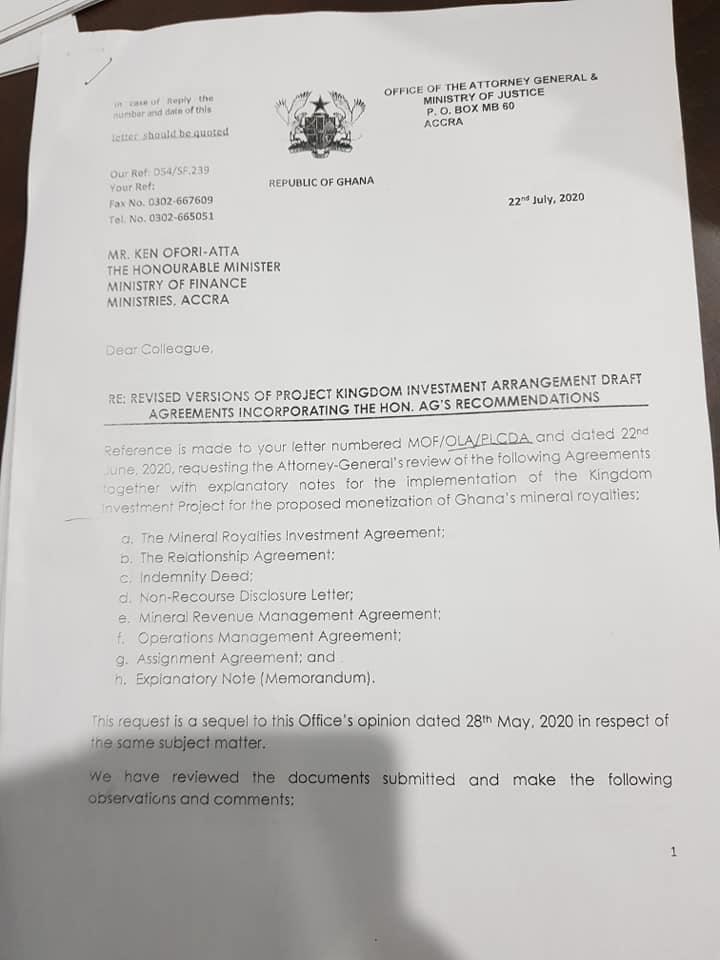

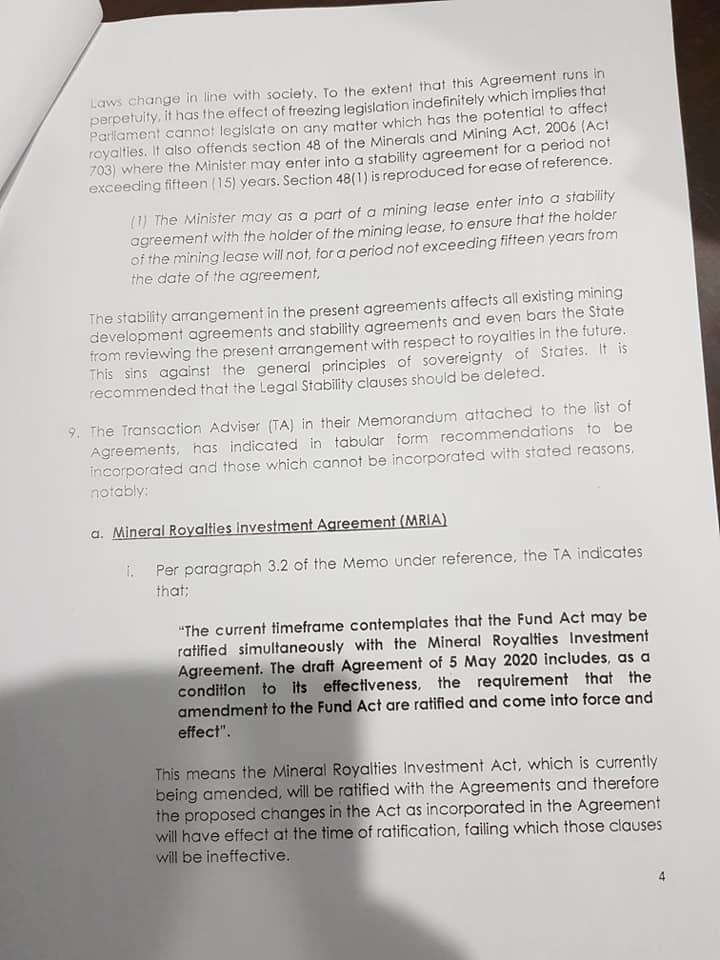

The Attorney General and Minister of Justice, Gloria Akufo, has reportedly raised red flags about the Agyapa Royalties deal saying the arrangement clearly sins against the general principle of sovereignty of the state.

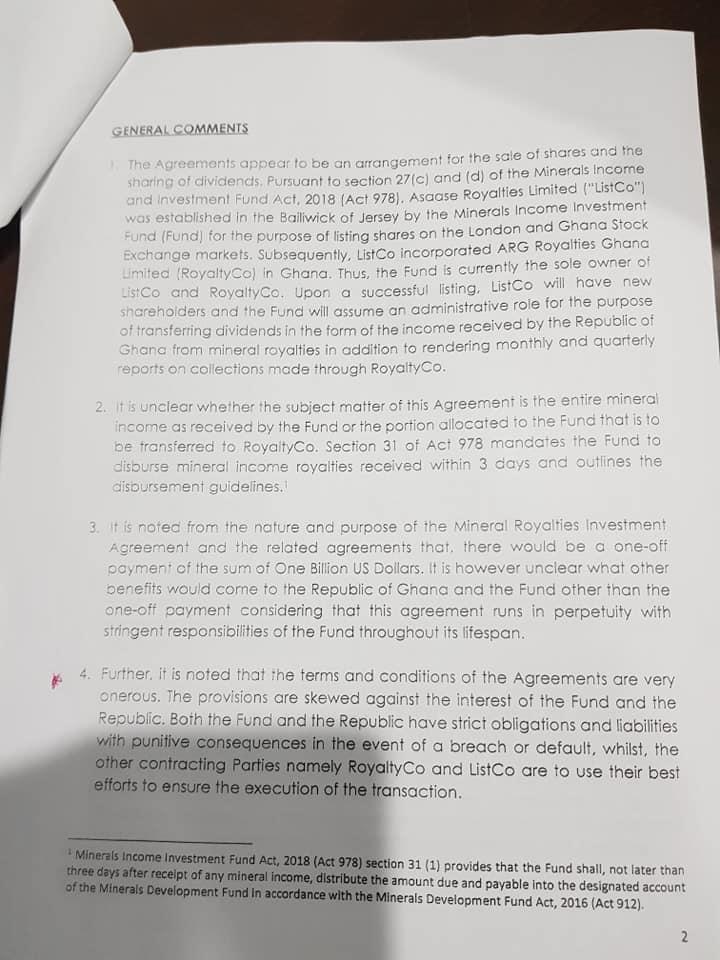

She described the inability of the state to review or evaluate the effectiveness of the Agyapa Royalties deal in future as “unconscionable”.

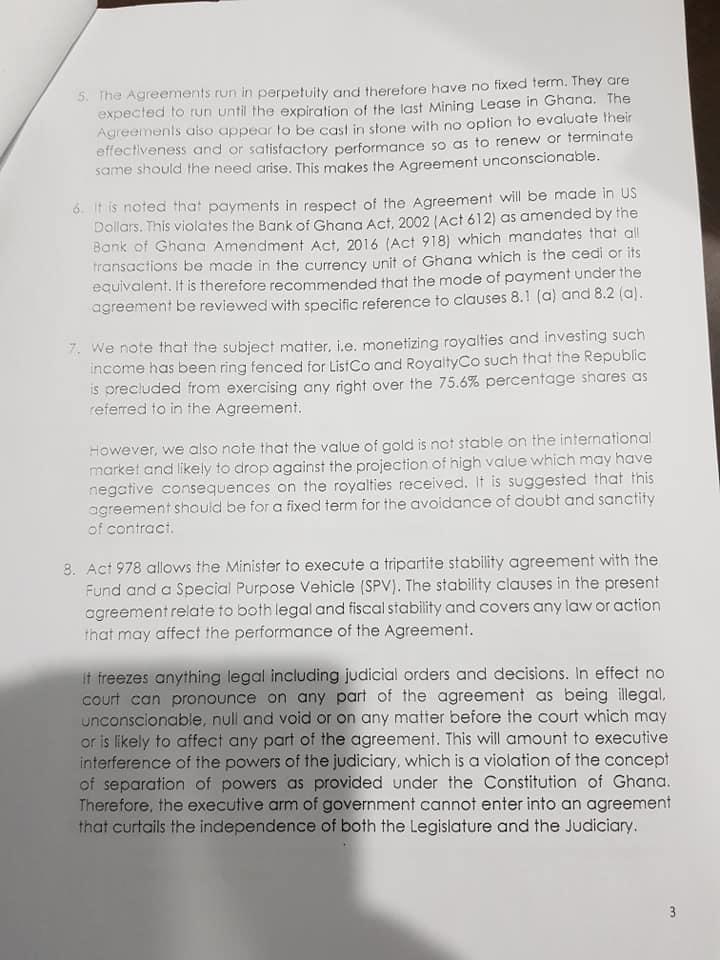

“The stability arrangement in the present agreements affects all existing mining development agreement and stability agreement and even bars the state from reviewing the present agreement with respect to royalties in the future,” the AG said in an opinion on the deal to the Finance Minister.

In a leaked letter in the possession of Kasapafmonline.com, the Attorney General also indicated that the deal violates the Bank of Ghana Act, 2016 (Act 918) which mandates that transactions be made in the currency unit of Ghana which is the cedi or its equivalent, as payments in respect of the agreement is quoted in US Dollars.

Leaked letter

There has been a hue and cry over the Agyapa Royalty deal by a section of the public including the Minority in Parliament who have questioned the credibility of the agreement calling for withdrawal of the deal.

Also, some 15 Civil Society Organisations on Tuesday held a press conference to kick against the deal.

At the conference, the CSOs made an emphatic demand for a suspension of the deal until all documents relating to the beneficial owners of the deal are disclosed.

About the Agyapa deal

Parliament August 14th approved the controversial Agyapa Mineral Royalty Limited agreement with the government of Ghana despite a walkout by the Minority.

Two years ago, the House passed the Minerals Income Investment Fund Act 2018 which establishes the Fund to manage the equity interests of Ghana in mining companies, and receive royalties on behalf of government.

The fund is supposed to manage and invest these royalties and revenue from equities for higher returns for the benefit of the country.

The law allows the fund to establish Special Purpose Vehicles (SPVs) to use for the appropriate investments. Last month, government introduced an amendment to the act to ensure that the SPVs have unfettered independence.

The approval will enable the country to use a special purpose vehicle, Agyapa Royalties Limited to secure about $1 billion to finance large infrastructural projects.

In line with that, Agyapa, which will operate as an independent private sector entity, will be able to raise funds from the capital market, both locally and internationally, as an alternative to the conventional debt capital market transactions.

The funds, which are expected to be raised from the Ghana Stock Exchange (GSE) and the London Stock Exchange (LSE), will be a long-term capital, without a corresponding increase in Ghana’s total debt stock and hence without a public debt repayment obligation.

---kasapafmonline

Tuesday’s downpour destroys ceiling of Circuit Court '8' in Accra

Tuesday’s downpour destroys ceiling of Circuit Court '8' in Accra

SOEs shouldn't compromise on ethical standards, accountability – Akufo-Addo

SOEs shouldn't compromise on ethical standards, accountability – Akufo-Addo

Father of 2-year-old boy attacked by dog appeals for financial support

Father of 2-year-old boy attacked by dog appeals for financial support

Jubilee House National Security Operative allegedly swindles businessman over sa...

Jubilee House National Security Operative allegedly swindles businessman over sa...

Nobody can order dumsor timetable except Energy Minister – Osafo-Maafo

Nobody can order dumsor timetable except Energy Minister – Osafo-Maafo

Mahama wishes National Chief Imam as he clock 105 years today

Mahama wishes National Chief Imam as he clock 105 years today

J.B.Danquah Adu’s murder trial: Case adjourned to April 29

J.B.Danquah Adu’s murder trial: Case adjourned to April 29

High Court issues arrest warrant for former MASLOC Boss

High Court issues arrest warrant for former MASLOC Boss

Align academic curriculum with industry needs — Stanbic Bank Ghana CEO advocates

Align academic curriculum with industry needs — Stanbic Bank Ghana CEO advocates

Election 2024: We'll declare the results and let Ghanaians know we've won - Manh...

Election 2024: We'll declare the results and let Ghanaians know we've won - Manh...