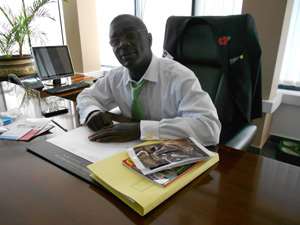

Prince Kofi Amoabeng

Prince Kofi Amoabeng, Chief Executive Officer (CEO) of UT Bank, has disclosed that the bank achieved 40 percent growth in its net interest income last year.

He said the achievement was as a result of the growth of the bank's loan book.

Speaking at the Annual General Meeting (AGM) of the bank in Accra, Mr. Amoabeng said 'the growth in our net interest income remained strong year-on-year, rising by 40 percent to GH¢188 million mainly as a result of the growth in our loan books'.

He said non-funded income growth was equally impressive as it grew by 23 percent to GH¢53 million in the year under review.

Explaining further, Mr. Amoabeng intimated that the bank continued to invest towards the improvement of its e-business platforms in order to enrich customer service offering.

He disclosed that UT completed its migration to the VISA platform and now offers customers a wide range of products including debit, prepaid and Youth Cards.

Joseph Nsonamoah, Chairman of the Board, in a message read on his behalf, said in spite of the challenges in the macro-economic environment, which negatively impacted on the bank's financial performance, UT remains resolute in its efforts to achieve its long-term vision of redefining banking.

By Jeffrey De-Graft Johnson

Former Kotoko Player George Asare elected SRC President at PUG Law Faculty

Former Kotoko Player George Asare elected SRC President at PUG Law Faculty

2024 elections: Consider ‘dumsor’ when casting your votes; NPP deserves less — P...

2024 elections: Consider ‘dumsor’ when casting your votes; NPP deserves less — P...

You have no grounds to call Mahama incompetent; you’ve failed — Prof. Marfo blas...

You have no grounds to call Mahama incompetent; you’ve failed — Prof. Marfo blas...

2024 elections: NPP creates better policies for people like us; we’ll vote for B...

2024 elections: NPP creates better policies for people like us; we’ll vote for B...

Don’t exchange your life for wealth; a sparkle of fire can be your end — Gender ...

Don’t exchange your life for wealth; a sparkle of fire can be your end — Gender ...

Ghana’s newly installed Poland train reportedly involved in accident while on a ...

Ghana’s newly installed Poland train reportedly involved in accident while on a ...

Chieftaincy disputes: Government imposes 4pm to 7am curfew on Sampa township

Chieftaincy disputes: Government imposes 4pm to 7am curfew on Sampa township

Franklin Cudjoe fumes at unaccountable wasteful executive living large at the ex...

Franklin Cudjoe fumes at unaccountable wasteful executive living large at the ex...

I'll 'stoop too low' for votes; I'm never moved by your propaganda — Oquaye Jnr ...

I'll 'stoop too low' for votes; I'm never moved by your propaganda — Oquaye Jnr ...

Kumasi Thermal Plant commissioning: I pray God opens the eyes of leaders who don...

Kumasi Thermal Plant commissioning: I pray God opens the eyes of leaders who don...