The government has been hit in the face to stop borrowing since the ordinary Ghanaians are not feeling the impact of the huge sums of monies borrowed already by the government.

Critics have argued that, government’s borrowing has rather exerted hardship on Ghanaians. They explain that, the high debt of Ghana has resulted in high interest rate on loans, rising inflation, and high cost of living.

According figures presented by the Minister of Finance to Parliament fortnight ago, Ghana’s public debt stock has grown by a whopping GH¢ 70 billion representing a 200 per cent increase in the last four years.

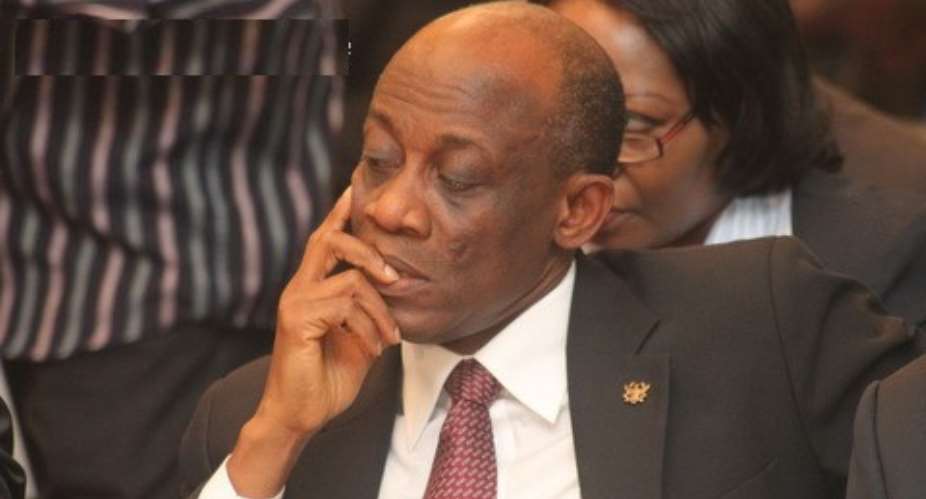

According to information available as confirmed by the Minister of Finance, Mr Seth Terkper recently in parliament, Ghana’s total public debt moved from GH¢35.1 billion in 2012 to GH¢ 105 billon in March 2016.

The debt stock as at December 2015 stood at GHC100billion, equivalent to 72.9 percent of GDP, according to the Ministry of Finance.

Also, government sources indicate that only GH¢5 billion was added to the debt stock within the first three months of 2016.

Apparently, one of the critics, who is a Member of Parliament (MP) for Obuasi West, Kwaku Kwarteng has indicated that government’s penchant for borrowing will only impose hardship on the poor and make it difficult for businesses to thrive.

Mr Kwarteng comments follows recent request by Finance Minister Seth Terkper to Parliament to approve an additional GHC1.89 billion for government.

“Where will this additional money come from? Government says that the money will come from the energy sector levies. But that will still not be enough so they will go and borrow to make up the difference.

He said “in spite of all these, there is no assurance in the supplementary budget as to when the erratic power supply will end so that businesses can operate smoothly and create jobs.”

There is no assurance that the high electricity tariff would go down, there is no assurance that lending rates will come down so that businesses can borrow and expand to create jobs. There is no assurance that cost of living will go down. There is nothing!”

However, in spite of concerns about government’s borrowing spree, Mr Terkper maintains it has been able to slow down debt accumulation.

“We are proud to note that, for the first time since the declaration of HIPC in 2001, we were able to first, slow down the rate of growth of debt accumulation between 2014 and 2015,” he told Parliament on Monday.

He is confident debt management strategies will help reduce the debt level substantially.

But, the Institute for Fiscal Studies (IFS) maintains that the huge surge in the country’s public debt stock is attributable to the large fiscal deficits registered over the years, which were financed by funds borrowed from both domestic and foreign sources.

Executive Director of the Institute, Prof Newman Kusi recalled that Ghana in 2014 continued to face a moderate risk of debt distress, although the overall debt vulnerabilities increased, and the country’s debt service-to-revenue ratio was approaching high-risk levels.

“Driven by loose fiscal policy, deteriorating financing terms and external pressures, several of the country’s domestic and external debt indicators also deteriorated; total public debt service-to-revenue ratio was not only on a rapidly increasing path but had breached its indicative long term threshold,” he pointed out.

Commenting on the issue, Economist at the University of Ghana, Legon, Dr Eric Osei Assibey described Ghana’s debt situation as a very difficult one, “particularly looking at the precarious nature of government’s financing needs.”

According to him, “It’s worrying because it is obvious that the economy is not doing well; businesses are suffering; energy challenges remain unresolved and so if the productive sectors are not working there is no way we can generate enough revenue to support developmental projects.”

Government must realise it cannot spend what it doesn’t have and must reduce its expenditure to conform to its revenue generation; this is the easiest way of avoiding a debt overhang.

Dr Assibey reminded government “you cannot say you are pursing fiscal consolidation and still maintain loose expenditure levels, particularly when your revenues are low.”

He warned against government’s resort to increasing taxes in a bid to rake in more revenue, noting that “frequent increment in taxes is itself inimical to the performance of the economy because high tax revenue has been shown to stifle economic growth as it increases tax avoidance, evasion and fraud.”

The economist reminded government that Ghana’s deal with the IMF spelt out clearly that government’s expenditures should be limited to priority areas of the economy.

There’s nothing you can do for us; just give us electricity to save our collapsi...

There’s nothing you can do for us; just give us electricity to save our collapsi...

Ghanaian media failing in watchdog duties — Sulemana Braimah

Ghanaian media failing in watchdog duties — Sulemana Braimah

On any scale, Mahama can't match Bawumia — NPP Youth Organiser

On any scale, Mahama can't match Bawumia — NPP Youth Organiser

Never tag me as an NPP pastor; I'm 'pained' the 'Akyem Mafia' are still in charg...

Never tag me as an NPP pastor; I'm 'pained' the 'Akyem Mafia' are still in charg...

Your refusal to dedicate a project to Atta Mills means you never loved him — Kok...

Your refusal to dedicate a project to Atta Mills means you never loved him — Kok...

2024 elections: I'm competent, not just a dreamer; vote for me — Alan

2024 elections: I'm competent, not just a dreamer; vote for me — Alan

2024 elections: Forget NPP, NDC; I've the Holy Spirit backing me and nothing wil...

2024 elections: Forget NPP, NDC; I've the Holy Spirit backing me and nothing wil...

2024 elections: We've no trust in judiciary; we'll ensure ballots are well secur...

2024 elections: We've no trust in judiciary; we'll ensure ballots are well secur...

Performance tracker: Fire MCEs, DCEs who document Mahama's projects; they're not...

Performance tracker: Fire MCEs, DCEs who document Mahama's projects; they're not...

Train crash: Railway ministry shares footage of incident

Train crash: Railway ministry shares footage of incident