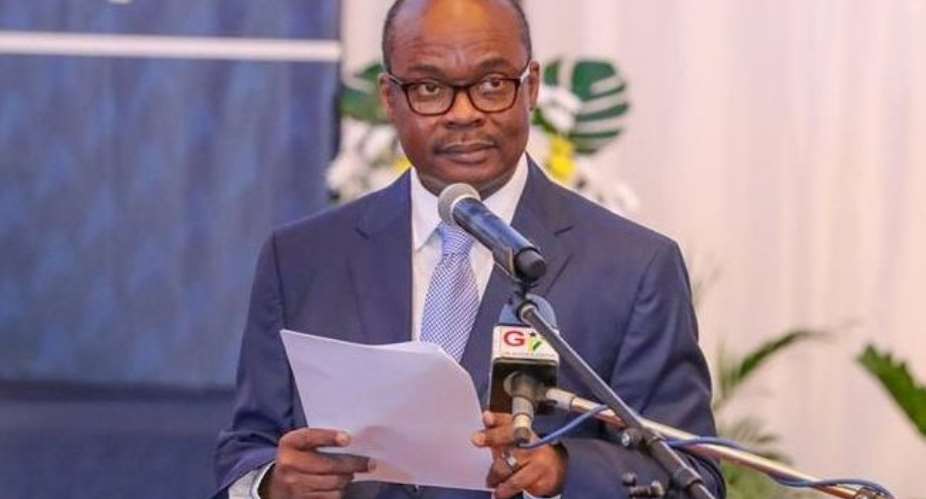

Governor of the Bank of Ghana, Dr. Ernest Addison, has stated that the recent 3rd quarter contraction of the economy is in line with the Central Bank's economic recovery projection.

His comments come on the back of new data from the Ghana Statistical Service indicating that the Ghanaian economy has contracted for the second straight quarter, with the value of goods and services produced in the 3rd quarter of 2020 declining by 1.1 percent when compared to the value of goods and services produced in the same period in 2019.

Speaking at the University of Ghana Alumni lecture on the theme, “Pandemic, The Economy and Outlook”, Dr. Addison said that the rebound can be attributed to the evidence of some green shoots in economic activity garnered from the Bank of Ghana's survey on consumer confidence which had bounced back to pre-lockdown levels as consumers responded positively to the steady lifting of restrictions.

“Just yesterday, the Ghana Statistical Service put out an estimate of the third-quarter GDP growth suggesting that the economy contracted by 1.1 percent during the third quarter. It must be pointed out that this is consistent with the rebound view as the economy has recovered from a contraction of 3.1 percent to 1.1 percent during the quarter.

Recent report from the International Growth Centre (IGC) corroborates this view as employment rates and hours worked per adult which fell substantially in March and April have largely reverted to its pre-Covid levels in August and September. Headline inflation also eased to single digits at 9.8 percent in November,” he said.

He also stated that business confidence has also improved although the Index remained below pre-lockdown levels. Our latest high-frequency economic indicators, such as consumer spending, industrial consumption of electricity, and construction activities have all reached pre-lockdown levels.

With respect to the financial sector, Dr. Addison noted that the banking sector remains liquid and well-positioned to support growth, benefitting significantly from the recent reforms.

“To a large extent, the policy interventions have also helped improve the soundness of the banking sector and reduced the potential adverse spillback effects that the banking sector may have had on the macro-financial landscape. The sector remains robust as reflected by the strong Financial Soundness Indicators – Capital adequacy levels are above the regulatory limits, the NPL ratio has declined, and profitability remains strong.”

On the impact of covid-19 on the sector, he said findings revealed that, overall, the banking sector is robust and largely resilient to the pandemic-related shocks, adding, tail risks arising from the changing macroeconomics landscape has had a moderate effect and the banking sector soundness index has improved from the pre-pandemic levels.

---citinewsroom

We’ll no longer tolerate your empty, unwarranted attacks – TUC blasts Prof Adei

We’ll no longer tolerate your empty, unwarranted attacks – TUC blasts Prof Adei

Bawumia donates GHc200,000 to support Madina fire victims

Bawumia donates GHc200,000 to support Madina fire victims

IMF to disburse US$360million third tranche to Ghana without creditors MoU

IMF to disburse US$360million third tranche to Ghana without creditors MoU

Truck owner share insights into train collision incident

Truck owner share insights into train collision incident

Paramount chief of Bassare Traditional Area passes on

Paramount chief of Bassare Traditional Area passes on

Two teachers in court over alleged illegal possession of BECE papers

Two teachers in court over alleged illegal possession of BECE papers

Sunyani: Victim allegedly shot by traditional warriors appeals for justice

Sunyani: Victim allegedly shot by traditional warriors appeals for justice

Mahama vows to scrap teacher licensure exams, review Free SHS policy

Mahama vows to scrap teacher licensure exams, review Free SHS policy

Government will replace burnt Madina shops with a new three-story, 120-store fac...

Government will replace burnt Madina shops with a new three-story, 120-store fac...