Everywhere looks white, Agyaaku. It snowed in the night. My eyes got fixed on the plants lined up in the window across where I sit, as I took a break from what I am doing on my computer. Admiring these lovely plants, I intermittently look at the miniature drum below the plants, and the snow outside. This took my mind off the music I am listening to, until one track came in with its catchy line. I could not help but to concentrate on the song. It reminded me of the current budget statement presented by our finance minister a couple of weeks ago.

Nana as you are well aware, the budget has generated a lot of discourse in our beloved motherland. Most of these discussions have been about introduction of new taxes and abolishment of some tolls. The rate at which the new tax has been pegged is also in question. But frankly, I am a supporter of taxes. I prefer taxing the current generation to develop our country, to borrowing for development. We should do well to bequeath the next generation with assets not liabilities. They should not be made to swim in oceans of legacy debts; hence my affinity to taxes.

You smiled, Agyaaku. The seed you planted in us about doing well for our next generation has yielded good results. I must say the Amanone I live now, and the high taxes paid here has fertilized what you planted in me. But Nana, that is not exactly what I am writing you about. I am not writing you about the generation aspect of the taxes, but the reporting of it. So you guessed right, Agyaaku: I was listening to the song ‘Taxman’ by L.P. Dube. It is incredible how Mr Dube could sing to touch almost all spheres of our society, is it not?

The line that caught my attention in ‘Taxman’, Agyaaku, was “I wanna know where the money goes!” As you are aware, Nana, taxes are collected from every part of the country, and rightly so. Every region of our dear republic contributes its share to the domestic revenue through taxes. But it looks like reporting it has become problematic.

Nana, before this year’s budget presentation I have heard of how poor other regions contribute to our domestic tax. That was some full moons ago. I learnt it came about as a result of some regions calling for their fair share of development. To them, most landmark infrastructural developments are concentrated in the capital city, and its region. And the speed at which they are executed is way beyond the tortoise-paced execution of infrastructural projects in other regions. Then bang, they were told they do not contribute much in terms of domestic revenue to the national coffers. I doubted this rebuttal or assertion knowing very well how statements can be manufactured, twisted or spun on the social media high street. But alas! I was proven wrong.

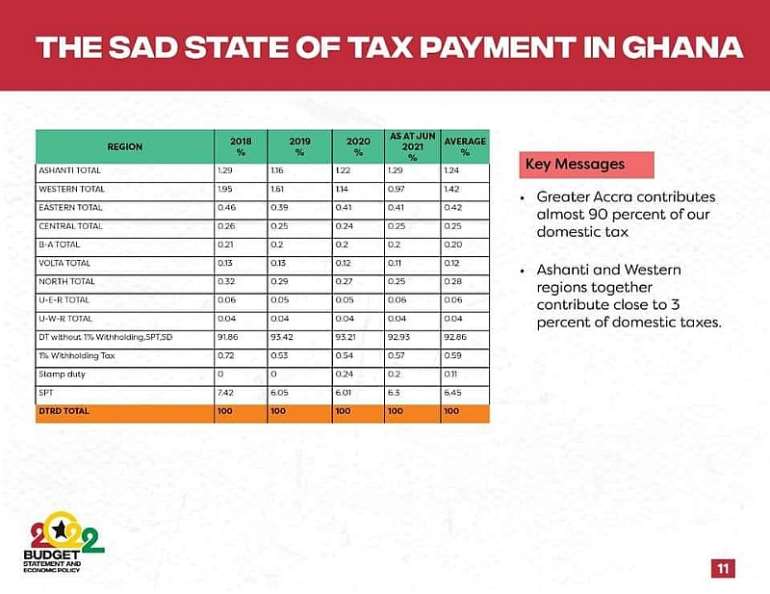

In the 2022 Budget Statement & Economic Policy presented to parliament by the sector minister, it is stated that Greater Accra Region contributes about 90% of our domestic tax revenue. As soon as I saw this, Agyaaku, I asked myself ‘how is that possible? There must be something wrong somewhere.’ Nana, remember that we are talking about domestic taxes here. These are mainly income taxes and NHI levies as well as some VAT and other corporate taxes. Of course import and export VAT are excluded from this.

Agyaaku, one do not need to be an economist, tax expert, auditor or similar to notice that the assertion above on regional contribution to domestic taxes is flawed. Our system of governance and administration will tell you this. Nana let us take income tax as an example. Every public sector employee has their income tax deducted and paid in Accra. So you may be an Agricultural Extension Agent (AEA) working at Ohiamadwen in Western Region, but your taxes will be paid in Accra, not Shama or Takoradi. The District Director of Education for Shama District and all teachers in that district have their income tax deducted and paid in Accra, and recorded under Greater Accra Region. The scenario affects all public sector workers across the country: doctors, police, military, nurses, etc. The income taxes of all these are captured under the account of Greater Accra region, even though they may be working in the Upper East, Eastern, Volta or Bono regions. Surprised, Agyaaku? Well, that is not all.

Consider our parliamentarians, Nana. There are 275 of them. All of the income taxes of these 275 MPs are paid and captured under Greater Accra Region (which has 34 MPs). Their income tax contributions are not captured under their respective districts or regions; they are captured under Greater Accra Region. The same goes for other high earners in our republic: ministers, judges, presidential staffers, state bankers, etc. So why will the Greater Accra Region not end up contributing about 90% of our domestic taxes, Agyaaku?

You may think this is all. But no, it is not! In the private sector, most institutions are also having this same centralised system like the state has. Thus they pay their employees’ income tax in Accra, where their headquarters are. Mention can be made of the telecom companies, the numerous banks, media enterprises, and even some churches. Their workers income taxes are deducted and paid in Accra, under the Greater Accra Region even though most of these workers are working in branches located in other regions. This bloats the contribution of Greater Accra region, while depriving the other regions of their true contributions to the domestic tax.

So, Nana, to paraphrase the title of the slide of the Honourable Minister of Finance’s presentation, this is THE SAD STATE OF TAX REPORTING IN GHANA. Something must change from this way of reporting our domestic taxes by regions. It is too kwashiorkorish and an insult to the other regions. And, Agyaaku, I have been wondering why none of the MPs representing the people of the various regions did not raise, and has not raised an objection to this sad way of our tax reporting. Are they really representing the people and regions that voted for them to be there? Not in this case, surely. They should wake up, for their respective regions want to know where their monies go. Their regions want to know where the taxes of their MPs and the people working in these regions are recorded.

I will take leave of you, Agyaaku, with the hope that this way of reporting our domestic tax will not repeat itself in the future. It is too loud to be silent about in its current shape and form. And while waiting, I will keep listening to Mr Dube’s Taxman.

Mɛsan aba biem!!!

Source: 2022 Budget Statement

Source: 2022 Budget Statement

Written by: Clement Boateng

( www.clemboatconsult.com )

Email: [email protected]

Saglemi Housing Project will not be left to rot – Kojo Oppong Nkrumah

Saglemi Housing Project will not be left to rot – Kojo Oppong Nkrumah

Transport fares hike: GPRTU issue two-day ultimatum

Transport fares hike: GPRTU issue two-day ultimatum

ARC endorses Alan as presidential candidate – Buaben Asamoa

ARC endorses Alan as presidential candidate – Buaben Asamoa

Akufo-Addo appoints Kwasi Agyei as new Controller and Accountant-General

Akufo-Addo appoints Kwasi Agyei as new Controller and Accountant-General

PNC dismiss reports of mass resignations

PNC dismiss reports of mass resignations

PAC advocates for revenue collectors to be engaged on commission basis, not full...

PAC advocates for revenue collectors to be engaged on commission basis, not full...

Genser Energy commissions 110km of natural gas pipeline at Anwomaso

Genser Energy commissions 110km of natural gas pipeline at Anwomaso

Naa Torshie calls for tolerance, peace ahead of 2024 election

Naa Torshie calls for tolerance, peace ahead of 2024 election

Asantehene commends Matthew Opoku Prempeh for conceiving GENSER Kumasi Pipeline ...

Asantehene commends Matthew Opoku Prempeh for conceiving GENSER Kumasi Pipeline ...

Let’s do away with ‘slash and burn politics’ in Ghana — Dr Adutwum

Let’s do away with ‘slash and burn politics’ in Ghana — Dr Adutwum