$24,021.16 million) at the end of December 2013. Of the total public debt stock, external debt was GH¢21,545.72 million (US$11,461.71 million) while domestic debt amounted to GH¢27,132.7 million (US$12,559.45 million), representing 47.72% and 52.28% of total debt, respectively.

Mr. Speaker in terms of GDP, the total public debt stood at 55.77 percent as at end-December 2013, representing an increase from the December 2012 ratio of 48.03 percent. The increase in the public debt was largely on account of the issuance of Eurobond and disbursement for major infrastructure projects such as the Bui Dam, the Ghana Gas Project, the Coastal Protection Projects, and Redevelopment of the Police Hospital.

SECTION THREE: MACROECONOMIC PERFORMANCE FROM JAN-MAY 2014

Mr. Speaker, I now present the macroeconomic performance for the first five months of 2014.

Macroeconomic Targets for 2014

Mr. Speaker, the 2014 Budget aims at restoring stability and set the following targets:

overall real GDP (including oil) growth of 8.0 percent;

non-oil real GDP growth of 7.4 percent;

An end year inflation target of 9.5 percent within the band of ±2 percent;

overall budget deficit equivalent to 8.5 percent of GDP; and

Gross International Reserves of not less than 3 months of import cover of goods and services.

Developments from January to May 2014 indicate that the economy continues to face challenges due to unfavourable developments in both domestic and external environments. However, as we have noted already, the medium term prospects are brighter. The details of the macroeconomic performance for the period under review are highlighted below.

GDP Performance

Mr. Speaker, GDP grew by 6.7 percent in the first quarter of 2014, down from 9.0 percent in the corresponding period in 2013. The Agriculture Sector led with a growth of 12.7 percent, up from 6.7 percent in the analogous quarter in 2013. The Services Sector followed with a growth of 4.6 percent compared to 10.4 percent recorded in the same quarter of 2013, while the Industry Sector contracted by 1.1 percent compared to its growth of 8.1 percent growth in the corresponding period in 2013.

Inflation

Mr. Speaker, inflation has continued to increase in 2014, after assuming double digit rates in 2013. Inflation rose to 15 percent in June, 2014 from 13.5 percent at the end of December 2013. The rise in inflation during the period was mostly influenced by cost push pressures arising from upward adjustments of petroleum and utility prices, higher transportation cost, and the pass through effect of the currency depreciation. We expect inflation to ease with good harvests, stabilization of the cedi and improvement in economic performance.

Banks' Outstanding Credit

Mr. Speaker, the annual growth rate of banks' outstanding credit to the public and private institutions in May 2014 indicated an upward trend as it stood at 46.0 percent (GH¢6,725.3 million) against 34.6 percent (GH¢3,756.8 million) at the end of May 2013. In real terms, it grew from 21.4 percent in May 2013 to 27.2 percent in May 2014. The private sector accounted for 88.8 percent of the total outstanding credit at the end of May 2014 compared with 88.1 percent at the end of May 2013.

The nominal growth rate in outstanding credit to the private sector alone increased from 32.7 percent at the end of May 2013 to 47.2 percent at the end of May 2014. In real terms, the growth rate increased from 19.6 percent at the end of May 2013 to 28.2 percent at the end of May 2014.

Interest Rate Developments

Mr. Speaker, developments in interest rates in the first five months of 2014 indicate a rising trend. The Monetary Policy Committee increased the Policy Rate by 200 bps to 18.0 percent at its meeting in February and recently to 19.0 percent to rein in the volatility in the domestic foreign exchange market.

Consequently, money market instruments recorded significant increases in rates during the review period compared to the downward trend observed in 2013. On year-to-date basis, the rates on 91-day and 182-day treasury bills increased by 526 bps and 246 bps, respectively, to 24.07 percent and 21.29 percent, respectively.

Exchange Rates Developments

Mr. Speaker, the cedi weakened during the first five months of the year on account of relatively higher demand for foreign exchange from both the formal and informal sectors relative to the supply. While still a major concern, thAnchore rate of depreciation moderated after March following a tighter monetary policy stance and strict implementation of existing foreign exchange regulation by the Central Bank.

In the Inter-Bank Market, the Ghana Cedi recorded cumulative depreciation of 23.9 percent against the US dollar, 24.1 percent against the pound sterling and 21.4 percent against the euro in the first five months of 2014.

To address the liquidity overhang and improve supply of foreign exchange in the markets, the cash reserve requirement of banks was revised to 11.0 percent from 9.0 percent while Net Open Position (NOP) limits of banks have been revised downwards. The single currency NOP has been reduced from 10.0 percent to 5.0 percent and the aggregate NOP has been reduced from 20.0 percent to 10.0 percent.

Meanwhile the foreign exchange measures introduced in February 2014 have been revised in June to minimise the unintended consequences of the measures.

Balance of Payments

Mr. Speaker, the value of merchandise exports during the first five months of 2014 was estimated at US$5,871.9 million, indicating a decline of 7.5 percent from the outturn in the corresponding period of 2013. The decline in exports was as a result of low receipts from gold and crude oil against strong demand for foreign currencies. Total value of merchandise imports during the review period was valued at US$6,028.4 million, also indicating a decline of 17.8 percent on the level in the corresponding period of 2013. The decline in imports was recorded in both oil and non-oil imports. The trade balance for the period January to May 2014 consequently registered a deficit of US$156.6 million, an improvement from a deficit of US$990.8 million recorded by end-May 2013. AnchorAnchor

International Reserves

Mr. Speaker, at the end of June 2014, the country's Gross International Reserves stood at US$4,471 million sufficient to provide 2.5 months of imports cover compared to the stock position of US$5,632.15 million at the end of December 2013 which could cover 3.1 months of imports. This development partly reflects the seasonality in foreign exchange flows during the year.

Fiscal Performance

Mr. Speaker, against the background of ensuring fiscal prudence and debt sustainability,2014 Budget uses the overall budget deficit as the fiscal anchor, and targets a reduction in the deficit from 10.1 percent of GDP in 2013 to 8.5 percent of GDP in 2014. The 2014 Budget, therefore, introduced a number of revenue enhancing measures, debt management reforms, and expenditure rationalisation and realignment of the key components in the Budget, namely compensation, goods and services, debt service and capital.

Mr. Speaker, preliminary data from January to May of the year indicate that, both revenue and expenditure were below their respective targets for the period. However, as in 2013, since the shortfall in revenue was lower than the shortfall in expenditure, the resulting cash fiscal deficit was equivalent to 3.6 percent of GDP, against a target of 3.5 percent. This compares to a deficit equivalent to 4.0 percent of GDP for the same period in 2013.

Revenue

Mr. Speaker, total revenue and grants for the period was GH¢9,043.8 million or 7.9 percent of GDP, against a target of GH¢9,527.9 million or 8.3 percent of GDP. The shortfall in total revenue and grants for the period was the result of low disbursement of project grants from our development partners and lower domestic revenue collections. In nominal terms, the provisional outturn was 14.3 percent higher than the outturn for the same period in 2013.

Total tax revenue amounted to GH¢7,076.8 million, 2.7 percent lower than the Budget target of GH¢7,273.7 million. The shortfall in tax revenue was partly due to the slowdown in economic activity, the delay in the implementation of the change in petroleum excise from specific to ad valorem, lower than anticipated revenue from excise taxes as well as the delay in the implementation of the VAT on fee based financial services. In addition, declining gold prices on the world market and rising operating cost led to lower corporate income taxes from the mining sector.

Oil Tax Revenue, however performed very well as it was 179.3 percent higher than the budget target and 211.5 percent higher than the outturn for the same period in 2013.

Grant disbursements from our development partners was only 21.0 percent of the budget target and 72 percent lower than the outturn recorded during the same period of 2013 mainly on account of slow disbursement of project grants from our development partners. Anchor

Expenditure

Mr. Speaker, total expenditure, including payments for the clearance of arrears and outstanding commitments from January to May 2014 amounted to GH¢13,170.9 million (11.5 percent of GDP), against a target of GH¢13,587.5 million (11.8 percent of GDP). The outturn was 3.1 percent lower than the budget target and 12.6 percent higher for the same period in 2013.

Expenditure on Wages and Salaries for the period totaled GH¢3,802.9 million, 2.2 percent higher than the budget target of GH¢3,720.3 million and 26.2 percent higher than the outturn for the same period in 2013. In addition to this, an amount of GH¢348.5 million was spent on the clearance of wage arrears.

Mr. Speaker, interest payment for the period totaled GH¢2,832.1 million, 26.0 percent higher than the Budget target of GH¢2,246.8 million and 49.8 percent higher than the outturn for the same period in 2013. The higher interest cost in the period was the result of high domestic interest rates and higher than estimated domestic borrowing during the period. Domestic interest cost was 35.8 percent higher than the Budget target. On a year-on-year basis, domestic interest grew by 49.5 percent.

Capital expenditure from January to May 2014 amounted to GH¢1,767.2 million, against the Budget target of GH¢2,169.9 million. The outturn was 26.9 percent higher than the outturn for the same period in 2013. The shortfall in capital spending was mainly as a result of lower than estimated foreign financed-capital expenditure due to the slow disbursement of project loans and grants. A successful launch of the 2014 Eurobond is expected to bridge the gap.

Overall Budget Balance and Financing

Mr. Speaker, the cash fiscal deficit of 3.6 percent of GDP for the period under review was financed mainly from domestic sources, resulting in a Net Domestic Financing (NDF) of the budget of GH¢3,234.5 million (2.8 percent of GDP). The NDF for the period was 6.5 percent higher than the budget target of GH¢3,036.9 million.

Foreign Financing of the budget was GH¢848.4 million, against a target of GH¢1,011.5 million.

Petroleum Revenue Receipts for the First Half 2014

Mr. Speaker, US$562.48 million was realised as total petroleum receipts in the first half of 2014. This consists of US$410.44 million lifting proceeds from the sixteenth to nineteenth liftings and US$152.04 million from other petroleum receipts such as corporate income tax, royalties, surface rentals. Of this amount, transfers to Ghana National Petroleum Corporation (GNPC) for Equity Financing Cost (US$33.72 million) and its share of the Net Carried and Participating Interest (US$78.73 million) amounted to US$112.45.

Mr. Speaker, The remaining balance of US$450.03 million was distributed between the Annual Budget Funding Amount (US$204.54 million) and the Ghana Petroleum Funds (US$245.49 million), in accordance with the provisions in the PRMA. Of the amount allocated to the Ghana Petroleum Funds, the Ghana Heritage Fund received US$73.65 million, while the Ghana Stabilisation Fund received US$171.84 million.

Developments in Public Debt

Mr. Speaker, provisional public debt stock as at end-May 2014 was GH¢62,861.72 million (US$21,661.52 million), representing 54.8 percent of GDP compared to the same period end-May 2013 of GH¢38,593.77 million (US$19,977.11). This is made up of GH¢34,331.22 million (US$11,830.19 million) and GH¢28,530.50 million (US$9,831.32 million) for external and domestic debt respectively.

Mr. Speaker, Ghana's total external debt stock stood at GH¢34,331.22 million (US$11,830.19 million) at the end May 2014 representing 29.93 percent of GDP and 54.61 percent of total public debt. The high Ghana Cedi equivalent of the end-May figure partly as a result of the depreciation of the Ghana Cedi. Similarly, the total domestic debt stock at GH¢28,530.50 million (US$9,831.32 million) at the end of May 2014 representing 24.87 percent of GDP and 45.39 percent of Total Public Debt. The low US Dollar equivalent of the end-May figure is as a result of the depreciation of the Ghana Cedi.

SECTION FOUR: STATUS OF IMPLEMENTATION OF KEY POLICY INITIATIVES AND MEASURES

Mr. Speaker, in presenting the 2014 Budget, we outlined a number of policy initiatives and fiscal measures aimed at:

resolving our short-term imbalances from the 2012 Budget over-runs; and

consolidating and sustaining our Lower Middle Income status.

These measures also prepare us for managing traditional volatilities and policy setbacks; and deal with the challenges of financing and accelerating our development. We hereby present an update on the implementation of these measures.

Addressing Ghana's International Reserves to Restore the Value of the Ghana Cedi

Mr. Speaker, there is no doubt that the Ghana Cedi has lost value in recent months. However, we are working to stabilise the value of our currency. There are a number of factors that have contributed to this phenomenon:

The loss of foreign exchange from the rapid fall in world commodity prices, especially gold and cocoa in the 2013 fiscal year;

The loss of foreign exchange from the sharp decline in grants from our Development Partners from 2012 to date;

Speculative activities of some Banks, Financial Institutions and foreign exchange bureaux that are allowed to retain foreign exchange; and

Our growing and insatiable appetite for the consumption of imported goods which is putting a strain on available foreign exchange reserves.

While this depreciation could be positive for exporters, its impact has to some extent affected fixed income earners, inflation, interest rates and economic activities.

Consequently, Government has, and will continue to design and implement appropriate responses including the following:

Continuing review and clarification of the Bank of Ghana foreign exchange measures to stop its unintended consequences, especially those that affect business confidence, and introduce further measures intended to boost the flow of foreign exchange into the economy;

Increasing the production of crude oil and gas to reduce the reliance on imported light crude oil for the generation of power, thereby reducing the demand for forex. This coupled with expected reversals in the low world commodity price of cocoa would improve the foreign exchange position of Government;

Enforcing H.E. the President's directive for all MDAs and MMDAs to patronize Made-in-Ghana products to preserve foreign exchange;

Addressing the annual seasonality of our foreign exchange inflows by effectively arranging the smooth use of our international reserves through interventions including swaps, especially for the period after the cocoa season;

Continuing with on-going discussions with the business community that is allowed to retain significant foreign exchange to channel those funds through the Bank of Ghana and our domestic banks;

Ensuring compliance with Customs import valuation which tends to undermine our tariff policies and makes imported goods cheaper in relation to domestic goods on our market;

Enforcing Government's directive for MDAs and MMDAs to award contracts only in Ghana Cedis.

At the same time, checking the illegal practice of dealing in forex transactions on a large and often speculative scale without licence; and

Implementing the directive of Cabinet to review our laws and generous incentive packages to make retentions commensurate with the risk associated with doing business

Mr. Speaker, these measures will assure Ghanaians, especially the business community, that we can manage rapid shortfalls in commodity prices; implement compliance and regulatory measures without affecting business confidence and foreign exchange flows; and use additional future flows of foreign exchange for investment, not consumption and wage payments.

Automatic Fuel Price Adjustment and Mitigating Measure

Mr. Speaker, the recent queues at the filling stations arising from delayed adjustments of fuel prices and speculations grossly affected business activities and caused a lot of personal discomfort for Ghanaians.

In the same vein, the recent significant ex-pump fuel price increase was equally disruptive for the average Ghanaian and as with similar past increases, affects the effective planning by the business community.

The implementation of a gradual and automatic adjustment to ex-pump fuel price within tolerable price bands and the establishment of an effective over/under recovery mechanism that will avoid wide swings in prices.

In addition, interventions in the areas of support for public and urban transportation will be pursued to ensure alternative options for the most vulnerable in society. In this regard, an estimated 450 buses are expected soon to contribute to this process.

Government will also review the fuel pricing structure and the method of assessing foreign exchange losses and subsidies to reduce the overall fiscal deficit.

Sustaining the New Pay Policy

Mr. Speaker, one of the major policy challenges to align the budget since 2010 is the implementation of the Single Spine Pay Policy (SSPP). Government is therefore implementing a number of initiatives to ensure the sustainability of the Single Spine Pay Policy towards our goal of achieving a wage to tax revenue ratio of 35 percent by 2017. These measures include:

Public Sector Wage Negotiations: Mr. Speaker, in line with the conclusions reached at the Ho Forum on the sustainability of the SSPP, wage adjustment for 2014 was moderated through the wage negotiation process resulting in the introduction of 10 percent Cost of Living Allowance (COLA) effective May 2014 to cushion workers. Government will work closely with Organised Labour and Employers' Associations towards the completion of the 2015 wage negotiations before the presentation of the 2015 Budget to Parliament.

Weaning off Sub-vented Agencies from Government payroll: As at June, 2014, the Sub-Committee on Sub-vented Agencies held preliminary meetings with eight (8) out of the twelve (12) identified Sub-vented Agencies to assess their capacities and readiness to be weaned-off Government subvention. The issues that are being considered include:

The need to amend laws that established the institutions;

Irregular review of fees, levies and charges on the goods and services they provide, which is preventing them from making sufficient income/revenue;

The need to complete on-going projects before weaning-off. These would require Government support.

Recruitment and Replacement: Government is also implementing the following measures on recruitment and replacement to control the wage bill:

enforcement of policy of institutions seeking financial clearance before recruitment and replacement of staff;

imposition of sanctions on heads of institutions who flout the policy on financial clearance;

payment of arrears of newly recruited staff not exceeding 3 months until auditing is done by the -General for the rest of accrued arrears;

justification of request for replacement of staff by MDAs/MMDAs at the Public Services Commission or the OHCS for initial approval, in addition to a final approval by the Ministry of Finance; and strict enforcement of expiry of financial clearance at the end of each year.

Market Premium: Mr. Speaker, in line with Section 3.5 of the Government's white paper on guidelines for the determination of Market Premium under the Single Spine Pay Policy, the Fair Wages and Salaries Commission is to determine Market Premium for the attraction and retention of critical but scarce skills in the Public Service within the budget constraints of relevant MDAs. To this end a labour market survey is being conducted to identify critical but scarce skills to form the basis for the determination of Market Premium for such skills. Consistent with Section 4.2 of the white paper, Market Premium shall not apply to all jobs within a particular service classification or be granted across board. The newly determined Market Premium shall come into force in 2015 at which stage the payment of interim Market Premium will cease.

Public Service-Wide Performance Management System: Mr. Speaker, the following activities have so far been completed under the Public service–wide performance management system at the end of June. These are a:

working document or blueprint to guide the roll out of the Public Service-Wide Performance Management Monitoring and Evaluation System;

policy document and proposal for sourcing funds;

performance management monitoring and evaluation instrument;

monitoring and evaluation framework; and

national roundtable conference on productivity.

Categories 2 and 3 Allowances: Mr. Speaker, the ongoing work on harmonization and standardisation of Categories 2 and 3 is at advanced stages. Consistent with the outcome of the Ho Forum on the sustainability of the Single Spine Pay Policy, government has indicated that the implementation of the recommendations by the PSJNC and its sub-committee on the subject matter will be subject to budget constraints.

National Research Facility: Mr. Speaker, in the 2014 Budget Statement and Economic Policy, Government indicated its decision to review the existing system of payment of Book and Research Allowance and replace it with a research and innovation facility with a seed funding of GH¢15 million, which has been created and funded. The Professor Mireku Gyimah Committee was mandated to make recommendations on the operationalisation and establishment of the National Research Facility. They have submitted their report and implementation will commence soon.

Human Resource Management Policy: Mr. Speaker, the Comprehensive Human Resource Management Policy Framework and Manual has been approved by Cabinet. Training of selected public service organizations for the policy framework and manual will begin in August 2014. Furthermore, the Human Resource Management Information System (HRMIS) is being implemented to strengthen controls around entrance, progression and exit of public service employees, link HR information to budget preparation and payroll processing.

Nine MDAs – Public Services Commission (PSC), Office of the Head of Civil service (OHCS), Local Government Service (LGS), Ghana Education Service (GES), Ghana Health Service (GHS), Ministry of Food and Agriculture (MoFA), Ghana Police Service and Ghana Prisons Service, which constitute about 80 percent of the total workforce in the public service, have been selected to pilot the project.

Payroll Upgrade: The upgrade of the IPPD2 payroll system has been completed and has been used to run the payroll from February 2014 to date. The upgraded IPPD2 has resulted in the correction of inherent errors in the old payroll calculations as well as distortions to individual monthly salaries.

Integration of Payroll: The upgraded payroll system has been integrated into GIFMIS. This will facilitate budgetary control over payroll costs. With this, heads of institutions now have direct responsibility for managing the payroll budget as they do for other items of expenditure.

Electronic Salary Payment Vouchers (ESPV): The ESPV system provides online access to heads of management units and human resource managers to approve staff to be paid for a particular month as well as the amounts to be paid to them. With the 24-hour access to the payroll data, the manager has adequate time to continuously review the payroll report. As at the end of June, the system had been deployed to 73.3 percent of management units in the Greater Accra Region. The validation of the June payroll of these management units has resulted in the deletion of 266 names and blocking for investigation of 2,531 staff. The total estimated payroll cost of the 2,797 staff is GH¢36.7 million per annum. Projecting this result to the entire mechanised payroll and discounting it by 40 percent generates an estimated savings of GH¢414 million per annum or GH¢172.5 million for the rest of the year.

Electronic Pay Slips System (E-pay slip): At the end of June 2014, about 385,000 government employees on the mechanised payroll representing 75 percent with a geographical coverage of 90 percent have registered on the E-Pay slip system. The verbal complaints by employees on salaries have minimized because the system provides information to employees as well as an avenue for channelling of complaints. Registration onto the system is ongoing and it is expected that all staff will be registered by the end of 2014.

Payroll Audit: Mr. Speaker, the Internal Audit Agency conducted a pilot audit on GES staff in the Shai Osudoku District of the Greater Accra Region. This exercise was to validate staff strength and determine whether adequate controls existed over the management of the payroll and personnel records to confirm payroll data. The audit has been completed and it was observed that 40 teachers representing 4.7 percent of the staff strength who were on the GOG payroll were neither on the nominal payroll of their management units nor sighted during the headcount. We have taken action to block the salaries of the 40 teachers whilst measures are being taken to expand the audit to cover other districts and also recover illegal payments.

Biometric Registration: Validation of the current Biometric database is in progress to isolate duplicate names. A total of 1,656 employees data have been identified as duplicates for further interrogation with an estimated payroll cost savings of about GH¢6.5 million. The biometric registration function will be merged with that of the National Identification Authority.

Implementation of Provisions and Review of the PRMA

Mr. Speaker, the approved downward revision of the 40 percent share of the Net Carried and Participating Interest to 30 percent has since been implemented. The retention of the 70 percent allocation of the benchmark revenue for ABFA and 30 percent of the Ghana Petroleum Funds (GPFs) has also been implemented.

The Ghana Stabilisation Fund has been capped at US$250 million consistent with Section 23(3) of the PRMA. As at May 2014, an excess of US$176 million had been realized. Out of this amount, US$16 million (GH¢50 million) was lodged into the newly established Contingency Fund and the difference of US$159 million is being used for debt repayment.

The legislative review of the Petroleum Revenue Management Act (PRMA) which may affect provisions related to the petroleum benchmark revenue and Public Interest and Accountability Committee (PIAC) membership, among others, is on-going and will be presented to Parliament shortly.

Resource Mobilization Initiatives

Mr. Speaker, a number of tax measures were introduced in the 2014 Budget. The status of implementation of these measures are as follows

A compliance exercise has started to compare customs data on importers with the domestic records of taxpayers. Additionally, GIFMIS systems data is being used to confirm the accuracy of withholding taxes deducted and paid by withholding agents to GRA. This data will also be used to review domestic tax obligations relating to filing and issuing of tax clearance certificates.

These assessments are based on revelations that include discrepancies between what taxpayers import and pay as import duties and the corresponding domestic tax payments. Also either withholding taxes deducted are not being paid to GRA or lower withholding tax rates are being used to calculate the payments. It is also clear that many taxpayers do not declare their TIN or the tax office code where they are registered.

Most tax defaulters invited have accepted their liabilities without objection and have started paying their liabilities. Within 2 weeks of the exercise GH¢6.8 million tax liability has been uncovered by the Medium Tax Offices and GH¢20 million from the Large Taxpayers Office.

All the statutory compliance and enforcement tools, including tax audits and investigations, are being employed in this exercise by GRA.

The Ministry of Finance has since directed the GRA that Tax Identification Numbers and tax office codes should form part of declarations made by taxpayer for external (import and export) and domestic tax transactions.

The Customs Division of GRA has put in place additional measures to enforce compliance. Among others, it has set up a task force to mount road blocks to detect and arrest vehicle owners who have not paid the correct taxes on the vehicles. GRA is collaborating with DVLA to detect fake vehicle registration. In that regard, a portal has been created for buyers to text to a short code to verify their vehicle's status. This exercise is important as revenue from taxes on vehicles form about 18 percent of customs revenue. In the first week of operation, 23 arrests and detention were made in Accra and 18 in Kumasi and Ho.

Special warehousing audits are being undertaken. Free zones audit will begin in August. These audits will emphasize on detection of misclassification, mis-description, wrong rates application, and under declaration of quantities and values of goods as well as verifying the tax liabilities of Free Zones enterprises in respect to their income tax, VAT/NHIL and other domestic taxes. Sanctions will be applied on affected importers/declarants. Post clearance monitoring has also been intensified.

To improve tax compliance, with the aim of achieving the revenue target for the year, technical assistance has been sought to use a consulting firm and an expert local technical group made up of former GRA staff, private tax experts, staff from the Tax Policy Unit of the Ministry of Finance among others to undertake Corporate Income Tax auditing and reconciliation, Pay As You Earn (PAYE) reconciliation and enforcement, VAT reconciliation and auditing and Customs Valuation and Examination.

Specifically, under the Customs Division of the GRA, the exercise will among others include:

valuation, with the aim of reducing undervaluation of imported goods and to confirm import prices, quality and quantities;

examination, to confirm the classification of imports for tax purposes. It will also help confirm quantity and quality of imports under valuation;

rationalization and review of the free zones regime to ensure activities of firms within the free zones align with regulations governing them;

enforcement of warehousing regime to ensure that goods taken into the warehouse are only released on payment of relevant taxes. There will be strict enforcement of accounting of goods stored in warehouse to track leakages of goods into the local market without payment of due taxes; and

development and application of systems to ensure goods in transit actually exit the country with sanctions applied for any infringement of the rules.

Mr. Speaker, under the Domestic Tax Revenue Division, activities will include:

support in reconciling the input-output relationship in the VAT mechanism throughout the import/manufacturing/wholesale and retail chain to enhance the audit process.

building capacity to ensure monthly withholding taxes by companies are reconciled and payments made on time.

support in corporate income tax auditing and reconciliation.

Public Debt Management

Mr. Speaker, the Debt Management Strategy that Cabinet and Parliament approved acknowledges our limited access to grants and concessional loans after attaining LMIC status. The measures outlined in the strategy are consistent with the anticipated rapid growth in our national output and will lead to higher per capita income in the next decade. In this regard, the strategy seeks, among others to:

establish an effective mechanism, through the Ghana Infrastructure Investment Fund (GIIF), to ensure repayment of loans and grants for commercially viable projects, notably those implemented by State-Owned Enterprises (SOEs).

support the GIIF with an allocation from the ABFA to leverage the capital markets for infrastructure development.

channel grants and concessional loans to finance social infrastructure projects;

channel commercial loans to finance commercially viable projects—with on-lending and escrow mechanisms to ensure their recovery; and

restructure expensive short-term and high-interest bearing debt, including domestic debt with hybrid holdings by extending their repayment period and/or lower interest costs.

Ghana Infrastructure Investment Fund (GIIF)

Mr. Speaker, government has started the process of setting up the Ghana Infrastructure Investment Fund (GIIF)—originally proposed as Ghana Infrastructure Fund (GIF) in the 2014 Budget. The purposes include the treatment of commercial projects on capital market basis, with recovery mechanisms that will lead to classifying elements of the Public Debt guaranteed by Government as Contingent Liability.

Mr. Speaker, we are pleased to note that we are making significant progress on this important initiative, with support from this august House with respect to the consideration of the GIIF Bill. Immediately upon passage, Government will put the necessary institutional structures in place to make the Fund operational.

Self-Financing and On-Lending policies

Mr. Speaker, an important element of the Government's New Debt Management Strategy is to recover loans that are used to support commercial projects (or projects that have underlying fees and charges). To date the Ministry of Finance has undertaken the following actions:

consultation with the Attorney General's Department, which has since advised that such loans should be approved by Parliament, unless otherwise stated;

completed the drafting of a standard On-lending Agreement for use by all MDAs and MMDAs;

prepared Guidelines on Escrow and Debt Service Account arrangements, with the CAGD advising BOG to open local currency and foreign exchange (US$) Debt Service Accounts; and

organization of meetings with State-owned Enterprises (SOES) on the concept and starting a reconciliation exercise with these entities: to be followed by meetings with MDAs and MMDAs.

Mr Speaker, when operational, the process will link conceptually to the GIIF mechanism for all commercial projects—through a revolving fund that can be used to do more projects and alleviate the burden of quasi-public debt on the Budget and taxpayers.

Debt Refinancing and Financing the Capital Budget

Mr Speaker, as noted in the 2014 Budget, a major feature of our Public Debt is their relative short-term nature and high-interest cost. To address this situation, government proposes to use a portion of the 2014 Sovereign Bond to refinance existing short-term domestic debt.

Mr. Speaker, following approvals by Parliament and the completion of other procurement processes, the Ministry of Finance has appointed local and foreign experts to assist with the 2014 Bond issue. The advice of the experts will determine the exact period for conducting “road shows” and floating the bond.

Managing Foreign Exchange Losses

Mr. Speaker, as part of the debt management policy approved by this House, government set up a foreign currency debt service account to minimize exposures to foreign exchange risks and potential default risks. Government has directed all MDAs/MMDAs to issue contracts and undertake transactions using the local currency, the Ghana Cedi. In cases where this is not possible, approval will have to be sought from the Ministry of Finance.

Public Investment Programme and Public Private Partnership

A policy and law on Public Investment Management to provide appropriate legislative framework to guide the delivery and management of public investment have been developed and will be submitted to Cabinet shortly.

A Bill to regulate Public Private Partnership (PPP) has been submitted to cabinet for approval and subsequent submission to Parliament.

Boost for SMEs, Stimulus for the Private Sector and Support to Local Industries

Mr. Speaker, Export Development and Agricultural Industrial Fund (EDAIF) has allocated a financial stimulus package for exports, pharmaceuticals, poultry, textiles and garments, SMEs and agro processing sectors to enhance their competitiveness for growth and job creation. During the period under review, 5 pharmaceutical companies that produce essential drugs were identified under this programme and so far, one application has been approved for funding. The other 4 applications are under consideration and funding will be approved shortly. The Ghana Cedi equivalent of US$10 million and GH¢9.7 million has been earmarked to facilitate the stimulus package for the Pharmaceuticals and poultry industries, respectively. An amount of GH¢10 million has also been set aside by EDAIF for the Youth Entrepreneurial Development Programme.

Funding has also been released by EDAIF to Irrigation Development Authority (IDA) for preliminary works to expand irrigation facilities for selected and other export crops in areas such as Tanoso, Nasia/Ligba, Okyereko, Tamne, Kamba, Sabare, Keta, Ho (Kpeve) Kpli, Amate and Mprumen to support small holder farmers. EDAIF is also supporting local rice production and has allocated GH¢20 million as part of measures to reduce rice imports. One thousand small scale farmers in Bawjiase and Nsawam will be supported to increase production.

Financial Sector Reforms

Mr. Speaker, Government is currently preparing SOE's for the capital market to enable them access affordable medium to long-term financing. Apart from education and awareness of potential SOEs, government is working with Development Partners to provide rating services for SOEs. The draft ToR has been developed to procure a consultant to assist with the study of the SOE sector to inform a technical support.

H.E. the President engaged Stakeholders in the Mortgage Finance Sector in response to the Housing initiative indicated in the State of the Nation's address. He has directed the Chairman of the Ghana Association of Bankers to submit a paper on innovative housing financing products to help address the country's housing deficit of approximately 1.2 million. In addition, government is developing a Ghana Housing Finance Initiative (GHFI) which seeks to increase housing supply and develop affordable loan products.

Banking Sector Reforms

Mr. Speaker, with the view to consolidating the Banking Act and its related amendments, strengthen the framework for consolidated supervision and address gaps in the Act, the Bank of Ghana has prepared the Banks and Special Deposit-Taking Institution Bill. In addition, Bank of Ghana has prepared the Ghana Deposit Protection Bill which seeks to boost the confidence and trust of financial consumers. The Bills are currently under consideration for submission to Cabinet.

Social Intervention Initiatives

Mr. Speaker, the process for the construction of 200 new Community Day Senior High Schools is in progress. The contract of the first batch of 50 schools has been awarded. Cabinet and Parliament have approved a loan to finance the construction of additional 23 Senior High schools and upgrade facilities in another 125 Senior High schools. These projects are expected to improve the quality in secondary education. Under the secondary education improvement project about 10,400 students will also receive special scholarships.

Mr. Speaker, government will support 5,651,342 pupils with Capitation Grants and 500,000 pupils will receive free school uniforms this year. Government will also continue to subsidise the Basic Education Certificate Examination (BECE) and the West African Senior Secondary Certificate Examination (WASSCE).

Mr. Speaker, the Bill on the proposed public university in the Eastern Region will soon be laid before this august House.

Right Honourable Speaker, on 10th June this year in Geneva, Switzerland, Ghana was recognized by the International Telecommunication Union (ITU) and given the 2014 World Summit on the Information Society (WSIS) PROJECT PRIZE AWARD in Rural Telephony. Our rural telephony project targets underprivileged and deprived Ghanaian communities with population of less than two thousand people. The latest community to benefit from this intervention was Tuluwe in the Northern region. The following towns are the next in line to benefit from the rural telephony project – Drobonso, Mafia, Boinzan, Agyemadiem, Wansapo, Kwasi Fanti, Aidoo Suazo, Essase, Sekesua, Akarteng among others.

As part of this year's celebration of Girls in ICT Day which is aimed at empowering disadvantaged girls to adopt ICT as a major tool for development, series of activities involving hands-on ICT workshops to encourage the study of technology-related disciplines were held at various Community Information Centres (CICs) in the Eastern Region. 411 girls have so far benefitted from the training and sensitization workshops being conducted at the Community Information Centres. In 2013, 16 more Community Information Centres in Tepa, Kuntanase, Mehame, Mpohor Wassa, Half Assini, Yagaba, Damongo, Zebilla, Hlefi, Dzodze, Tegbi, Akatsi, Mepe etc were completed. This year, funds have been made available for the construction of 21 more Community Information Centres. The beneficiary towns include, Effiduase, Asuogyaman, Twifo Atti Morkwa, Bodi, Ngleshie Amanfro, Pantang, Keta, Battor, Drobonso, Sagnarigu, Nalerigu, Talensi, Pusiga, Lambussie, Wellembelle, Nandom, etc.

The dilapidated PWD warehouses near Kwame Nkrumah Circle are being converted into Business Process Outsourcing Grade A facility with 'Plug and Play' features for prospective investors and employees. The project when fully operational is estimated to generate 10,000 direct and indirect jobs.

The 780km Eastern Corridor optic fiber project to provide broadband infrastructure for over 120 towns and communiti

April 20: Cedi sells at GHS13.63 to $1, GHS13.06 on BoG interbank

April 20: Cedi sells at GHS13.63 to $1, GHS13.06 on BoG interbank

Dumsor: I'm very disappointed in you for messing up the energy sector — Kofi Asa...

Dumsor: I'm very disappointed in you for messing up the energy sector — Kofi Asa...

Dumsor: Instruct ECG MD to issue timetable and fire him for lying — Kofi Asare t...

Dumsor: Instruct ECG MD to issue timetable and fire him for lying — Kofi Asare t...

Ashanti region: Road Minister cuts sod for 24km Pakyi No.2 to Antoakrom road con...

Ashanti region: Road Minister cuts sod for 24km Pakyi No.2 to Antoakrom road con...

Train crash: ‘How could any normal person leave a car on rail tracks?’ — Frankli...

Train crash: ‘How could any normal person leave a car on rail tracks?’ — Frankli...

Train crash: Driver of abandoned vehicle not our branch chairman nor secretary —...

Train crash: Driver of abandoned vehicle not our branch chairman nor secretary —...

Kenya pays military homage to army chief killed in copter crash

Kenya pays military homage to army chief killed in copter crash

US agrees to pull troops from key drone host Niger: officials

US agrees to pull troops from key drone host Niger: officials

Mahama vows to scrap teacher licensure exams, review Free SHS policy

Mahama vows to scrap teacher licensure exams, review Free SHS policy

Government will replace burnt Madina shops with a new three-story, 120-store fac...

Government will replace burnt Madina shops with a new three-story, 120-store fac...